- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Investors Still Aren't Entirely Convinced By AMG Critical Materials N.V.'s (AMS:AMG) Revenues Despite 28% Price Jump

AMG Critical Materials N.V. (AMS:AMG) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

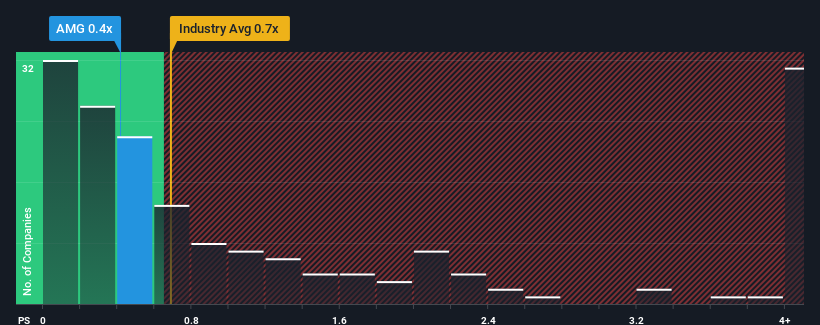

Although its price has surged higher, you could still be forgiven for feeling indifferent about AMG Critical Materials' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in the Netherlands is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for AMG Critical Materials

What Does AMG Critical Materials' P/S Mean For Shareholders?

AMG Critical Materials hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think AMG Critical Materials' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For AMG Critical Materials?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AMG Critical Materials' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Still, the latest three year period has seen an excellent 44% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.0% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 2.5%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that AMG Critical Materials is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now AMG Critical Materials' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at AMG Critical Materials' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware AMG Critical Materials is showing 3 warning signs in our investment analysis, and 2 of those are concerning.

If you're unsure about the strength of AMG Critical Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026