- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

Assessing CVC Capital Partners (ENXTAM:CVC): Is the Market Overlooking Its Valuation Potential?

Reviewed by Kshitija Bhandaru

CVC Capital Partners (ENXTAM:CVC) has seen its stock shift slightly recently, prompting some investors to revisit its performance over the past month. The company’s current value reflects ongoing sentiment rather than a specific event. This creates an opportunity to reassess its standing.

See our latest analysis for CVC Capital Partners.

Despite recent small shifts in CVC Capital Partners’ share price, the bigger picture shows momentum has been largely steady, with the latest share price at $15.55 and a one-year total shareholder return of -0.20%. Subtle moves like these often hint at the market carefully reassessing risk and growth potential, rather than responding to dramatic news or events.

If you’re interested in looking beyond the usual suspects, now’s a great time to explore fast growing stocks with high insider ownership.

With a modest dip in the past year but promising revenue and net income growth, is CVC Capital Partners currently trading below its true value? Alternatively, are investors already factoring in its future prospects and growth potential?

Most Popular Narrative: 20.3% Undervalued

CVC Capital Partners’ most widely followed narrative puts its fair value well above the last close, hinting at pent-up potential that markets may not fully appreciate. With recent price movements remaining relatively flat, it appears that underlying growth drivers and structural shifts are influencing this narrative’s outlook.

Robust fundraising and strategic expansion into Private Wealth and insurance position the company for long-term revenue growth and diversified fee income. Strategic acquisitions and investments in growth areas like AI and infrastructure could enhance revenue, operational efficiency, and margin expansion.

Want to know which levers are fueling this “undervalued” call? The most important assumptions might surprise you. The narrative revolves around future-shaping growth, powerful catalysts, and a margin transformation that sets eye-catching targets. See what’s really driving the calculation.

Result: Fair Value of $19.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, economic uncertainty and delays in future fundraising could challenge the stability of CVC Capital Partners’ earnings and test the bullish narrative.

Find out about the key risks to this CVC Capital Partners narrative.

Another View: Comparing Earnings Multiples

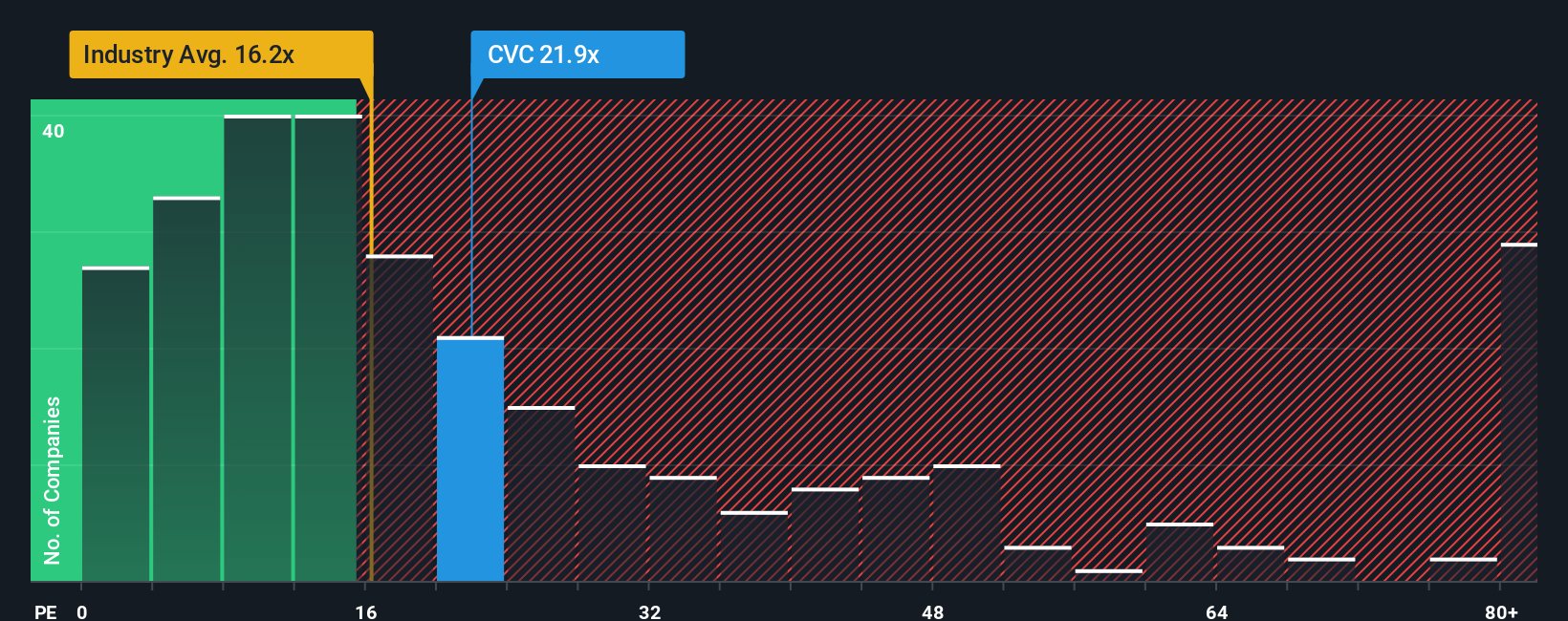

While analyst forecasts suggest CVC Capital Partners is undervalued based on future growth, a different picture emerges when you look at its actual price-to-earnings ratio. The company trades at 21.9 times earnings, which is higher than both the European industry average of 16 and its peer group at 21.4. Even compared to its fair ratio of 18.3, CVC appears expensive. This could mean investors are paying a premium for future potential, but also taking on valuation risk. Is the optimism warranted or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CVC Capital Partners Narrative

If you see things differently or want to dig deeper, jump in and shape your own view by exploring the facts firsthand. You can craft your perspective in just a few minutes. Do it your way

A great starting point for your CVC Capital Partners research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Get ahead of the crowd and make your next move count with handpicked investment themes. Don’t just follow trends; set them! Use the opportunities below to put yourself in a stronger position.

- Reap the rewards of consistent income by targeting these 19 dividend stocks with yields > 3% that deliver yields above 3% for reliable cash flow.

- Tap into breakthrough growth by targeting these 24 AI penny stocks that harness artificial intelligence for real-world innovation and market leadership.

- Benefit from value opportunities by pinpointing these 896 undervalued stocks based on cash flows that may be flying under Wall Street’s radar but are positioned for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives