- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Here's Why We Think AMG Advanced Metallurgical Group (AMS:AMG) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like AMG Advanced Metallurgical Group (AMS:AMG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for AMG Advanced Metallurgical Group

How Fast Is AMG Advanced Metallurgical Group Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It is awe-striking that AMG Advanced Metallurgical Group's EPS went from US$0.44 to US$5.88 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of AMG Advanced Metallurgical Group shareholders is that EBIT margins have grown from 4.7% to 20% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

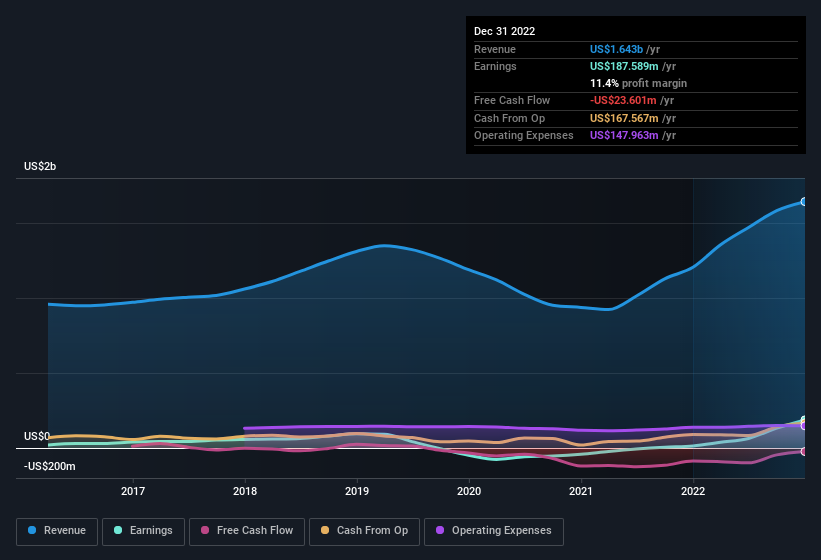

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of AMG Advanced Metallurgical Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are AMG Advanced Metallurgical Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that AMG Advanced Metallurgical Group insiders spent a whopping US$2.3m on stock in just one year, without so much as a single sale. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Chairman of the Management Board & CEO Heinz Schimmelbusch who made the biggest single purchase, worth €1.0m, paying €26.28 per share.

The good news, alongside the insider buying, for AMG Advanced Metallurgical Group bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$63m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does AMG Advanced Metallurgical Group Deserve A Spot On Your Watchlist?

AMG Advanced Metallurgical Group's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest AMG Advanced Metallurgical Group belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for AMG Advanced Metallurgical Group (of which 1 is a bit concerning!) you should know about.

The good news is that AMG Advanced Metallurgical Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026