- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA): Assessing Valuation After a Steady 4% Share Price Climb

Reviewed by Simply Wall St

Heineken (ENXTAM:HEIA) has quietly climbed about 4% over the past month and past 3 months, a steady move that has investors asking whether this slow re-rating has more room to run.

See our latest analysis for Heineken.

That recent 1 month share price return of around 4% comes after a muted year to date move, while the 1 year total shareholder return is still only in the low single digits. This suggests sentiment is stabilising rather than surging.

If Heineken’s slow grind higher has you wondering what else might be gathering quiet momentum, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings growing faster than revenue and the share price still trading at a sizable discount to analyst targets and intrinsic estimates, is Heineken quietly undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 19.2% Undervalued

With Heineken last closing at €69.68 against a narrative fair value of about €86.23, the current share price sits noticeably below projected worth. This frames a valuation story built on steady growth, rising margins and only a modestly higher required return.

Investments in digital transformation including scaling digital backbones, advanced route to market models, and data driven productivity (targeting over €500M in gross savings for 2025) are laying the groundwork for long term operational leverage and net margin expansion.

Curious how mid single digit sales growth, fatter margins and a lower future earnings multiple can still justify a meaningful upside? The narrative sets out the specific growth runway, profitability lift and valuation reset that define the gap between today’s price and its long term potential.

Result: Fair Value of €86.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, gains are not guaranteed, as FX volatility and structurally weaker European beer demand are both capable of undermining volume recovery and margin expansion.

Find out about the key risks to this Heineken narrative.

Another Lens on Valuation

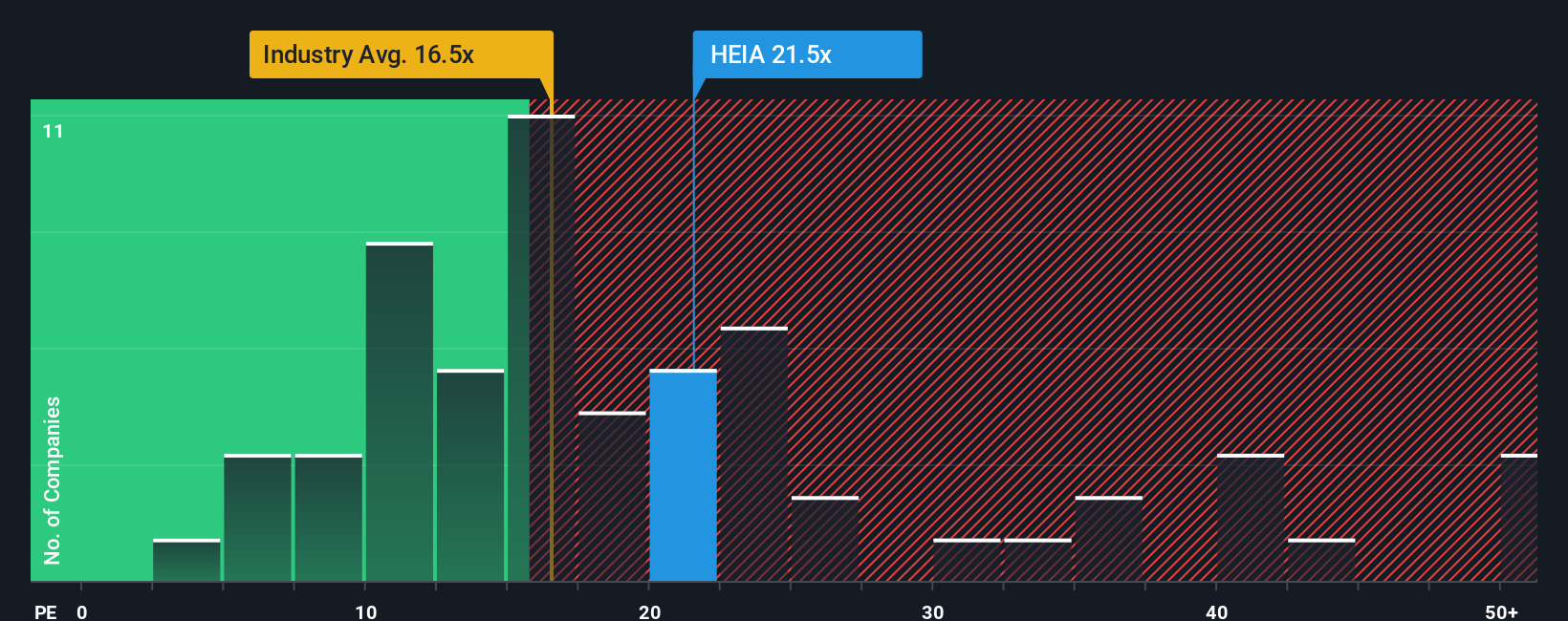

On earnings based valuation, Heineken looks far less of a bargain. Its 21.2x price to earnings ratio sits above the European beverage average of 17.3x and even a 21.2x fair ratio, suggesting limited margin of safety if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Narrative

If this perspective does not fully resonate, or you would rather explore the numbers yourself, you can build a personalised view in minutes using Do it your way.

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next Investing Move?

Before you move on, put Simply Wall St to work finding your next edge with targeted stock ideas tailored to different strategies and risk appetites.

- Secure potential long term compounders by scanning these 918 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Ride structural growth in healthcare and technology by focusing on these 30 healthcare AI stocks at the crossroads of medicine and machine intelligence.

- Tap into powerful income opportunities with these 14 dividend stocks with yields > 3% that can boost portfolio returns through dependable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026