- Netherlands

- /

- Electrical

- /

- ENXTAM:SIFG

We Think The Compensation For Sif Holding N.V.'s (AMS:SIFG) CEO Looks About Right

Key Insights

- Sif Holding's Annual General Meeting to take place on 12th of May

- Salary of €398.9k is part of CEO Fred van Beers's total remuneration

- Total compensation is similar to the industry average

- Sif Holding's EPS grew by 9.6% over the past three years while total shareholder return over the past three years was 33%

Under the guidance of CEO Fred van Beers, Sif Holding N.V. (AMS:SIFG) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 12th of May. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Sif Holding

Comparing Sif Holding N.V.'s CEO Compensation With The Industry

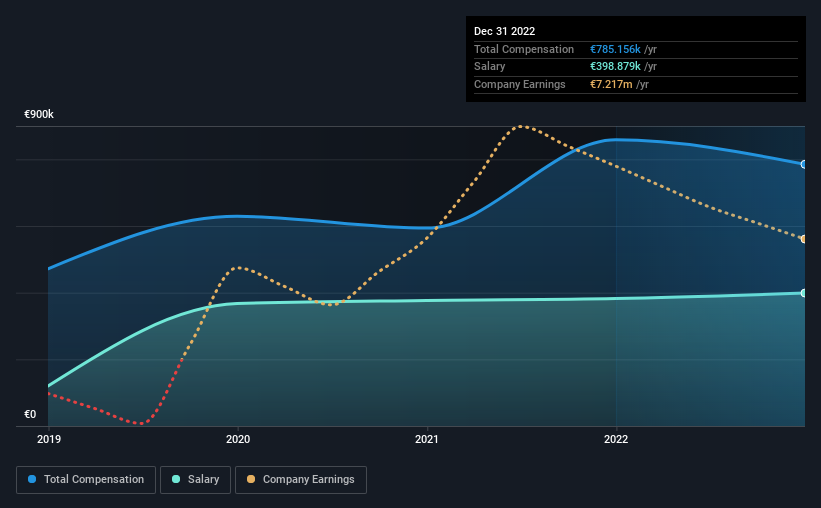

According to our data, Sif Holding N.V. has a market capitalization of €309m, and paid its CEO total annual compensation worth €785k over the year to December 2022. Notably, that's a decrease of 8.5% over the year before. In particular, the salary of €398.9k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the the Netherlands Electrical industry with market caps ranging from €181m to €726m, we found that the median CEO total compensation was €705k. So it looks like Sif Holding compensates Fred van Beers in line with the median for the industry. Moreover, Fred van Beers also holds €200k worth of Sif Holding stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | €399k | €382k | 51% |

| Other | €386k | €476k | 49% |

| Total Compensation | €785k | €858k | 100% |

On an industry level, roughly 48% of total compensation represents salary and 52% is other remuneration. Sif Holding is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Sif Holding N.V.'s Growth Numbers

Over the past three years, Sif Holding N.V. has seen its earnings per share (EPS) grow by 9.6% per year. Its revenue is down 11% over the previous year.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sif Holding N.V. Been A Good Investment?

Sif Holding N.V. has served shareholders reasonably well, with a total return of 33% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Sif Holding.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:SIFG

Sif Holding

Manufactures and sells foundation piles for offshore wind farms and metal structures in the Netherlands, the United Kingdom, the United States, Norway, South Korea, Spain, France, Poland, Belgium, Germany, rest of the European Union, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives