As European markets face renewed concerns over inflated AI stock valuations, with major indices like the STOXX Europe 600 and Germany's DAX experiencing declines, investors are increasingly seeking opportunities in less conspicuous areas of the market. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating the current landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. operates in the real estate, construction, and infrastructure sectors both within the Netherlands and internationally, with a market cap of approximately €1.62 billion.

Operations: Heijmans generates revenue from three main segments: Living (€1.00 billion), Work (€662.60 million), and Connecting (€1.05 billion).

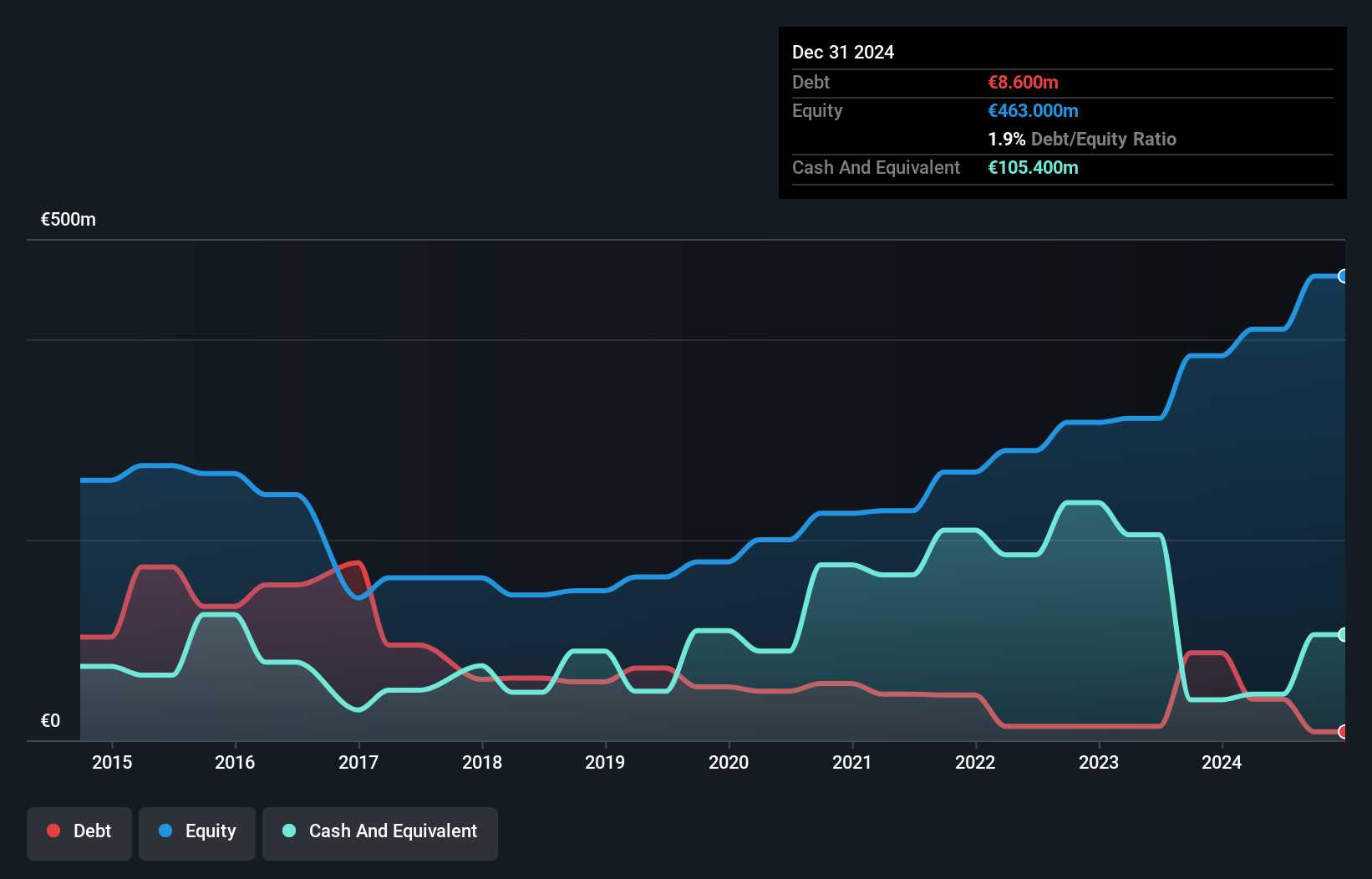

Heijmans, a notable player in the construction sector, is trading at 54.7% below its estimated fair value, offering potential upside for investors. The company has demonstrated strong earnings growth of 42.3% over the past year, outpacing the industry average of 9.1%. With a debt to equity ratio reduced from 24.5% to just 2.1% over five years and interest payments well covered by EBIT at 33.9 times, Heijmans shows robust financial health. However, challenges such as political uncertainty and labor shortages could impact future performance despite forecasts predicting annual revenue growth of 4.8%.

Wavestone (ENXTPA:WAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Wavestone SA is a consulting firm that offers management consulting and information system services both in France and internationally, with a market capitalization of approximately €1.21 billion.

Operations: Wavestone generates revenue primarily from management consulting and information system services, totaling approximately €943.67 million. The company's net profit margin is 10.5%, highlighting its efficiency in converting revenue into profit after expenses.

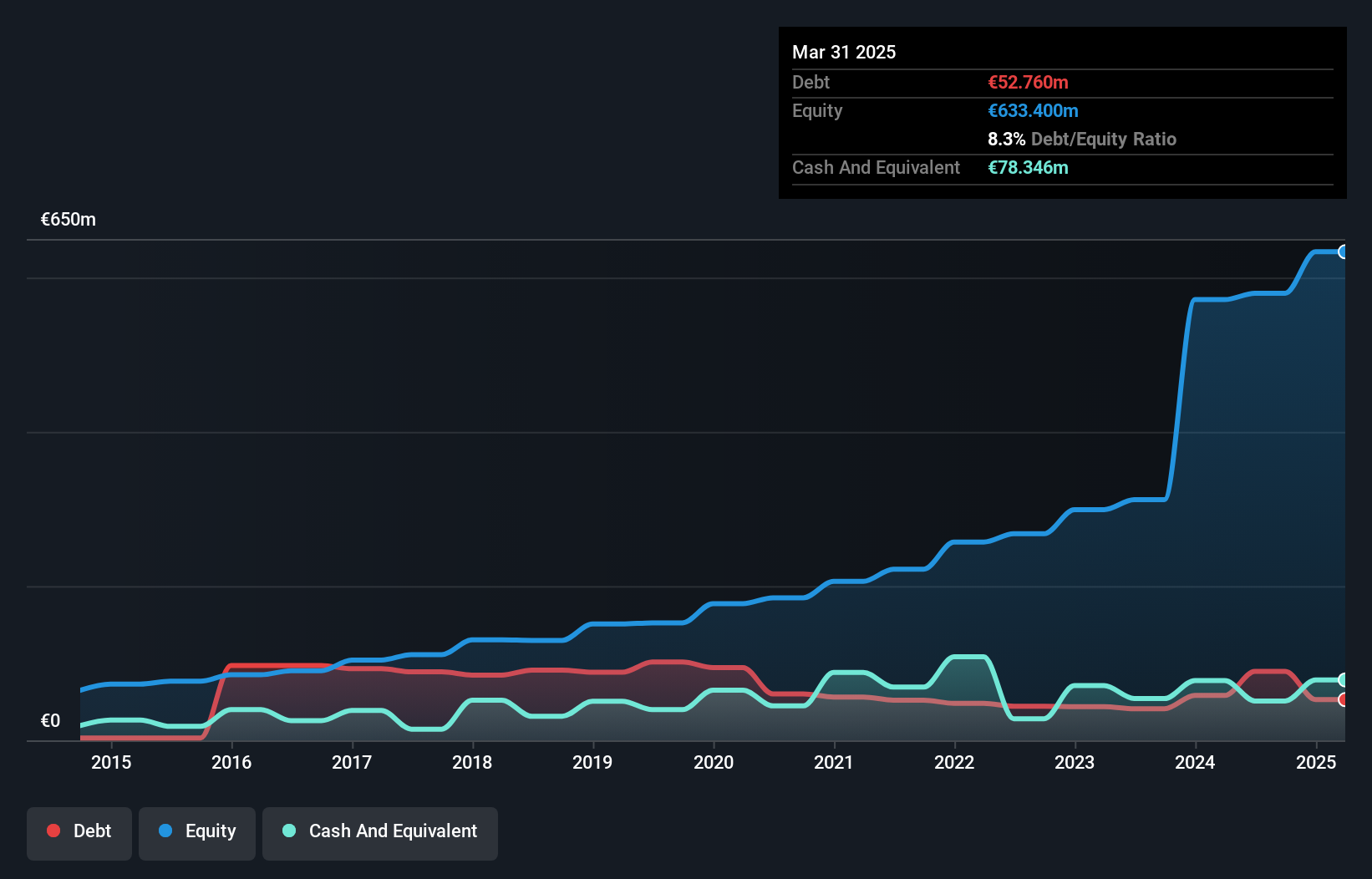

Wavestone, a notable player in the IT consulting sector, has demonstrated robust financial health. Its earnings surged by 29.8% over the past year, outpacing the broader IT industry which saw a -5.6% change. The firm is trading at 24.8% below its estimated fair value, suggesting potential upside for investors seeking value opportunities. With a debt to equity ratio reduced from 53.2% to 8.3% over five years and more cash than total debt, Wavestone exhibits strong financial management and stability. Recent revenue reports show slight growth with €226 million for Q2 of fiscal year 2025/2026 compared to €225 million previously, indicating stable performance amid market challenges.

- Click here and access our complete health analysis report to understand the dynamics of Wavestone.

Assess Wavestone's past performance with our detailed historical performance reports.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gränges AB (publ) is a company involved in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications across Asia Pacific, Europe, and the Americas with a market cap of approximately SEK14.85 billion.

Operations: Gränges generates revenue primarily from its Gränges Americas segment, contributing SEK12.60 billion. The net profit margin is a key indicator of financial performance, reflecting the company's ability to convert revenue into profit after accounting for all expenses.

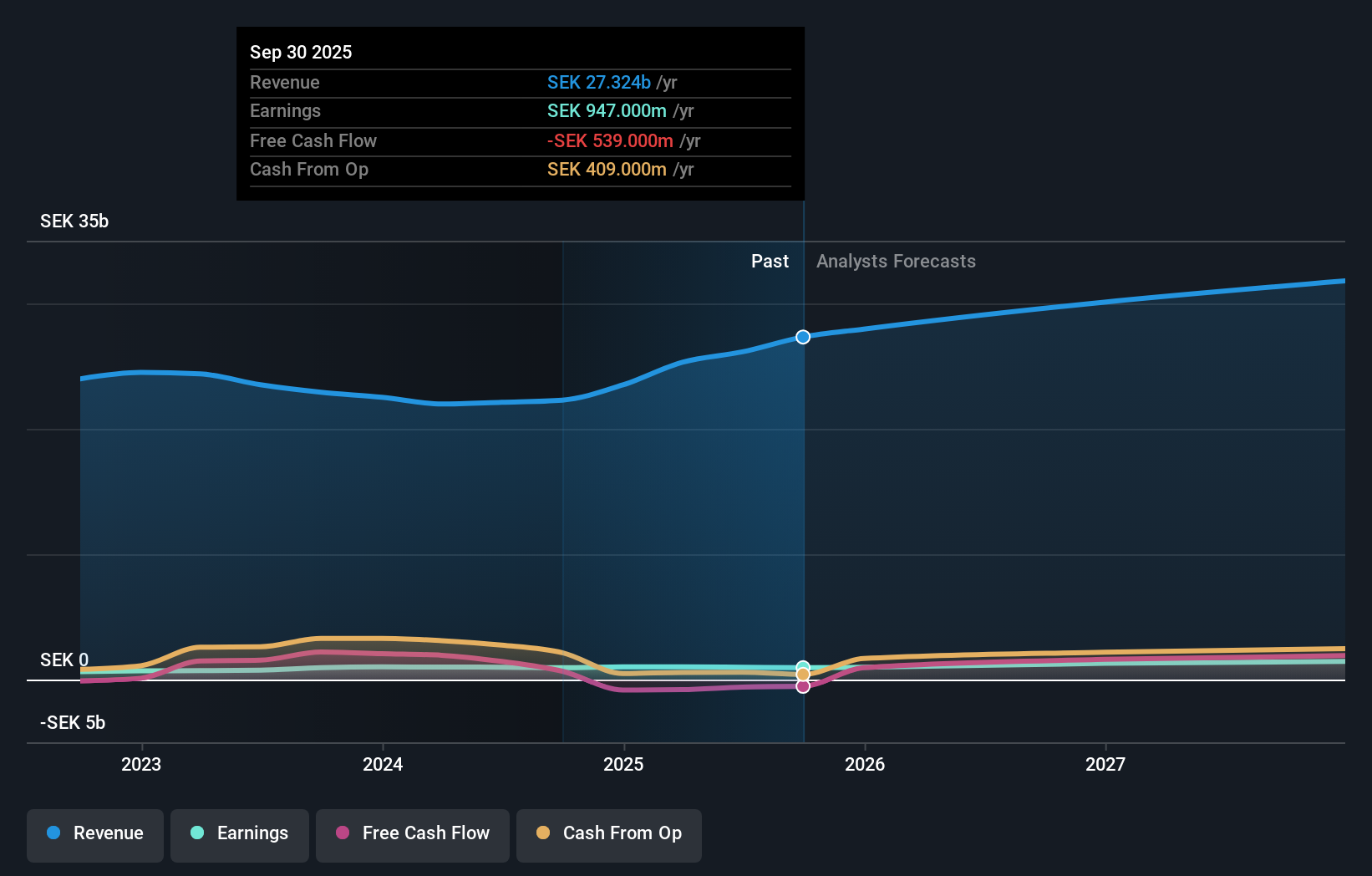

Gränges, a nimble player in the metals industry, showcases resilience with earnings growth of 0.4% over the past year, outpacing the sector's -16.8%. Despite challenges like weak automotive demand and economic uncertainties in Europe, Gränges leverages its regional production strategy to bolster net margins and mitigate tariff risks. The company reported a Q3 sales surge to SEK 6.93 billion from SEK 5.75 billion last year but saw net income dip to SEK 242 million from SEK 285 million. With EBIT covering interest payments by 6.2 times and a satisfactory debt-to-equity ratio of 37.6%, Gränges remains poised for future expansion amidst market volatility.

Next Steps

- Explore the 314 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wavestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:WAVE

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.