It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For example, the Koninklijke DSM N.V. (AMS:DSM) share price has soared 106% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 23% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Check out our latest analysis for Koninklijke DSM

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

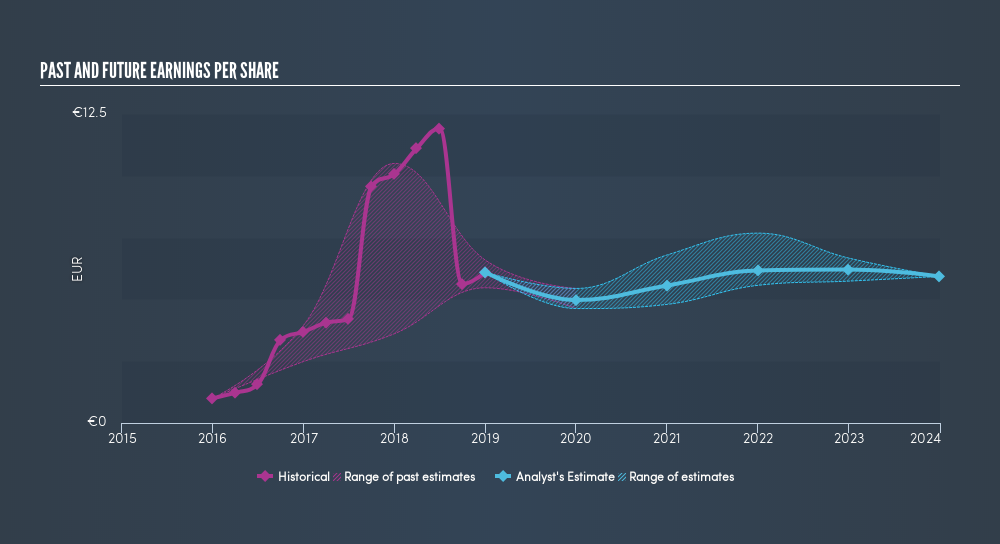

Koninklijke DSM was able to grow its EPS at 83% per year over three years, sending the share price higher. The average annual share price increase of 27% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Koninklijke DSM has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Koninklijke DSM's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Koninklijke DSM's TSR for the last 3 years was 123%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Koninklijke DSM shareholders have received a total shareholder return of 23% over the last year. That's including the dividend. That's better than the annualised return of 19% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Koninklijke DSM scores on these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTAM:DSM

DSM-Firmenich

Provides nutrition, health, and beauty solutions in Switzerland, the Netherlands, rest of Europe, the Middle East and Africa, North America, Latin America, China, and rest of Asia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives