- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIO

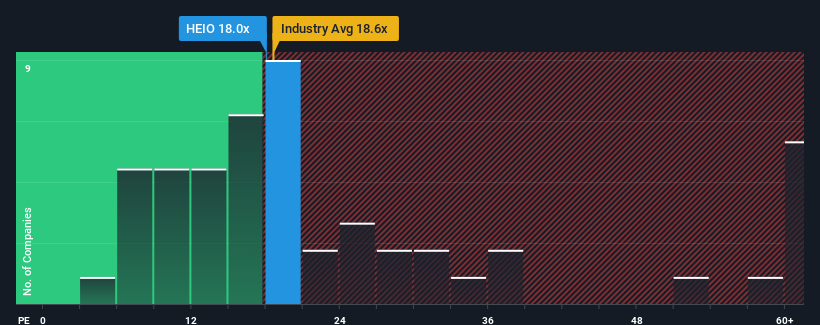

Heineken Holding N.V.'s (AMS:HEIO) P/E Still Appears To Be Reasonable

There wouldn't be many who think Heineken Holding N.V.'s (AMS:HEIO) price-to-earnings (or "P/E") ratio of 18x is worth a mention when the median P/E in the Netherlands is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Heineken Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Heineken Holding

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Heineken Holding's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the watching the company. Meanwhile, the rest of the market is forecast to expand by 18%, which is not materially different.

In light of this, it's understandable that Heineken Holding's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Heineken Holding's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Heineken Holding maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Heineken Holding you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Heineken Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:HEIO

Heineken Holding

Through its subsidiaries, engages in brewing and selling beer and cider in the Netherlands and internationally.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives