- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:EXO

Exor (ENXTAM:EXO): Exploring If Current Valuations Reflect Underlying Value

Reviewed by Simply Wall St

Exor (ENXTAM:EXO) has caught investors’ attention recently, prompting some to take a closer look at its diverse operations across automotive, sports, and publishing. The stock’s performance provides an interesting perspective on the company’s current valuation.

See our latest analysis for Exor.

Exor’s share price has softened in recent months, with a 30-day share price return of -6.65 percent and a notable year-to-date decline of -18.68 percent. The bigger picture reflects a one-year total shareholder return of -22.32 percent. This suggests that while Exor has a rich mix of assets and global holdings, sentiment has shifted and momentum is currently on the back foot.

If recent price swings have you reassessing your options, this could be the perfect opportunity to broaden your view and discover fast growing stocks with high insider ownership

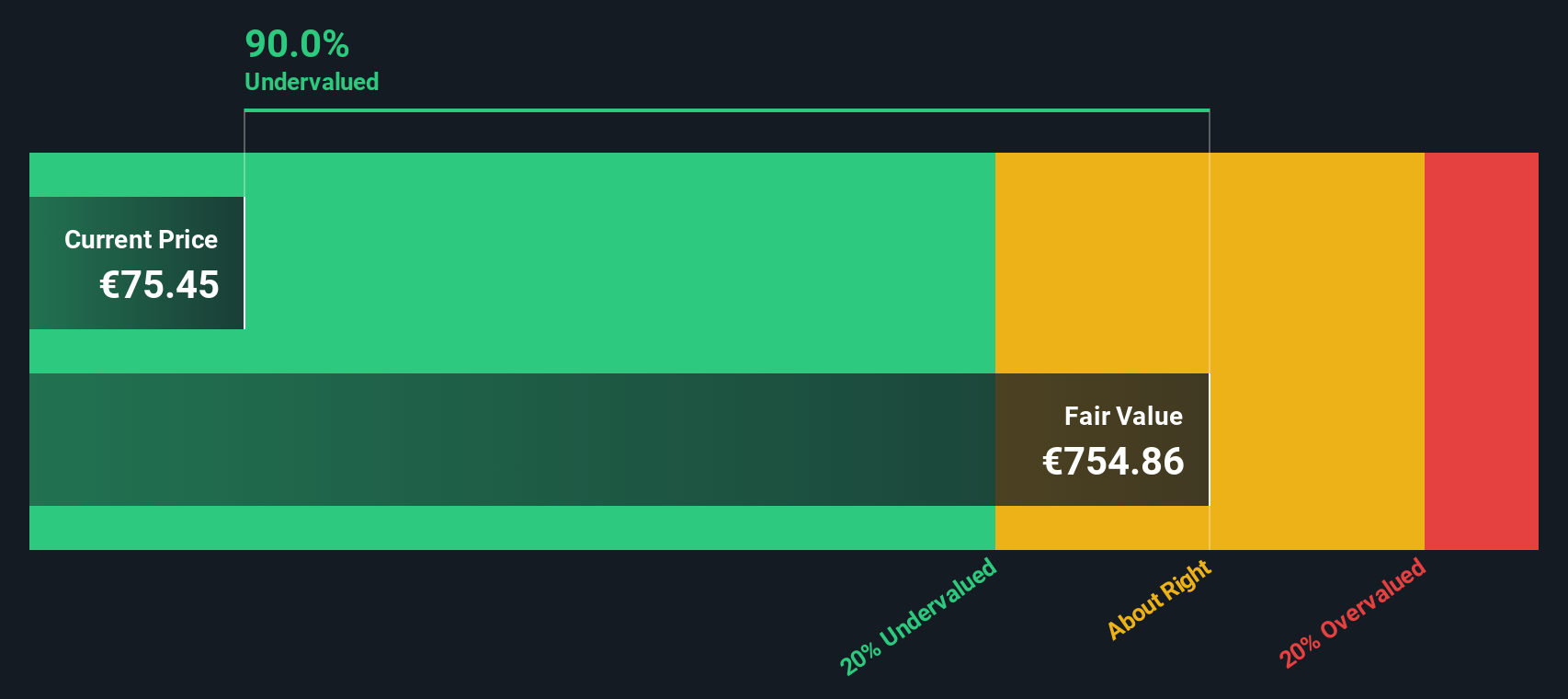

So, amid these recent declines and mixed signals, is Exor currently trading below its intrinsic value, or is the market already factoring in all of its future prospects, leaving little room for upside?Price-to-Book of 0.4x: Is it justified?

Exor’s current price-to-book ratio stands at just 0.4x, a stark discount relative to its last close price of €72.25 and its industry peers. Such a low multiple indicates the market values Exor’s assets well below their accounting value.

The price-to-book ratio measures a company’s market value relative to its net asset value. This is particularly relevant for diversified holding companies like Exor. A ratio below 1 typically points to market skepticism about asset quality or future profitability. However, it can also signal untapped value if the market’s assumptions prove overly pessimistic.

Compared to European diversified financial firms, which average a 1x price-to-book, Exor’s ratio underlines just how deep the discount is. Against its peer average of 6x, the gap is even more striking and suggests the market assigns Exor far lower value per asset than its rivals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.4x (UNDERVALUED)

However, Exor's persistent negative net income and recent revenue declines could signal challenges that may affect its valuation outlook in the future.

Find out about the key risks to this Exor narrative.

Another View: Discounted Cash Flow Signals Even Greater Undervaluation

Taking a look through the lens of our DCF model, Exor appears to be priced at an even steeper discount. At €72.25 per share, it trades a massive 84.3% below our estimate of fair value (€458.91). This approach suggests much more upside. Could the market be missing something crucial here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Exor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Exor Narrative

If you see things differently or want to dive into the data on your own terms, you can shape your own perspective in just a few minutes. Why not Do it your way.

A great starting point for your Exor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to spot new opportunities beyond Exor, let Simply Wall Street’s powerful screeners guide your next smart move. Other investors are already seizing these ideas, and you don’t want to be left behind.

- Lock in reliable income by evaluating these 15 dividend stocks with yields > 3% offering strong yields and a history of rewarding shareholders.

- Step ahead of trends with these 25 AI penny stocks, where AI-driven companies are transforming entire industries and outpacing old rivals.

- Uncover unmatched value potential from these 927 undervalued stocks based on cash flows, highlighting stocks the market may be seriously overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:EXO

Exor

Engages in the automotive, agriculture and construction, sports car, commercial vehicle, and powertrain businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.