Stock Analysis

- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Exploring Dividend Stocks On Euronext Amsterdam In May 2024

Reviewed by Simply Wall St

As of May 2024, the Euronext Amsterdam, like many global markets, has been navigating a complex landscape shaped by fluctuating inflation rates and cautious monetary policies across Europe. Amid these conditions, dividend stocks continue to attract attention for their potential to offer investors steady income streams in uncertain times. In this context, understanding what constitutes a robust dividend stock becomes crucial. Investors typically look for companies with a strong track record of stable and rising dividends, sound financial health, and the ability to withstand economic fluctuations—qualities that are particularly reassuring in the current economic environment.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.65% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.66% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.89% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 4.53% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.37% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.16% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and abroad, with a market capitalization of approximately €574.07 million.

Operations: Koninklijke Heijmans N.V. generates revenue primarily through its Construction & Technology segment (€1.08 billion), followed by Infrastructure Works (€800.03 million), Real Estate (€411.79 million), and Van Wanrooij segment (€124.76 million).

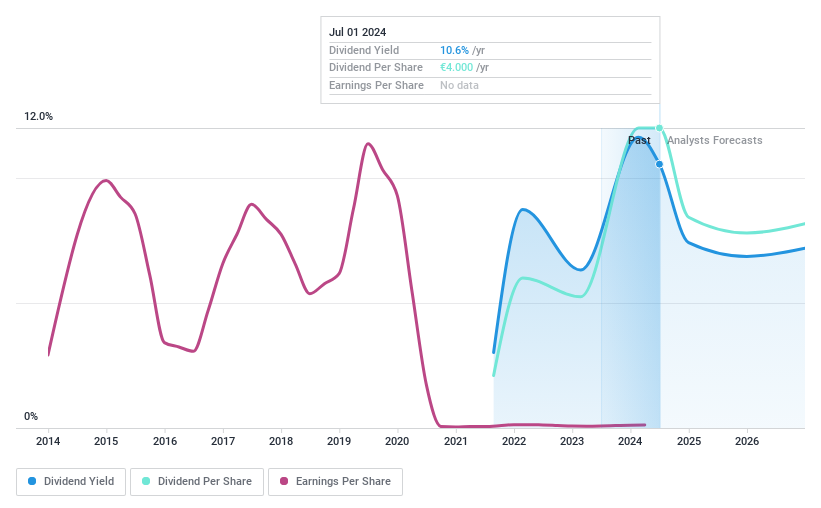

Dividend Yield: 4.2%

Koninklijke Heijmans offers a dividend yield of 4.16%, which is lower than the top quartile of Dutch dividend stocks at 5.57%. Despite this, the dividends are well-supported with a payout ratio of 37.1% and cash payout ratio of 59%, indicating sustainability from earnings and cash flow perspectives. However, its dividend track record shows volatility over the past decade, suggesting potential uncertainty for consistent growth in payouts. The company's earnings have seen an annual increase of 19.4% over five years, pointing to underlying business strength despite recent share price volatility and shareholder dilution within the last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Koninklijke Heijmans.

- In light of our recent valuation report, it seems possible that Koninklijke Heijmans is trading behind its estimated value.

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a range of work and human resources services, with a market capitalization of approximately €8.93 billion.

Operations: Unfortunately, the provided text does not include specific details about Randstad N.V.'s revenue segments. Therefore, I'm unable to summarize this information into one sentence. If you have additional data or a breakdown of their revenue streams, please provide it for a comprehensive summary.

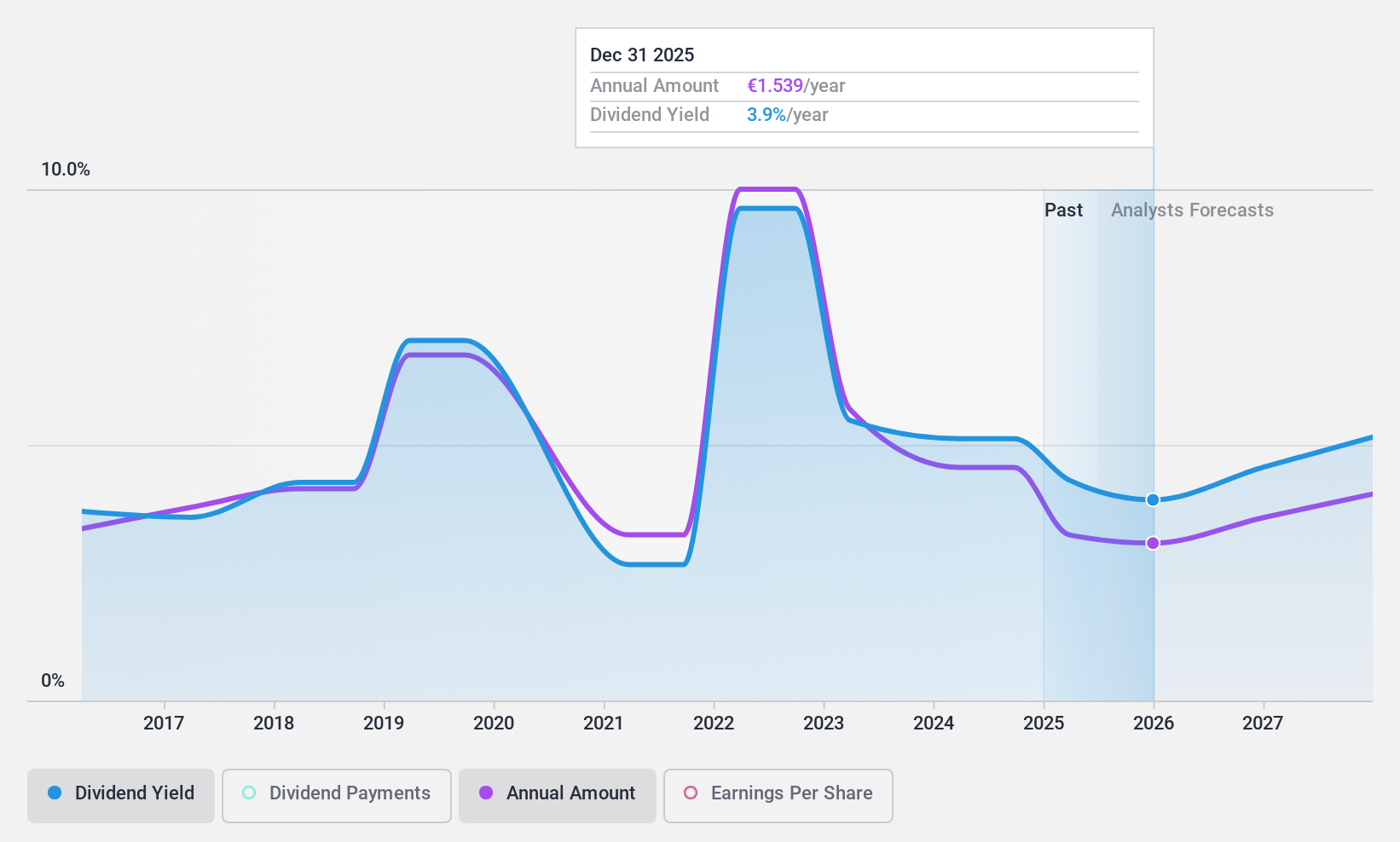

Dividend Yield: 4.5%

Randstad's dividend yield stands at 4.53%, below the top quartile in the Dutch market. Despite a decade of fluctuating dividends, recent financials show dividends are supported by a 73.4% payout ratio and a 45.9% cash payout ratio, ensuring coverage from both earnings and cash flow. However, Q1 reports indicate a downturn with sales dropping to €5.94 billion from €6.52 billion year-over-year and net income falling to €88 million from €154 million, potentially impacting future payouts.

- Unlock comprehensive insights into our analysis of Randstad stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Randstad shares in the market.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV is a financial services provider operating both in the Netherlands and internationally, with a market capitalization of approximately €1.71 billion.

Operations: Van Lanschot Kempen NV generates revenue through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

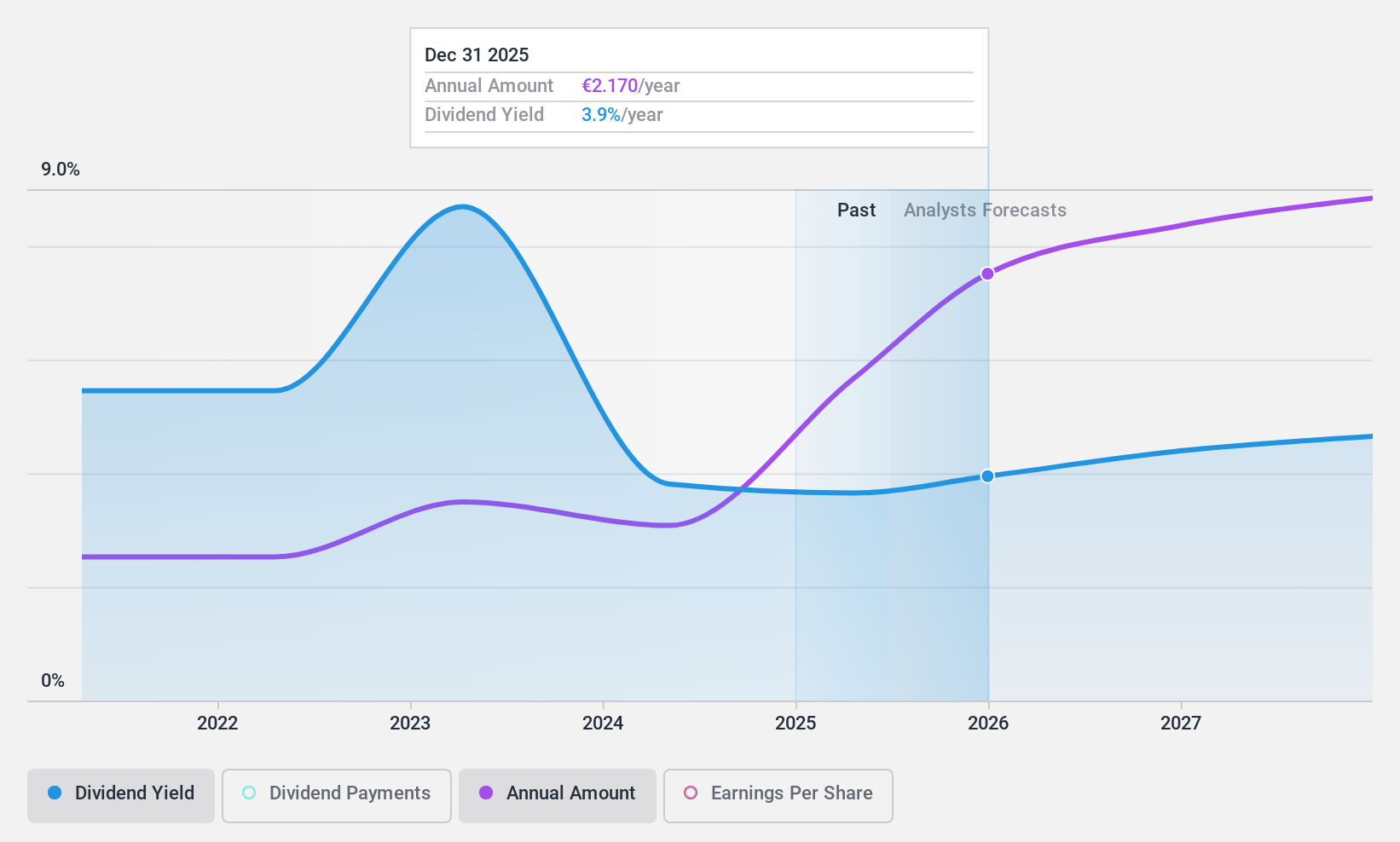

Dividend Yield: 9.9%

Van Lanschot Kempen, with a dividend yield of 9.89%, ranks in the top 25% of Dutch dividend payers. The firm's dividends are well-supported by a payout ratio of 70.9%, projected to remain sustainable at 66.6% in three years. Despite this, it has a brief history of dividend payments under ten years and an unstable track record, coupled with shareholder dilution over the past year which might raise concerns about long-term sustainability and growth prospects for investors focused on stable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of Van Lanschot Kempen.

- Our comprehensive valuation report raises the possibility that Van Lanschot Kempen is priced lower than what may be justified by its financials.

Where To Now?

- Delve into our full catalog of 6 Top Euronext Amsterdam Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Van Lanschot Kempen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet and pays a dividend.