- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Philips (ENXTAM:PHIA): Exploring Valuation After a Period of Share Price Stability

Reviewed by Simply Wall St

Koninklijke Philips (ENXTAM:PHIA) shares have had modest moves recently, with the stock showing limited volatility over the past month. Investors continue to watch the company's progress after its previous strategic health tech pivots and recent earnings updates.

See our latest analysis for Koninklijke Philips.

While Koninklijke Philips' share price has remained fairly steady in recent weeks, the bigger picture reflects a long climb back from previous lows. The stock's 0.44% total shareholder return over the last year shows stability, but momentum appears to have slowed after strong three-year gains of nearly 99%.

If you’re exploring past health tech rebounds or want to see which healthcare stocks could be next, take a look at the leaders in our curated list: See the full list for free.

With shares trading below analyst price targets and at a significant discount to intrinsic value, the question arises: is Koninklijke Philips now undervalued, or has the market already accounted for all its future growth potential?

Price-to-Earnings of 133.2x: Is it justified?

Philips currently trades at a price-to-earnings (P/E) ratio of 133.2x, indicating that shares change hands at a significant premium to both sector averages and its peers.

The price-to-earnings ratio reflects how much investors are willing to pay for every euro of company earnings. This metric is commonly used in the medical equipment industry as a way to assess how optimistic the market is about future profitability.

At 133.2x, Philips is considerably more expensive than the European medical equipment industry average of 27.2x and the peer average of 27.2x. This substantial gap suggests there may be strong confidence in Philips’ future earnings growth or that current profits are temporarily low, which could increase the ratio. There is insufficient data to calculate a fair P/E ratio for direct comparison or as a benchmark, but the prevailing market sentiment is clearly pricing in a unique scenario for Philips shares.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 133.2x (OVERVALUED)

However, slower revenue growth or disappointing earnings updates could disrupt current optimism. This may lead investors to reassess Philips’ high valuation.

Find out about the key risks to this Koninklijke Philips narrative.

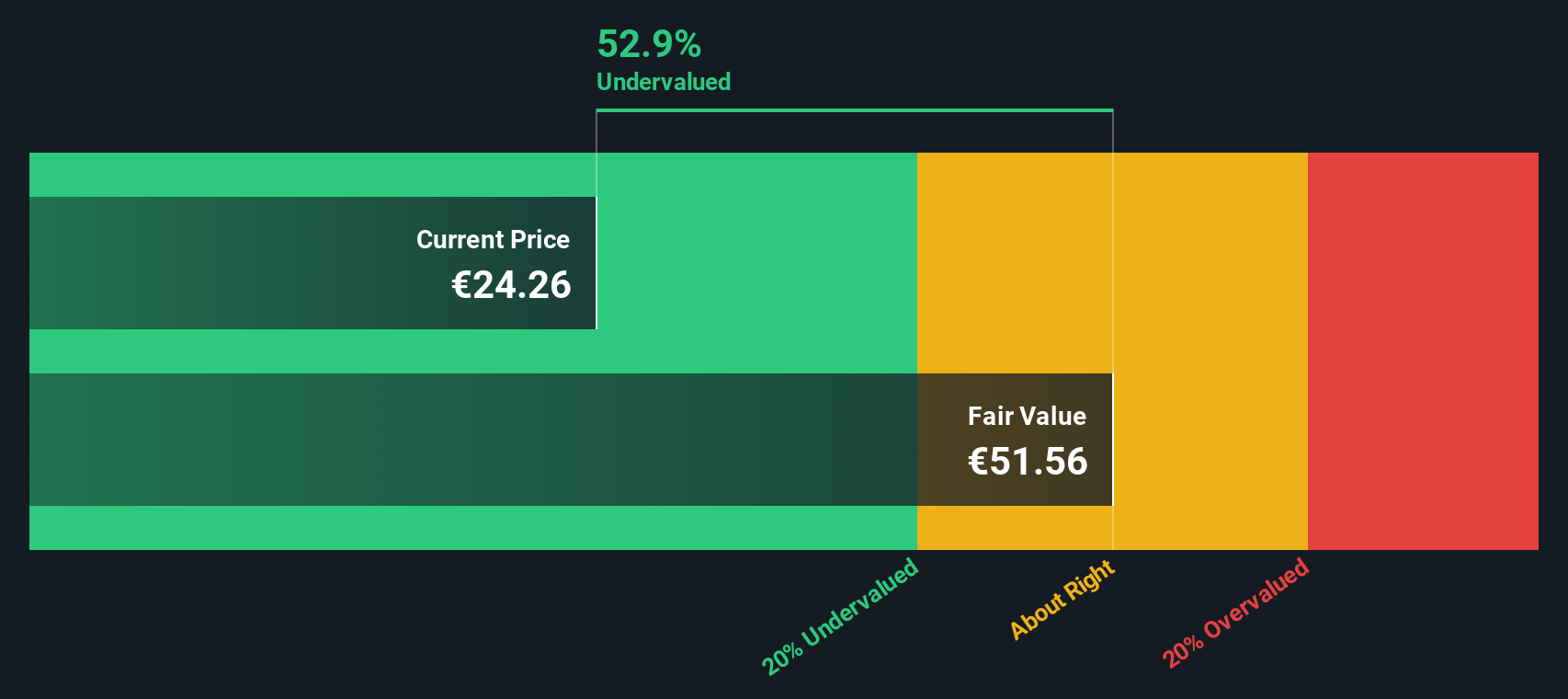

Another View: SWS DCF Model Suggests Undervaluation

While Philips appears expensive when assessed by its price-to-earnings ratio, our SWS DCF model offers a different perspective. The stock currently trades at €24.23, which is 35.5% below our estimated fair value of €37.59. This raises the question of whether the market may be pricing in more risk than actually exists.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you see the story from a different angle or want to test your own assumptions, you can quickly build your own perspective in just a few minutes. Do it your way.

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for opportunity. Simply Wall Street’s unique screeners put the next big themes at your fingertips. Don't let these smart strategies pass you by. See what could supercharge your portfolio next.

- Uncover high-yielding opportunities to boost your income with these 14 dividend stocks with yields > 3% offering attractive dividend payouts and solid fundamentals.

- Spot tomorrow’s breakthrough winners in cutting-edge tech by using these 25 AI penny stocks and get ahead of rapid advances in artificial intelligence.

- Tap into the potential of disruptive innovations with these 27 quantum computing stocks featuring companies on the frontier of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026