- Netherlands

- /

- Chemicals

- /

- ENXTAM:CRBN

European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index rising by 2.77% amid easing trade tensions, investors are increasingly turning their attention to dividend stocks as a means of generating steady income during uncertain economic times. In such an environment, selecting dividend stocks with strong fundamentals and consistent payout histories can offer a reliable source of returns while potentially mitigating some market volatility risks.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.03% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.00% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.98% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.42% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Corbion (ENXTAM:CRBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Corbion N.V. is a company that specializes in lactic acid and its derivatives, food preservation solutions, functional blends, and algae ingredients across various global regions with a market cap of €1.08 billion.

Operations: Corbion N.V.'s revenue is primarily derived from its Health & Nutrition segment, contributing €290.20 million, and its Functional Ingredients & Solutions segment, which accounts for €997.90 million.

Dividend Yield: 3.4%

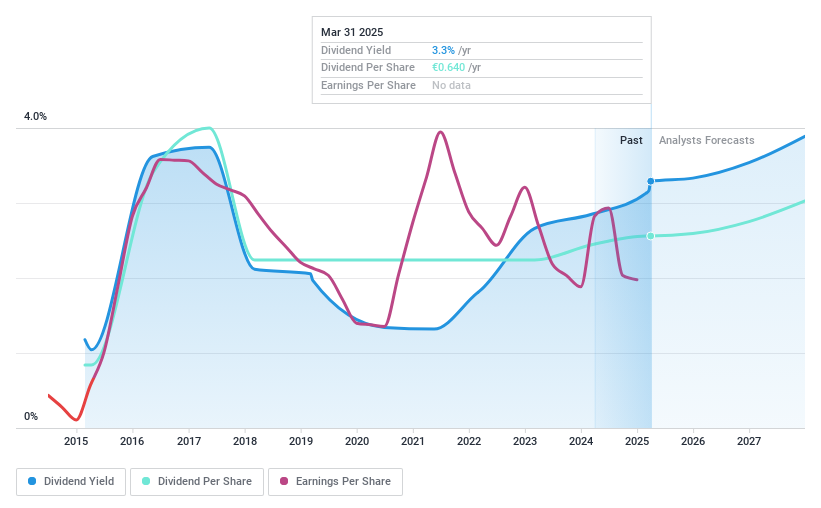

Corbion's dividend sustainability is supported by an 81.4% payout ratio and a cash payout ratio of 37.2%, indicating coverage by both earnings and cash flows. Despite a recent dividend increase to €0.64 per share, its yield of 3.43% lags behind top Dutch dividend payers. Earnings have seen growth, but the company's dividends have been volatile over the past decade, raising concerns about reliability despite long-term increases in payouts.

- Unlock comprehensive insights into our analysis of Corbion stock in this dividend report.

- Upon reviewing our latest valuation report, Corbion's share price might be too pessimistic.

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of €14.14 billion, focusing on providing asset management services.

Operations: Amundi generates its revenue primarily from asset management, with this segment contributing €6.66 billion.

Dividend Yield: 6.1%

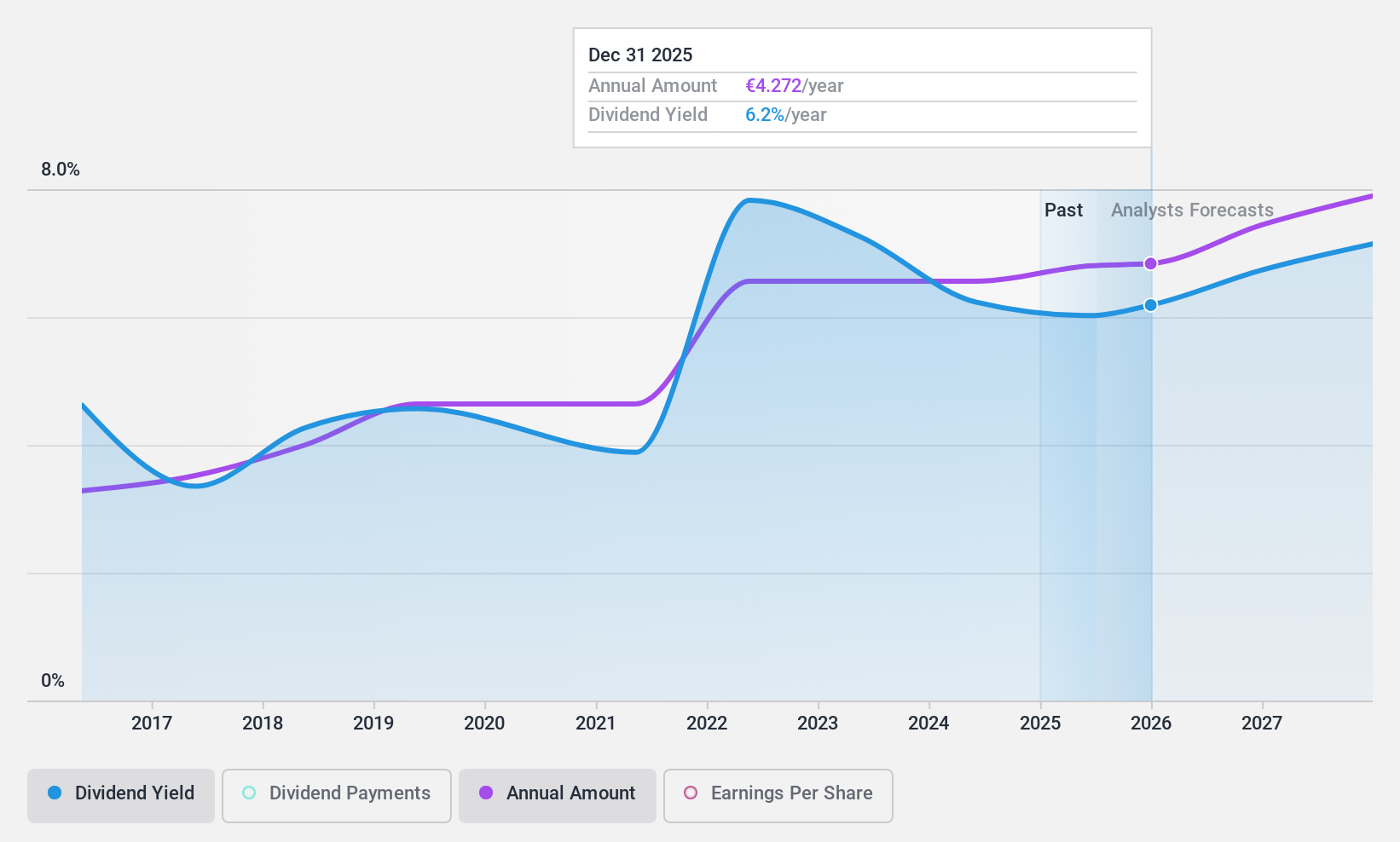

Amundi's dividend yield of 6.12% ranks in the top 25% of French market payers, supported by a payout ratio of 66.7% and a cash payout ratio of 56.8%, indicating coverage by earnings and cash flows. Despite recent increases, dividends have been volatile over the past nine years, raising reliability concerns. Earnings grew by 12% last year with revenue reaching €3.5 billion for 2024, reflecting strong financial performance amid plans for further dividend growth this year to €4.25 per share.

- Dive into the specifics of Amundi here with our thorough dividend report.

- The analysis detailed in our Amundi valuation report hints at an deflated share price compared to its estimated value.

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manitou BF SA, with a market cap of €736.24 million, develops, manufactures, and distributes equipment and services across various regions including Europe, the Americas, Asia-Pacific, Africa, and the Middle East.

Operations: Manitou BF SA generates its revenue primarily from the Products Division, which accounts for €2.25 billion, and the Services & Solutions (S&S) Division, contributing €409.10 million.

Dividend Yield: 6.5%

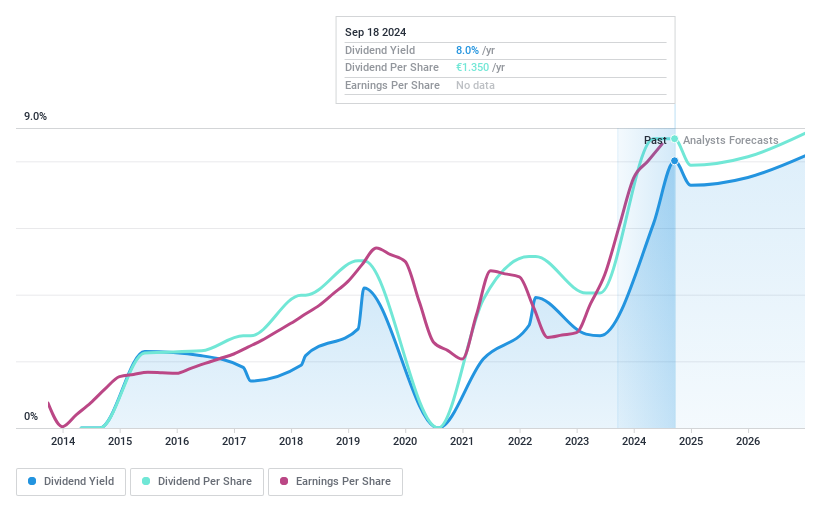

Manitou BF offers a dividend yield of 6.5%, placing it in the top 25% of French market payers, with dividends well-covered by earnings and cash flows (payout ratio: 31.7%; cash payout ratio: 34.9%). Despite growth over the past decade, dividends have been volatile, leading to reliability concerns. The stock trades at a significant discount to fair value and below analyst price targets, though recent share price volatility may impact investor sentiment.

- Click to explore a detailed breakdown of our findings in Manitou BF's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Manitou BF shares in the market.

Taking Advantage

- Explore the 239 names from our Top European Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CRBN

Corbion

Provides lactic acid and lactic acid derivatives, food preservation solutions, functional blends, and algae ingredients in the Netherlands, the United States, Asia, rest of North Americas, the rest of Europe, the Middle East, and Africa.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives