- Netherlands

- /

- Electrical

- /

- ENXTAM:LIGHT

Here's Why We Think Signify (AMS:LIGHT) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Signify (AMS:LIGHT), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Signify

Signify's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Signify has grown EPS by 25% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

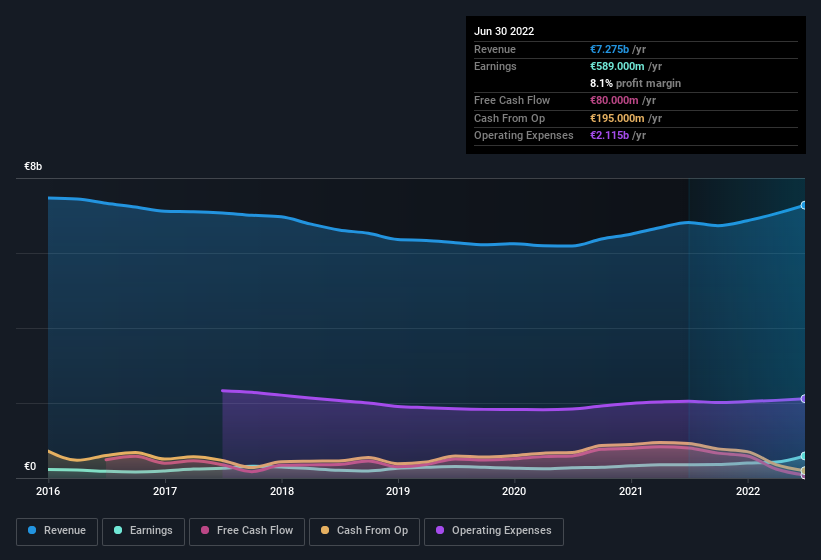

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Signify remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.8% to €7.3b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Signify's forecast profits?

Are Signify Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Signify insiders reported share sales in the last twelve months. Even better, though, is that the CFO & Member of Board of Management, Javier Van Engelen, bought a whopping €330k worth of shares, paying about €33.03 per share, on average. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

Does Signify Deserve A Spot On Your Watchlist?

For growth investors, Signify's raw rate of earnings growth is a beacon in the night. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. To put it succinctly; Signify is a strong candidate for your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Signify (2 are concerning!) that you need to be mindful of.

The good news is that Signify is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:LIGHT

Signify

Provides lighting products, systems, and services in Europe, the Americas, and internationally.

Flawless balance sheet, good value and pays a dividend.