- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Even after rising 4.8% this past week, Koninklijke Philips (AMS:PHIA) shareholders are still down 38% over the past five years

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Koninklijke Philips N.V. (AMS:PHIA), since the last five years saw the share price fall 42%. More recently, the share price has dropped a further 14% in a month. However, we note the price may have been impacted by the broader market, which is down 11% in the same time period.

While the last five years has been tough for Koninklijke Philips shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

We've discovered 1 warning sign about Koninklijke Philips. View them for free.To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Koninklijke Philips has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

The steady dividend doesn't really explain why the share price is down. It's not immediately clear to us why the stock price is down but further research might provide some answers.

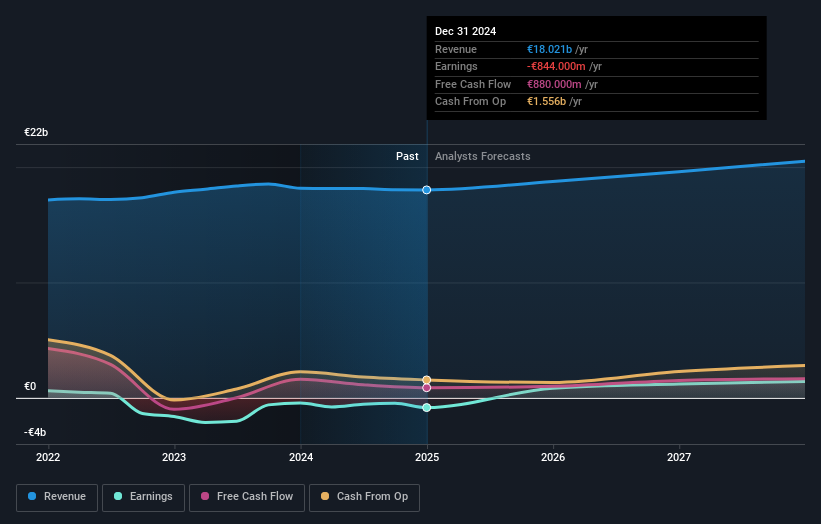

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Koninklijke Philips is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Koninklijke Philips will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Koninklijke Philips' TSR for the last 5 years was -38%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Koninklijke Philips shareholders have received a total shareholder return of 12% over the last year. Of course, that includes the dividend. That certainly beats the loss of about 7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Koninklijke Philips you should be aware of.

Of course Koninklijke Philips may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives