Stock Analysis

- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

June 2024 Guide To High Insider Ownership Growth Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets exhibit mixed signals with some regions showing modest gains while others face economic pressures, the Netherlands' market on Euronext Amsterdam remains a focal point for investors seeking growth opportunities. In this context, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between management's interests and those of shareholders, potentially fostering resilience and long-term value creation in fluctuating markets.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Envipco Holding (ENXTAM:ENVI) | 15.6% | 68.9% |

| Ebusco Holding (ENXTAM:EBUS) | 34% | 115.2% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

| PostNL (ENXTAM:PNL) | 30.8% | 24.2% |

Let's review some notable picks from our screened stocks.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines (RVMs) for recycling used beverage containers, primarily operating in the Netherlands, North America, and Europe with a market capitalization of approximately €357.68 million.

Operations: The company generates its revenue by designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 15.6%

Envipco Holding N.V. has demonstrated a significant turnaround, with its first quarter sales reaching €27.44 million, up from €10.41 million the previous year, and shifting from a net loss to a net profit of €0.147 million. Despite trading at 76.3% below its estimated fair value and experiencing high share price volatility recently, Envipco's revenue is expected to grow by 33.6% annually, outpacing the Dutch market's 9.5%. However, insider activity remains undisclosed over the past three months.

- Click here to discover the nuances of Envipco Holding with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Envipco Holding is trading beyond its estimated value.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a software-as-a-service provider tailored for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €265.73 million.

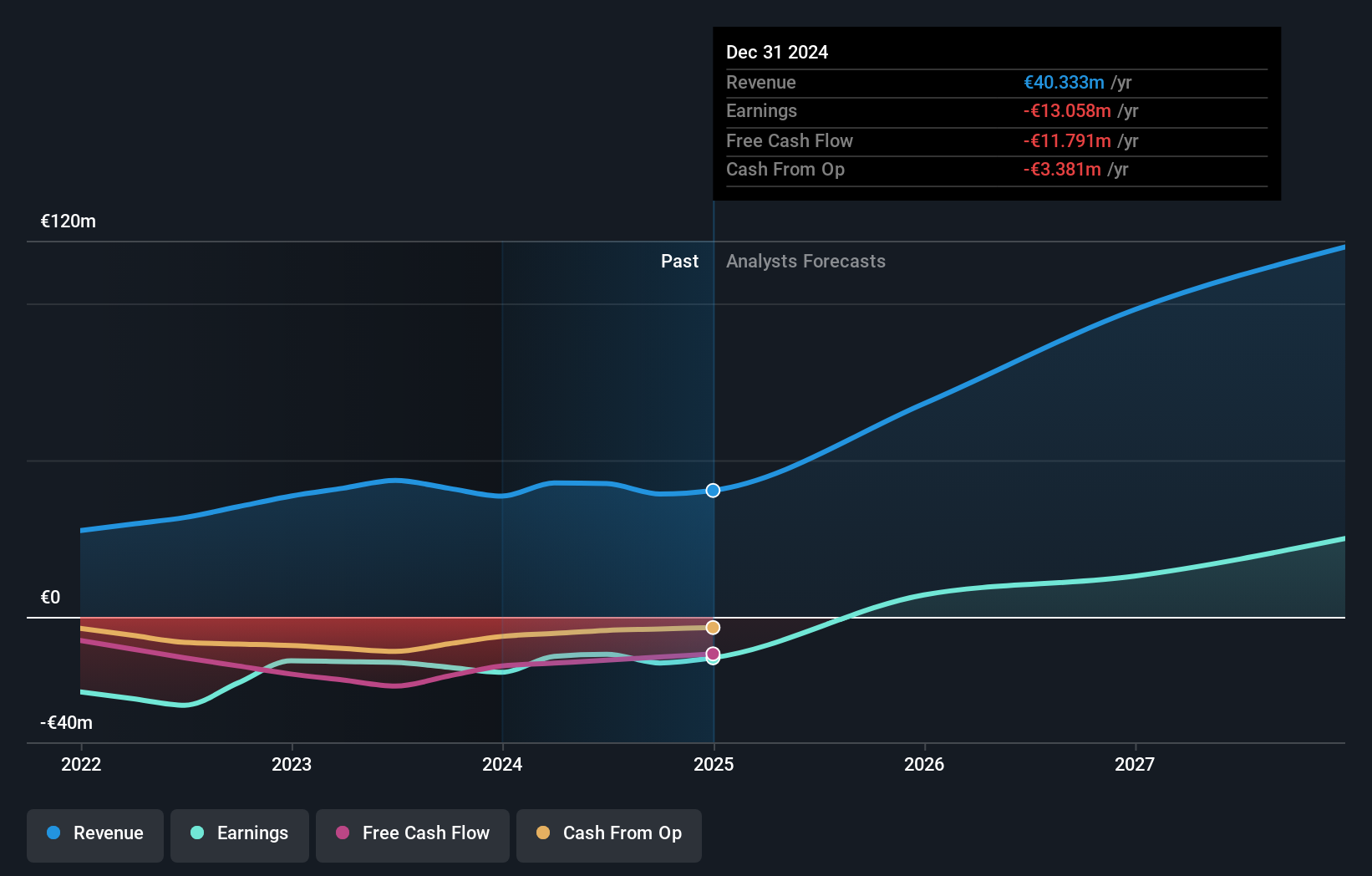

Operations: MotorK's revenue from its software and programming services totals €42.94 million.

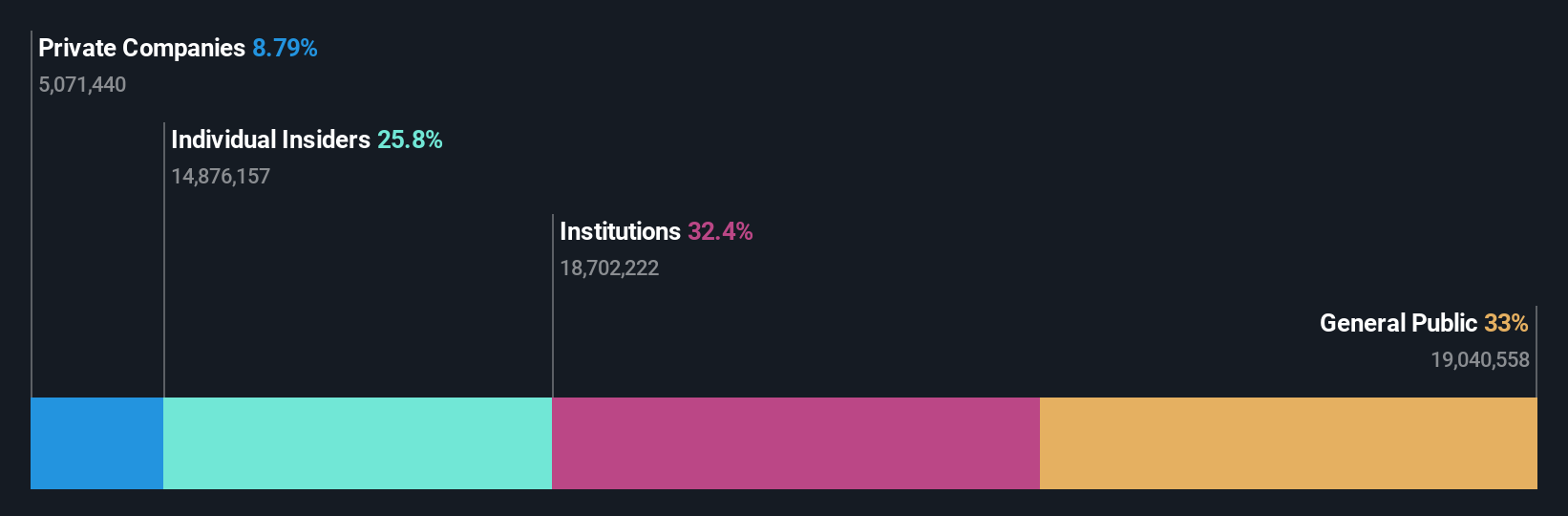

Insider Ownership: 35.8%

MotorK plc, amidst leadership changes with Helen Protopapas joining as director and Mauro Pretolani's departure, reported a slight decline in Q1 2024 revenues to €11.25 million from €11.43 million year-over-year. While the company has experienced shareholder dilution over the past year, it is poised for robust growth with earnings expected to increase by 105.85% annually and revenue projected to rise by 24% per year, significantly outpacing the Dutch market average of 9.5%.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that MotorK is priced higher than what may be justified by its financials.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.67 billion.

Operations: The company's revenue is primarily derived from its Packages and Mail in The Netherlands segments, generating €2.25 billion and €1.35 billion respectively.

Insider Ownership: 30.8%

PostNL, while trading at 49.2% below its estimated fair value, faces challenges with a high level of debt and unstable dividend track record. Despite this, the company's earnings are forecasted to grow by 24.23% annually over the next three years, outpacing the Dutch market's growth rate. Recent actions include completing a €298.67 million sustainability-linked bond offering, signaling strategic financial maneuvering amidst its profitability turnaround this year after reporting a net loss in Q1 2024.

- Navigate through the intricacies of PostNL with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, PostNL's share price might be too pessimistic.

Where To Now?

- Reveal the 6 hidden gems among our Fast Growing Euronext Amsterdam Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether MotorK is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with excellent balance sheet.