- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Assessing Adyen (ENXTAM:ADYEN) Valuation Following Modest Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Adyen.

Adyen’s 1-month share price return of 8.7% stands out as positive momentum is building after a period of mixed sentiment. While this recent strength has helped shares rebound slightly higher for the year, longer-term total shareholder returns remain muted. This underscores why some investors are still weighing the company’s growth story against ongoing competition and profitability questions.

If this shift in momentum has you interested in what else is out there, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading around 20% below analyst price targets and annual growth figures looking solid, the real question for investors now is whether Adyen is undervalued or if the market has already priced in future growth.

Most Popular Narrative: 17.6% Undervalued

Adyen's estimated fair value is set well above the latest closing price, suggesting the mainstream narrative sees meaningful upside potential from current levels.

Ongoing investments and traction in next-generation financial products (e.g., card issuing, embedded platform financial services) deepen client relationships, raise average revenue per merchant, and create new earnings streams, positively impacting margins over the long term.

Want to know what’s behind this bullish outlook? The secret sauce is hidden in analyst expectations about where earnings and margins could head next. Curious which big assumptions drive this price target? Dive in to find out.

Result: Fair Value of €1,812.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if enterprise merchant growth slows or value-added products underperform. These factors could potentially offset Adyen’s otherwise impressive momentum and future expectations.

Find out about the key risks to this Adyen narrative.

Another View: What Do the Numbers Say?

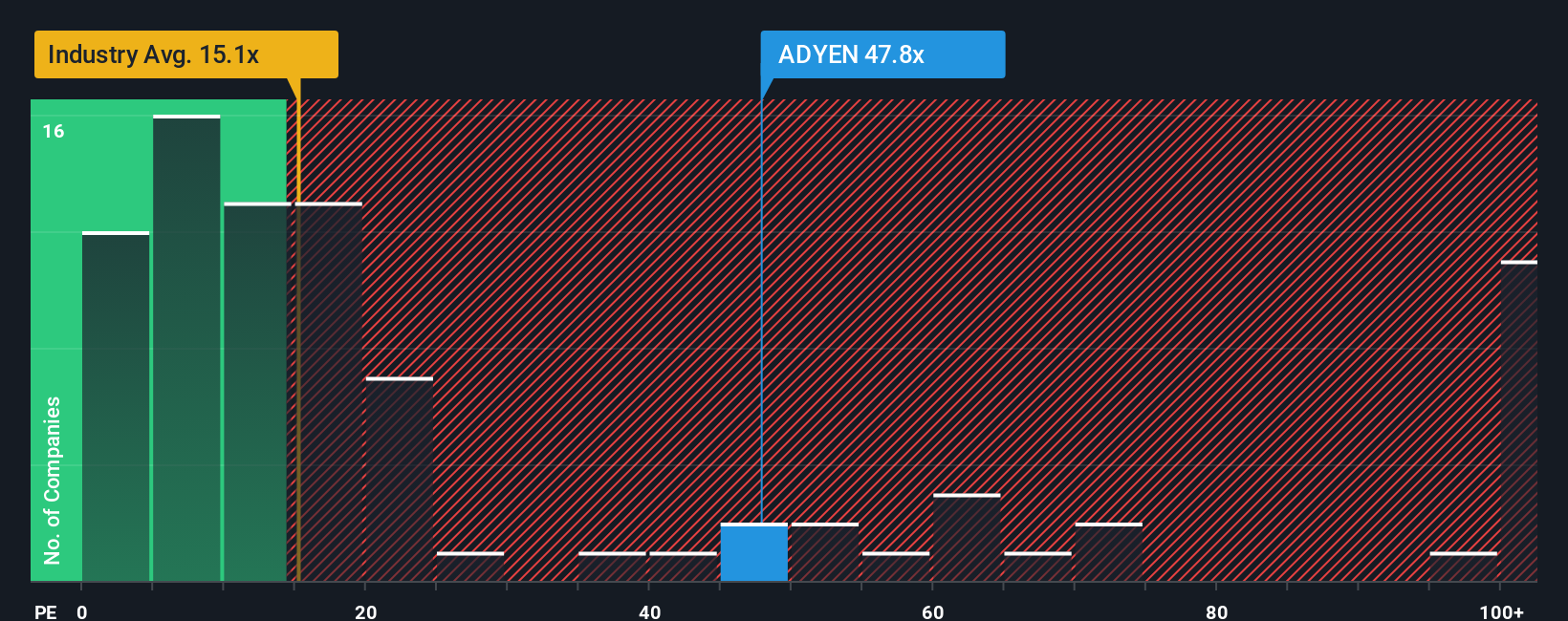

Looking at price-to-earnings, Adyen trades at 47.2x earnings, much higher than both the industry average of 15.2x and the peer average of 14.6x. Even compared to its own fair ratio of 20.4x, the current multiple suggests the stock is quite expensive. This kind of gap poses valuation risks. Could the market be expecting too much, or is there more growth ahead than others see?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own Adyen narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Looking for More Investment Ideas?

Smart investors never limit themselves to a single opportunity. Give yourself an edge and stay ahead of the crowd by exploring new stocks and trends below.

- Grow your portfolio's stability and income by checking out these 17 dividend stocks with yields > 3% with yields higher than 3%.

- Catch the next wave in cutting-edge tech by getting started with these 27 AI penny stocks shaping the future of artificial intelligence.

- Tap into market bargains by reviewing these 877 undervalued stocks based on cash flows that could be primed for strong returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives