- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

Some Shareholders Feeling Restless Over ArcelorMittal S.A.'s (AMS:MT) P/S Ratio

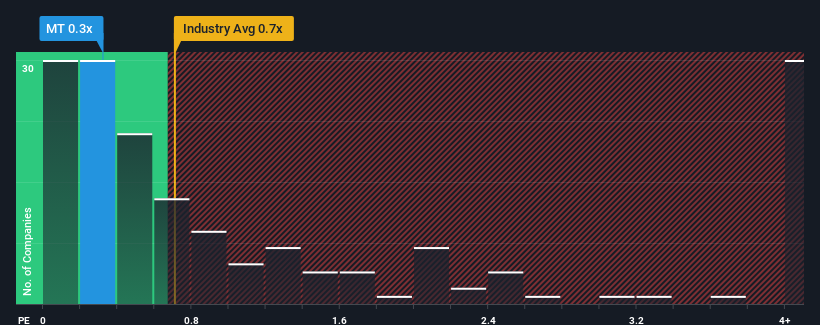

It's not a stretch to say that ArcelorMittal S.A.'s (AMS:MT) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in the Netherlands, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ArcelorMittal

How Has ArcelorMittal Performed Recently?

ArcelorMittal has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ArcelorMittal.Is There Some Revenue Growth Forecasted For ArcelorMittal?

ArcelorMittal's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.6% as estimated by the analysts watching the company. That's not great when the rest of the industry is expected to grow by 0.7%.

With this information, we find it concerning that ArcelorMittal is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does ArcelorMittal's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of ArcelorMittal's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You always need to take note of risks, for example - ArcelorMittal has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives