- Netherlands

- /

- Oil and Gas

- /

- ENXTAM:VPK

Subdued Growth No Barrier To Koninklijke Vopak N.V.'s (AMS:VPK) Price

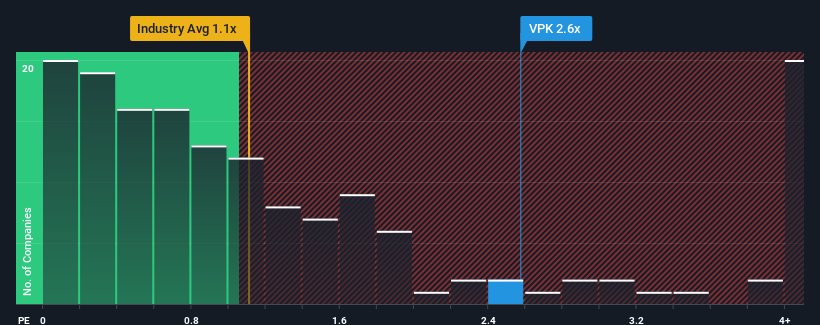

Koninklijke Vopak N.V.'s (AMS:VPK) price-to-sales (or "P/S") ratio of 2.6x may not look like an appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in the Netherlands have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Koninklijke Vopak

What Does Koninklijke Vopak's P/S Mean For Shareholders?

Recent times have been pleasing for Koninklijke Vopak as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Koninklijke Vopak will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Koninklijke Vopak's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.8%. Revenue has also lifted 21% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 1.8% per annum over the next three years. With the industry predicted to deliver 0.4% growth per annum, that's a disappointing outcome.

With this in mind, we find it intriguing that Koninklijke Vopak's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Koninklijke Vopak's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

For a company with revenues that are set to decline in the context of a growing industry, Koninklijke Vopak's P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for Koninklijke Vopak (1 is significant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Vopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:VPK

Koninklijke Vopak

An independent tank storage company, stores and handles liquid chemicals, gases, and oil products to the energy and manufacturing markets worldwide.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives