- Netherlands

- /

- Capital Markets

- /

- ENXTAM:FLOW

The one-year returns for Flow Traders' (AMS:FLOW) shareholders have been respectable, yet its earnings growth was even better

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. For example, the Flow Traders Ltd. (AMS:FLOW) share price is up 47% in the last 1 year, clearly besting the market decline of around 6.8% (not including dividends). That's a solid performance by our standards! However, the longer term returns haven't been so impressive, with the stock up just 2.1% in the last three years.

The past week has proven to be lucrative for Flow Traders investors, so let's see if fundamentals drove the company's one-year performance.

We've discovered 1 warning sign about Flow Traders. View them for free.While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

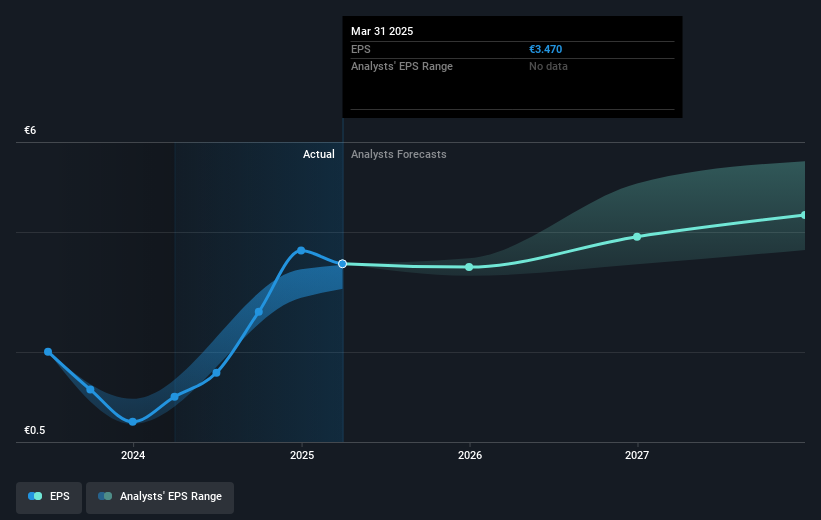

During the last year Flow Traders grew its earnings per share (EPS) by 177%. It's fair to say that the share price gain of 47% did not keep pace with the EPS growth. So it seems like the market has cooled on Flow Traders, despite the growth. Interesting. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.57.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Flow Traders has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Flow Traders will grow revenue in the future.

A Different Perspective

We're pleased to report that Flow Traders shareholders have received a total shareholder return of 48% over one year. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Flow Traders .

Of course Flow Traders may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FLOW

Flow Traders

Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives