Corbion N.V. (AMS:CRBN) will pay a dividend of €0.56 on the 31st of May. The dividend yield is 1.8% based on this payment, which is a little bit low compared to the other companies in the industry.

See our latest analysis for Corbion

Corbion's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, Corbion was earning enough to cover the dividend, but it wasn't generating any free cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Over the next year, EPS is forecast to expand by 9.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 41% by next year, which is in a pretty sustainable range.

Dividend Volatility

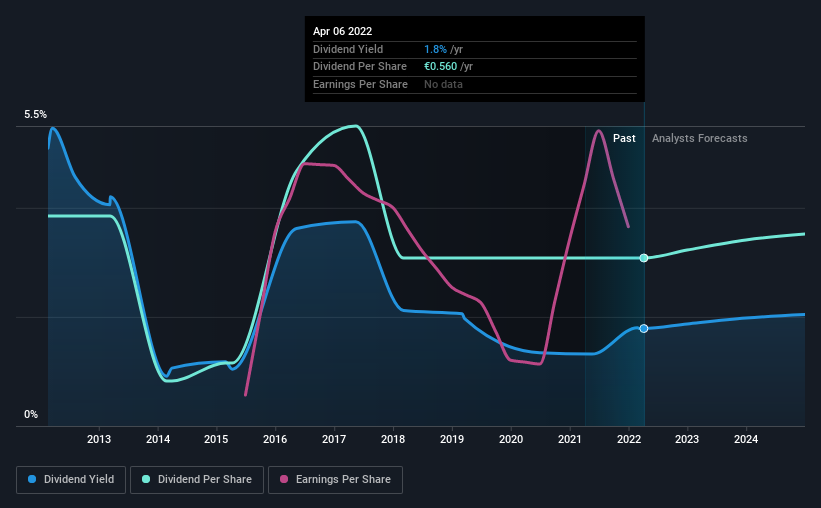

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2012, the dividend has gone from €0.70 to €0.56. The dividend has shrunk at around 2.2% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Over the past five years, it looks as though Corbion's EPS has declined at around 5.2% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While Corbion is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Corbion has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CRBN

Corbion

Provides lactic acid and lactic acid derivatives, food preservation solutions, functional blends, and algae ingredients in the Netherlands, the United States, Asia, rest of North Americas, the rest of Europe, the Middle East, and Africa.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives