- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Will Heineken's (ENXTAM:HEIA) Expansion of 0.0 Draught Outlets Redefine Its Growth Narrative?

Reviewed by Simply Wall St

- HEINEKEN recently marked a significant milestone by installing its 10,000th Heineken 0.0 draught outlet across Europe, covering major markets such as the Netherlands, UK, Spain, Ireland, and France.

- This expansion spotlights the surging mainstream appeal of alcohol-free beer options, with venues in these regions reporting strong consumer uptake and steady category growth.

- We’ll now assess how Heineken’s leadership in non-alcoholic draught beer may influence its broader growth and innovation narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Heineken Investment Narrative Recap

To be a shareholder in Heineken, you need to believe in the company’s ability to capture value from shifting consumer trends, especially ongoing demand for premium and no-alcohol beer options. While Heineken’s achievement of 10,000 Heineken 0.0 draught outlets in Europe signals progress in its innovation and expansion narrative, this milestone does not appear material enough on its own to alter the key short-term catalyst, recovery in European volumes, or the most significant current risk, continued currency headwinds and foreign exchange volatility impacting earnings.

The latest earnings announcement on July 28, 2025, is particularly relevant, as it showed Heineken recovering bottom-line performance despite revenue pressure. This suggests that ongoing diversification and premiumization, including successful rollouts like Heineken 0.0, may help mitigate some of the margin risks tied to shifting consumer habits and competitive intensity within mature regions. However, investors should still consider the company’s exposure to foreign exchange pressures in several key markets as a counterbalance to recent operational wins.

Yet, even with growth in no-alcohol beer, currency risks for Heineken persist and could impact future results, so investors should be alert to...

Read the full narrative on Heineken (it's free!)

Heineken's narrative projects €32.8 billion revenue and €3.0 billion earnings by 2028. This requires 4.0% yearly revenue growth and a €1.2 billion earnings increase from the current €1.8 billion.

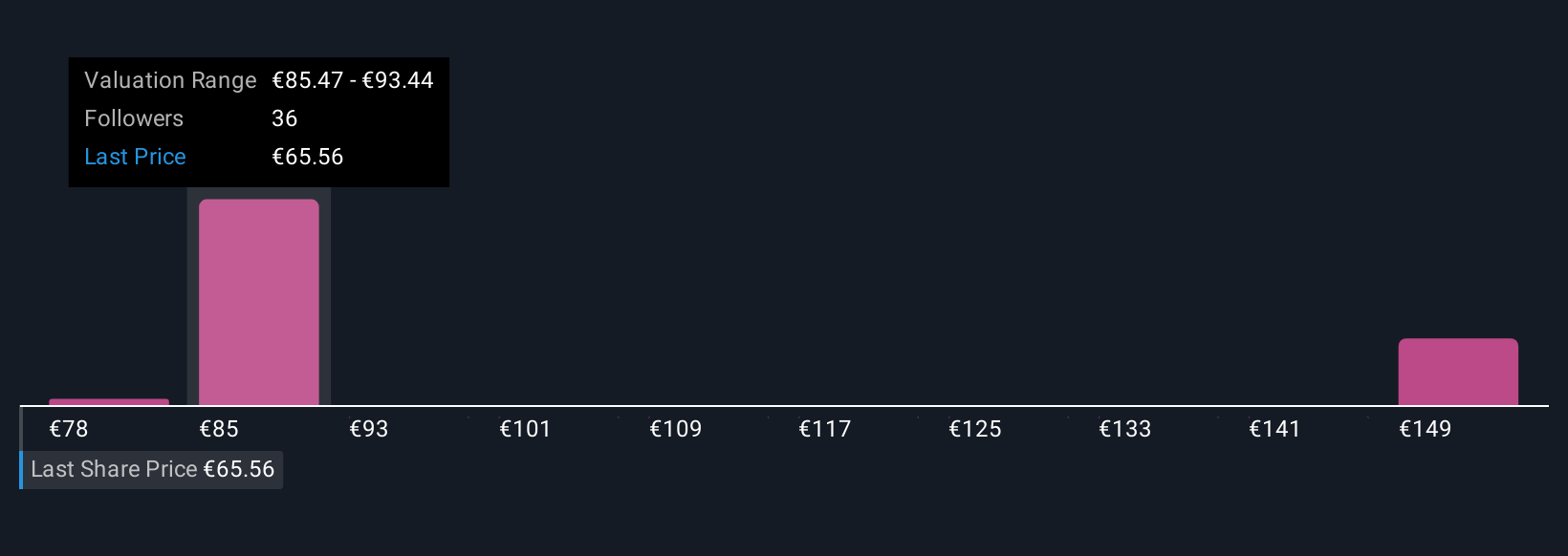

Uncover how Heineken's forecasts yield a €89.58 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members forecasted Heineken’s fair value from €77.50 up to €157.20, showing wide disagreement on market potential. You’ll find that foreign exchange risks remain a central concern, pointing to the value in reviewing multiple viewpoints on future earnings resilience.

Explore 5 other fair value estimates on Heineken - why the stock might be worth just €77.50!

Build Your Own Heineken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heineken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heineken's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives