- Netherlands

- /

- Packaging

- /

- ENXTAM:CABKA

Cabka's (AMS:CABKA) Upcoming Dividend Will Be Larger Than Last Year's

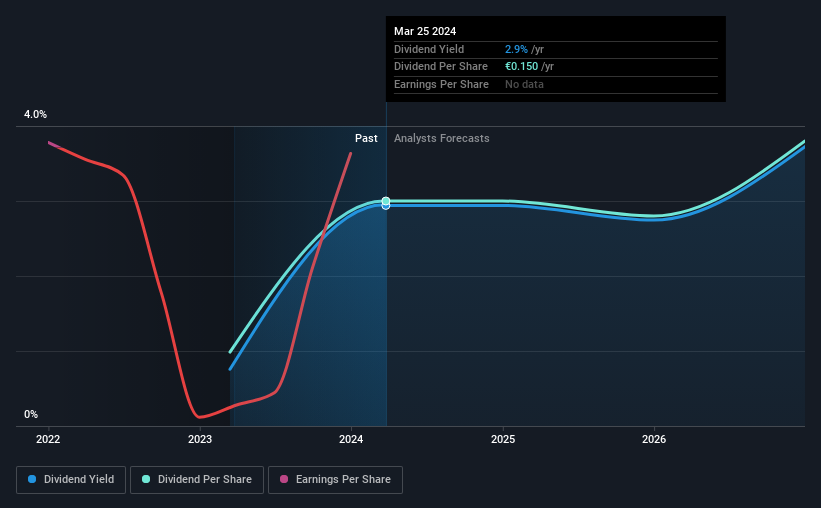

Cabka N.V. (AMS:CABKA) has announced that it will be increasing its dividend from last year's comparable payment on the 25th of August to €0.15. The payment will take the dividend yield to 2.9%, which is in line with the average for the industry.

View our latest analysis for Cabka

Cabka Doesn't Earn Enough To Cover Its Payments

Unless the payments are sustainable, the dividend yield doesn't mean too much. Despite not generating a profit, Cabka is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

The next 12 months is set to see EPS grow by 178.5%. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Cabka Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Cabka's earnings per share is up 98% on last year. It's nice to see earnings per share rising, but one year is too short a period to get excited about. Were this trend to continue, we'd be interested. Even though the company is not profitable, it is growing at a solid clip. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward. However, we would never make any decisions based on only a single year of data, especially when assessing long term dividend potential.

Cabka's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Cabka will make a great income stock. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 3 warning signs for Cabka (of which 2 are concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade Cabka, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CABKA

Cabka

Manufactures and sells pallets and large containers made from recycled plastic in Europe, North America, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives