- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIO

Is Heineken Stock Poised for a Comeback After Recent Global Brewing Slowdown?

Reviewed by Bailey Pemberton

Wondering what to do with Heineken Holding stock? You're not alone. Whether you’re a long-term shareholder looking for reassurance or a savvy investor eyeing new opportunities, the current climate for this European beverage giant is intriguing. The stock’s recent movements tell a story of modest resilience and cautious optimism. A 0.3% bump over the past week suggests some near-term confidence, but a 1.3% slip over the last month and a longer-term slide of -9.1% over the past year signal persistent market skepticism. Some of this can be chalked up to shifting sentiment about consumer staples and global beverage brands, especially amid changing consumer tastes and macroeconomic developments.

But here’s the part that deserves a closer look: when we put Heineken Holding through six widely accepted valuation checks, it scores a 4 out of 6, meaning it’s undervalued in two-thirds of the metrics that analysts use to assess whether a stock is trading below its worth. That’s a pretty strong starting position for such an established player. Of course, valuation is more than just ticking boxes or doing quick math. In the next section, we’ll break down exactly how Heineken Holding stacks up across the different valuation yardsticks, and I’ll also share an even more insightful approach for judging a stock’s true value, so stay tuned.

Approach 1: Heineken Holding Discounted Cash Flow (DCF) Analysis

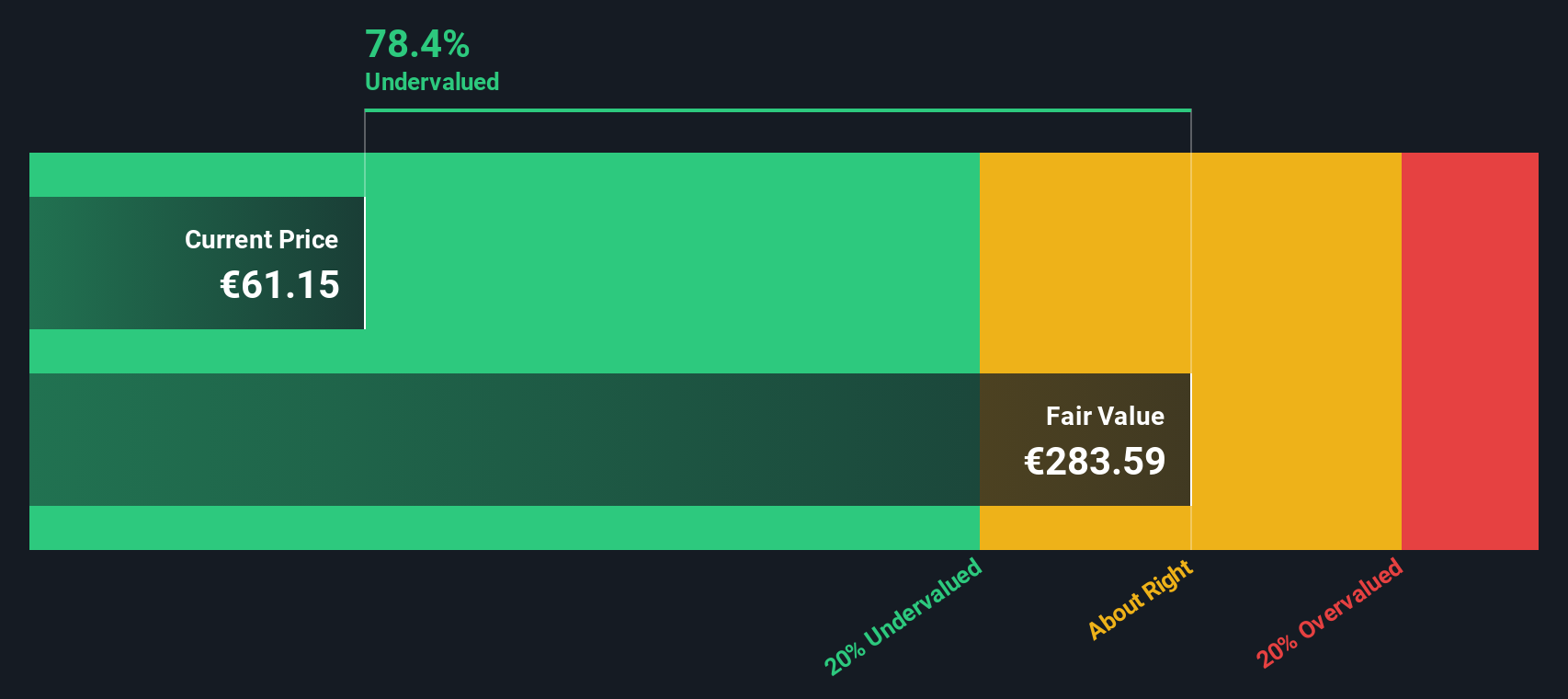

The Discounted Cash Flow (DCF) model is a cornerstone of valuation analysis, estimating what a company is truly worth by projecting its future cash flows and then discounting them back to today's value. For Heineken Holding, analysts begin with the latest available Free Cash Flow (FCF), which stands at approximately €2.79 billion. Projecting forward, estimates suggest annual FCF growth rates steadily rising around 1.2% to 1.6%. By 2035, the FCF is expected to reach about €3.24 billion, based on both analyst input and further extrapolations.

All cash flows are measured in euros. These projections capture expected operational growth while factoring in future uncertainties. Using these forecasts, the DCF model arrives at an intrinsic value for Heineken Holding of €280.91 per share. This implies the stock is trading at a 79.2% discount to its estimated fair value, indicating that the current market price does not fully reflect the company’s long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Heineken Holding is undervalued by 79.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Heineken Holding Price vs Earnings

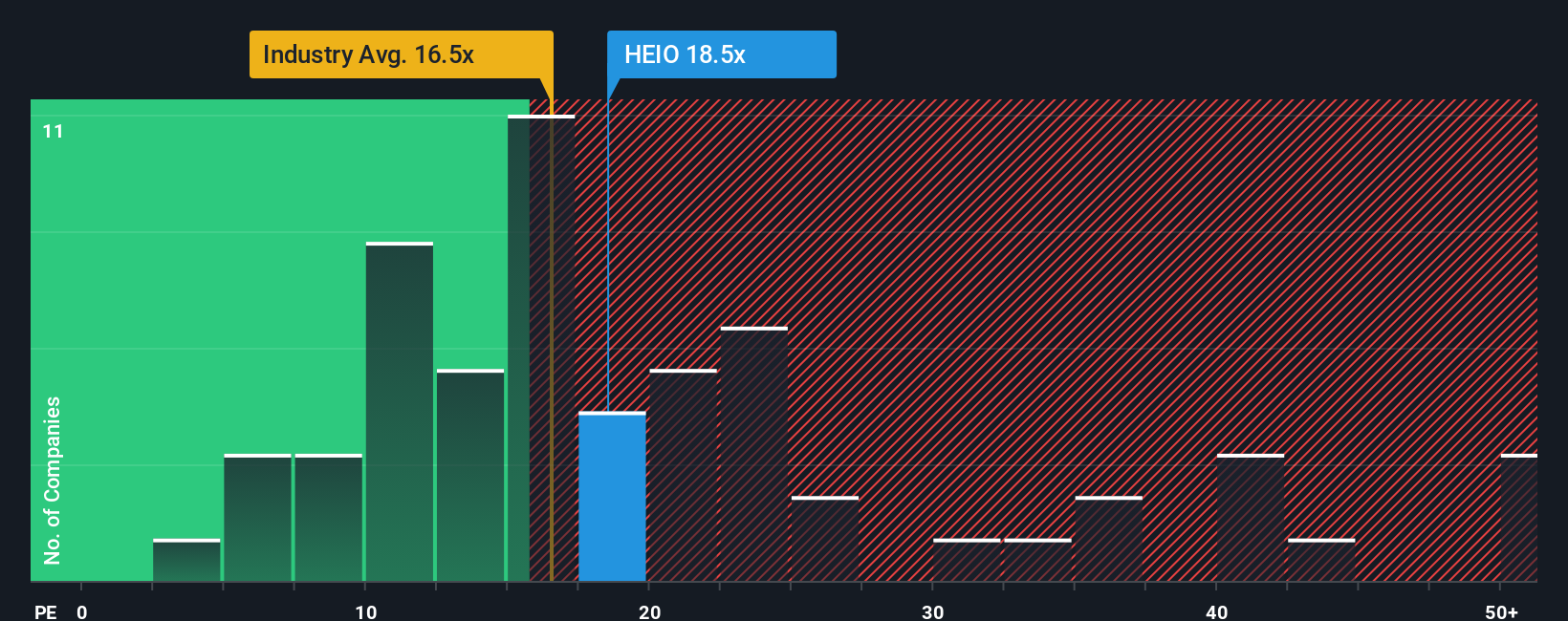

For profitable companies like Heineken Holding, the Price-to-Earnings (PE) ratio is a well-established way to gauge whether the stock price fairly reflects the company’s true earning power. Investors generally expect companies with higher growth prospects or lower risk profiles to command a higher “normal” or “fair” PE ratio. Businesses facing uncertainties or slower expansion usually trade at lower multiples.

Heineken Holding currently trades on a PE multiple of 17.68x. For context, this is just a touch below the beverage industry’s average of 18.02x and beneath the average PE of its peer group, which sits at 20.60x. While it is helpful to compare a company’s valuation against industry norms and direct competitors, these benchmarks do not always reflect the full picture. Company-specific growth, risk, and profitability factors can also significantly influence valuation.

This is where Simply Wall St's “Fair Ratio” comes in. This proprietary metric blends factors like Heineken Holding’s earnings growth rates, its relative risks, profit margins, market capitalization, and its position within the beverage industry. Essentially, this Fair Ratio offers a more holistic, nuance-driven benchmark for what the company’s PE ratio should be in light of its unique profile. In Heineken Holding’s case, the Fair Ratio is calculated at 22.68x, noticeably higher than both its current PE and industry averages. This suggests that the stock is trading below the multiple justified by its fundamentals, making the shares look undervalued by this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Heineken Holding Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, the reasoning and outlook you believe in, brought to life with your own forecasts for things like fair value, future revenues, earnings, and profit margins. Rather than just looking at numbers in isolation, Narratives connect the dots: they link the company’s story (what is happening in its business and industry) to a full financial forecast, then all the way to an estimate of fair value you can act on.

Narratives are an easy, powerful tool available on Simply Wall St’s Community page, trusted by millions of investors. They help you decide when to buy or sell by showing you in real time how your fair value stacks up against the current market price, so you can invest in line with your own convictions. What is more, Narratives update dynamically whenever new news or company results are released, so your thesis always stays fresh and relevant.

For example, with Heineken Holding, some investors have built bullish Narratives expecting digital investments and premium growth in emerging markets to drive future earnings and set a fair value of €104 per share. Others highlight regulatory or currency risks and estimate much lower fair values. This shows how Narratives empower you to invest based on your unique viewpoint, helping you make smarter, more confident decisions.

Do you think there's more to the story for Heineken Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIO

Heineken Holding

Engages in brewing and selling beer and cider in the Netherlands and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives