- Netherlands

- /

- Beverage

- /

- ENXTAM:CCEP

Coca-Cola Europacific Partners (ENXTAM:CCEP): Valuation Explored as Buybacks and Management Share Purchases Signal Confidence

Reviewed by Kshitija Bhandaru

Coca-Cola Europacific Partners (ENXTAM:CCEP) has taken additional steps to buy back ordinary shares, and management recently acquired shares as part of their Employee Share Purchase Plan. These moves emphasize leadership's confidence and alignment with shareholder interests.

See our latest analysis for Coca-Cola Europacific Partners.

The past few weeks have seen Coca-Cola Europacific Partners not just rolling out another major stage of its buyback program but also seeing management increase their personal stakes. These two moves seem to have reinforced market confidence. While the share price recently edged up, the real story is the company’s strong momentum in shareholder returns, with a 1-year total shareholder return of 11.06% and a remarkable 182.36% over five years, reflecting a track record of delivering long-term value.

If you’re interested in finding other companies where leadership backs their own strategy, now’s the moment to check out fast growing stocks with high insider ownership

Yet with shares trading at a discount to analysts’ price targets and strong growth metrics, investors might wonder whether Coca-Cola Europacific Partners is trading below its intrinsic value or if the market has already accounted for future gains.

Most Popular Narrative: 8.8% Undervalued

Coca-Cola Europacific Partners’ most widely followed narrative puts its fair value at €85.17, which stands nearly €7.5 per share above the last close of €77.7. The narrative’s pricing is built on confidence in long-term growth through expansion, innovation, and efficiency gains. All of these factors contribute to a higher future profit outlook.

Ongoing expansion in key European and Asia-Pacific markets is cited as a driver of sustained top-line growth. Bearish analysts express caution over slightly softer growth assumptions, which have prompted a marginal reduction in the price target.

The true intrigue lies in the closely watched expectations about where profits and margins will be three years from now. Interested in the detailed revenue forecasts, shrinking share counts, and the specific earnings trajectory that power this bold valuation? A full reveal is just one click away.

Result: Fair Value of €85.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer health trends or tougher regulation in sugary drinks could dampen growth. This may prompt the market to reassess Coca-Cola Europacific Partners' outlook.

Find out about the key risks to this Coca-Cola Europacific Partners narrative.

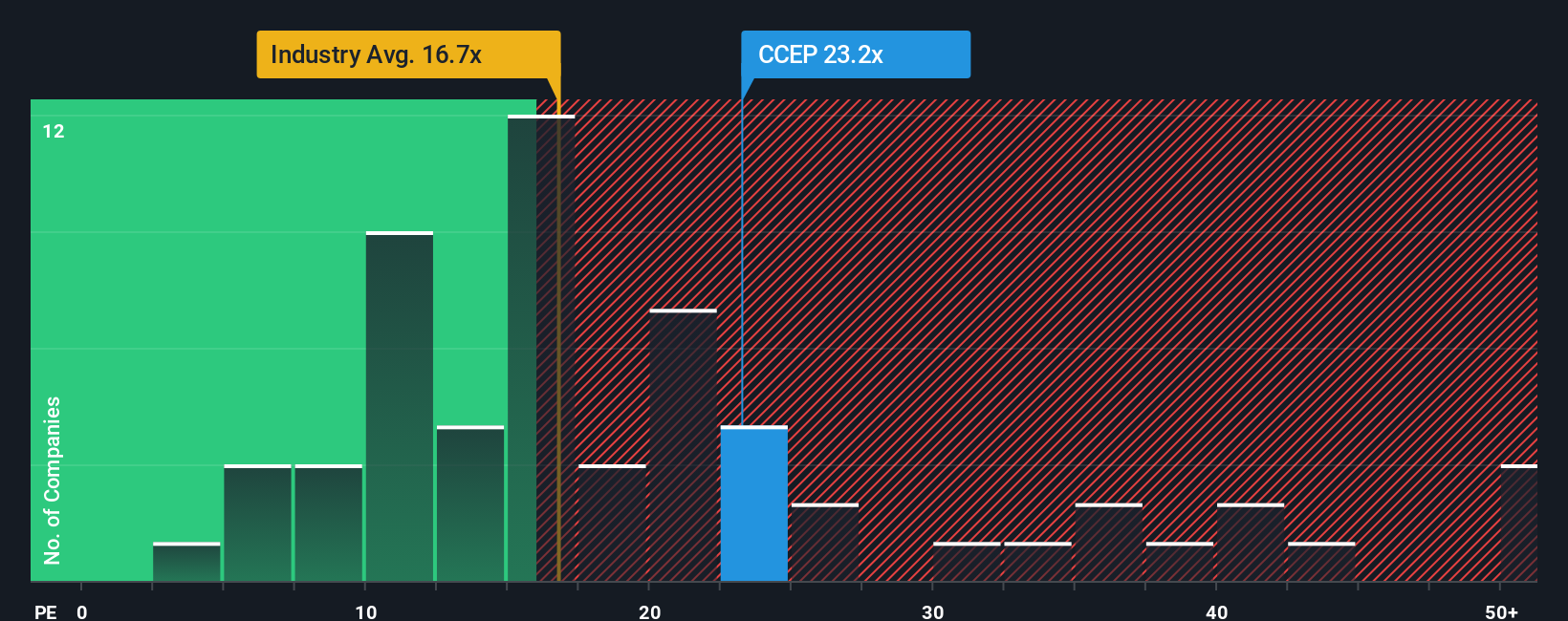

Another View: Earnings Ratio Signals Caution

While forecasts point to Coca-Cola Europacific Partners trading significantly below its estimated fair value, another approach tells a different story. The company’s price-to-earnings ratio stands higher than both the peer average (22.3x) and the broader European beverage industry (16.5x). Its fair ratio could be as low as 19.1x. This suggests the market may be pricing in limited upside or heightened risk, making valuation less clear-cut than it first appeared. If sentiment shifts, could the company re-rate towards that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coca-Cola Europacific Partners Narrative

If you see things differently or prefer charting your own course, why not explore the numbers yourself and craft a fresh perspective? It's quick and easy to do in just a few minutes. Do it your way

A great starting point for your Coca-Cola Europacific Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover unique market opportunities now. Do not let the next breakout stocks pass you by when just one quick search can put you ahead of the curve.

- Boost your portfolio's recurring income by tracking these 18 dividend stocks with yields > 3% with yields above 3% for reliable cash flow potential.

- Stay at the forefront of innovation and propel your strategy with these 24 AI penny stocks making waves in artificial intelligence.

- Capitalize on value by researching these 871 undervalued stocks based on cash flows identified as trading below their true potential based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CCEP

Coca-Cola Europacific Partners

Produces, distributes, and sells a range of non-alcoholic ready to drink beverages.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives