- Netherlands

- /

- Beverage

- /

- ENXTAM:CCEP

How Investors May Respond To Coca-Cola Europacific Partners (ENXTAM:CCEP) Ongoing Share Buybacks and Insider Purchases

Reviewed by Sasha Jovanovic

- In October 2025, Coca-Cola Europacific Partners continued its share buyback program, repurchasing and canceling over 106,000 ordinary shares as part of a broader initiative that could total €1 billion. Additionally, senior managers Ana Callol and Jose Antonio Echeverria acquired company shares through the Employee Share Purchase Plan, reinforcing alignment between leadership and shareholder interests.

- These actions highlight the company's commitment to enhancing shareholder value and reflect management’s confidence in Coca-Cola Europacific Partners’ long-term outlook.

- Given the ongoing buyback program, we'll explore how this increased focus on shareholder value and management ownership shapes the investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Coca-Cola Europacific Partners Investment Narrative Recap

To invest in Coca-Cola Europacific Partners, you need to believe in the enduring appeal of its beverage portfolio, continued international expansion, and ability to deliver shareholder returns amid evolving consumer and regulatory pressures. The latest share buyback and management share purchases reflect ongoing confidence from leadership but are unlikely to materially impact the biggest current risk: further government regulation or health-driven demand shifts in core markets. Short-term, these actions have a limited effect on the most important catalyst, which is growth from emerging markets like Indonesia.

Among recent announcements, the reaffirmation of FY 2025 earnings guidance stands out as most relevant. This confidence from management, despite ongoing buyback activity, suggests a commitment to meeting operational and profitability targets, a key foundation for sustained investor confidence, especially as shareholders monitor progress in challenging geographies and await signs of volume recovery.

Yet, alongside these positive signals, investors should also keep an eye on the mounting pressures from stricter regulations and shifting consumer habits, which could...

Read the full narrative on Coca-Cola Europacific Partners (it's free!)

Coca-Cola Europacific Partners' narrative projects €23.2 billion revenue and €2.2 billion earnings by 2028. This requires 3.5% yearly revenue growth and a €0.7 billion increase in earnings from €1.5 billion today.

Uncover how Coca-Cola Europacific Partners' forecasts yield a €85.17 fair value, a 11% upside to its current price.

Exploring Other Perspectives

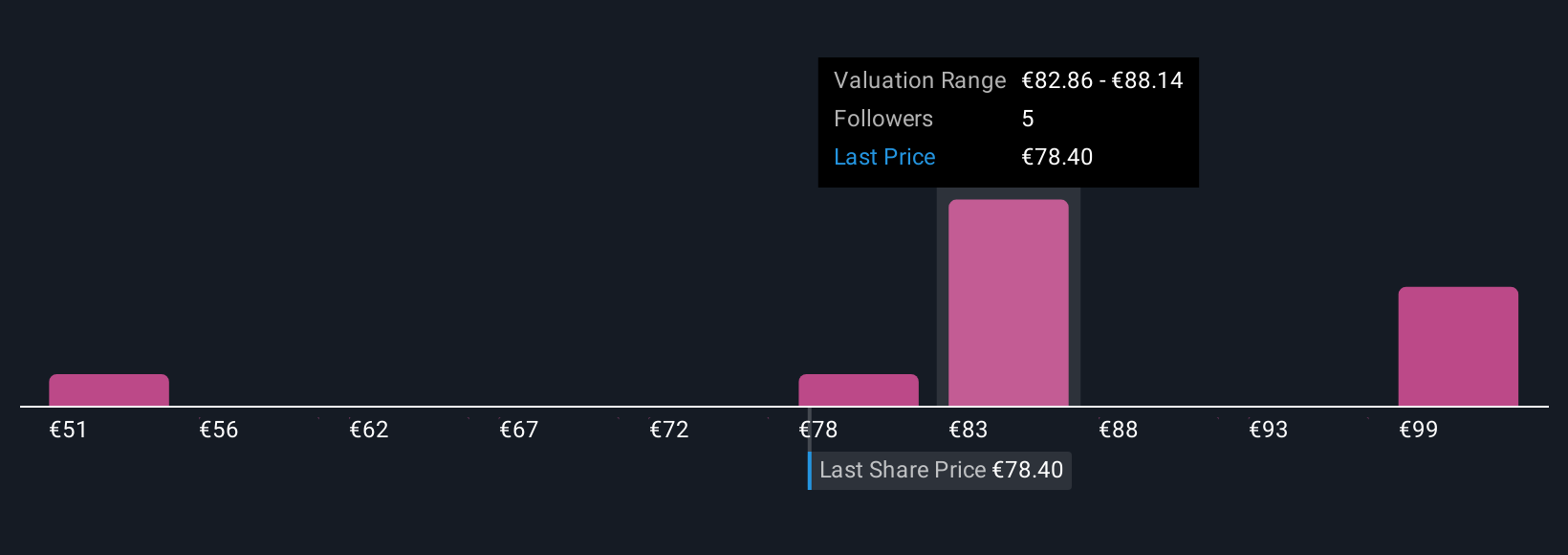

Four members of the Simply Wall St Community shared fair value estimates for Coca-Cola Europacific Partners, ranging from €51.14 to €103.98. While these views differ widely, they provide fresh context as the company moves forward with its buyback plan and faces the challenge of adapting to health and regulatory risks.

Explore 4 other fair value estimates on Coca-Cola Europacific Partners - why the stock might be worth as much as 35% more than the current price!

Build Your Own Coca-Cola Europacific Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Europacific Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coca-Cola Europacific Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Europacific Partners' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CCEP

Coca-Cola Europacific Partners

Produces, distributes, and sells a range of non-alcoholic ready to drink beverages.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives