- Netherlands

- /

- Professional Services

- /

- ENXTAM:ARCAD

Arcadis (ENXTAM:ARCAD) Is Up 10.0% After Hudson Tunnel Project Extension and €175M Buyback - What's Changed

Reviewed by Sasha Jovanovic

- In late September 2025, MPA Delivery Partners, a joint venture between Mace, Parsons Corporation, and Arcadis, announced it was awarded a US$665 million, 4.5-year contract extension by the Gateway Development Commission to continue managing the Hudson Tunnel Project, the most urgent rail infrastructure project in the United States. Arcadis also initiated a substantial €175 million share buyback program, representing roughly 5% of its outstanding shares, set to run through July 2026.

- The Hudson Tunnel Project is expected to generate more than 95,000 jobs and significant economic activity across the U.S., underscoring Arcadis’s role in transformative North American infrastructure while the buyback program signals confidence in its financial health and long-term strategy.

- We'll assess how Arcadis's expanded Hudson Tunnel Project role and active share buyback could reshape its medium-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arcadis Investment Narrative Recap

To hold Arcadis stock, investors need to believe in long-term demand for critical infrastructure and the company's ability to capture high-quality projects amid evolving sector needs. The recent Hudson Tunnel Project contract extension supports backlog stability and offers earnings visibility, but it does not materially address the short-term catalyst of sustained organic revenue growth or mitigate the immediate risk of persistent client delays and modest management growth outlooks.

The launch of a €175 million share buyback program is the most relevant recent announcement, reinforcing the company's confidence and aiming to enhance shareholder value even as near-term revenue growth remains modest. This approach aligns with catalysts tied to improving project pipeline quality and financial flexibility.

On the other hand, investors should be alert to how prolonged client delays in capital expenditure decisions could...

Read the full narrative on Arcadis (it's free!)

Arcadis is projected to reach €4.4 billion in revenue and €376.6 million in earnings by 2028. This outlook assumes a 3.9% annual decline in revenue and an earnings increase of €138.6 million from the current €238.0 million.

Uncover how Arcadis' forecasts yield a €57.93 fair value, a 22% upside to its current price.

Exploring Other Perspectives

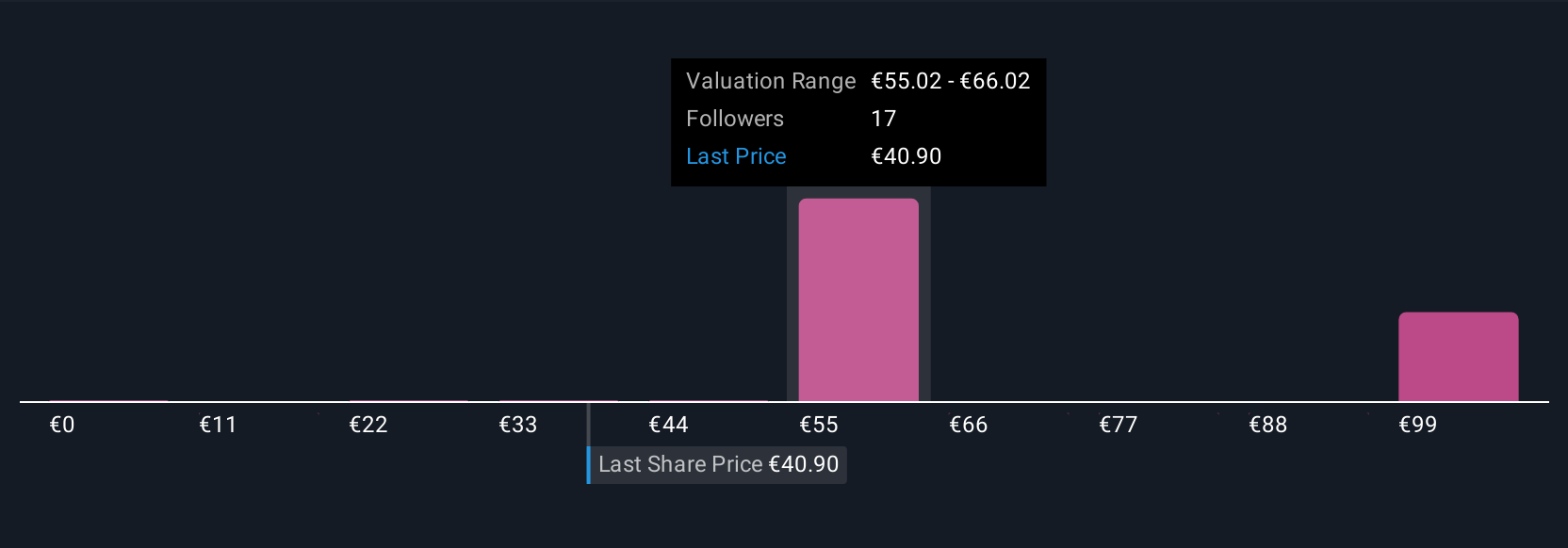

Five members of the Simply Wall St Community see Arcadis’ fair value ranging from €11 to over €112 per share. With client delays posing a current risk, you may want to compare these divergent outlooks before deciding what this could mean for the company’s results.

Explore 5 other fair value estimates on Arcadis - why the stock might be worth less than half the current price!

Build Your Own Arcadis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcadis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arcadis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcadis' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ARCAD

Arcadis

Offers design, engineering, architecture, and consultancy solutions for natural and built assets in The Americas, Europe, the Middle East, and the Asia Pacific.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives