- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Undervalued Stocks On Euronext Amsterdam Including Alfen And 2 More

Reviewed by Simply Wall St

The Euronext Amsterdam has been navigating a turbulent landscape, with mixed signals from the broader European markets and concerns over economic growth. Despite these challenges, there are opportunities for discerning investors to identify undervalued stocks that may offer potential value. In this article, we will explore three such stocks on Euronext Amsterdam, including Alfen. Identifying undervalued stocks often involves looking at companies with strong fundamentals that may be temporarily overlooked by the market due to broader economic conditions or sector-specific issues.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

| Alfen (ENXTAM:ALFEN) | €15.17 | €27.59 | 45% |

| Ctac (ENXTAM:CTAC) | €3.04 | €4.25 | 28.4% |

| ASML Holding (ENXTAM:ASML) | €784.00 | €878.31 | 10.7% |

| Envipco Holding (ENXTAM:ENVI) | €5.50 | €7.66 | 28.2% |

| Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

We'll examine a selection from our screener results.

Alfen (ENXTAM:ALFEN)

Overview: Alfen N.V., with a market cap of €329.49 million, operates through its subsidiaries in the design, engineering, development, production, and service of smart grids, energy storage systems, and electric vehicle charging equipment.

Operations: The company's revenue segments are Smart Grid Solutions (€188.38 million), EV Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

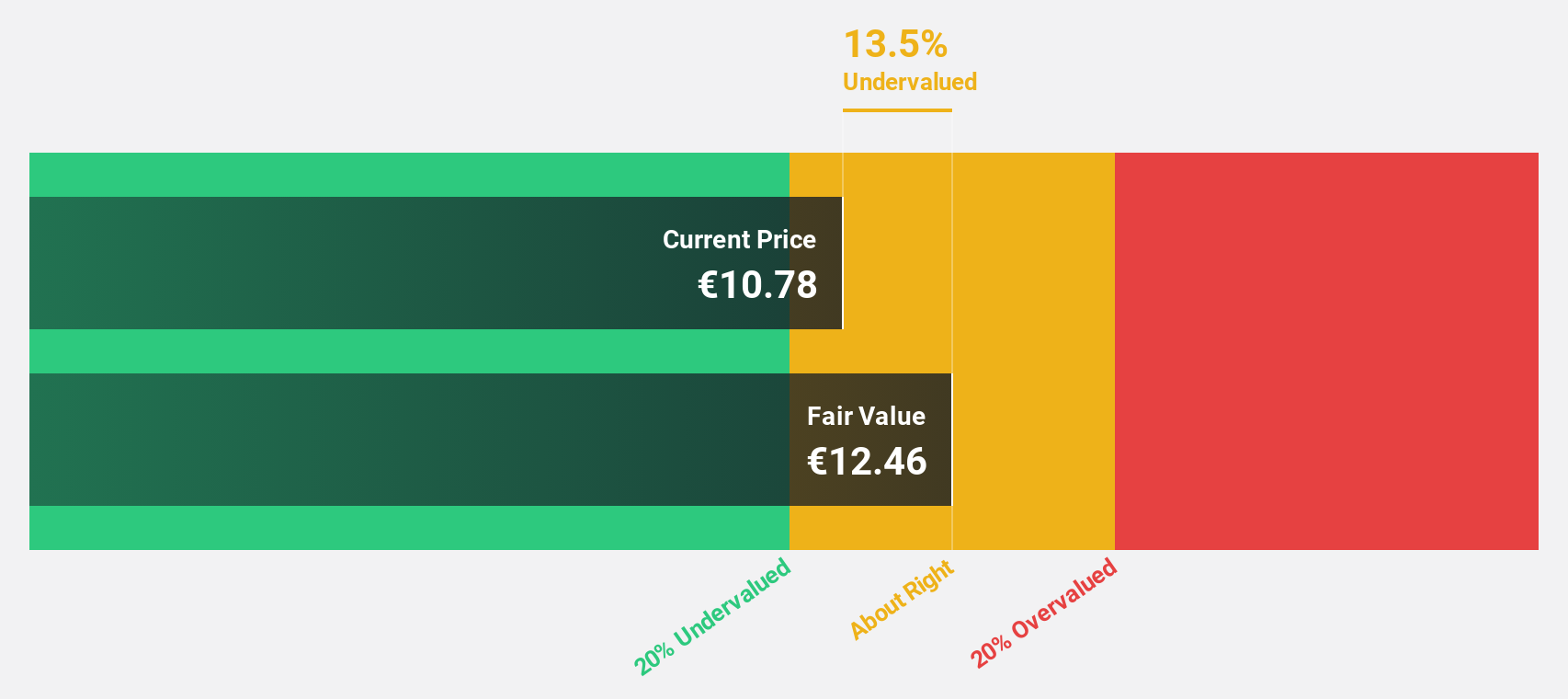

Estimated Discount To Fair Value: 45%

Alfen is trading at €15.17, significantly below its estimated fair value of €27.59, making it undervalued based on discounted cash flows. Despite a recent revision in revenue guidance from €590-660 million to €485-500 million, the company's earnings are forecast to grow significantly at 20.09% per year, outpacing the Dutch market's 19.6%. However, profit margins have declined from 12.1% last year to 5.9%, and its share price has been highly volatile recently.

- Our expertly prepared growth report on Alfen implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Alfen's balance sheet by reading our health report here.

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers with a market cap of €308.27 billion.

Operations: ASML's revenue from Semiconductor Equipment and Services amounts to €25.44 billion.

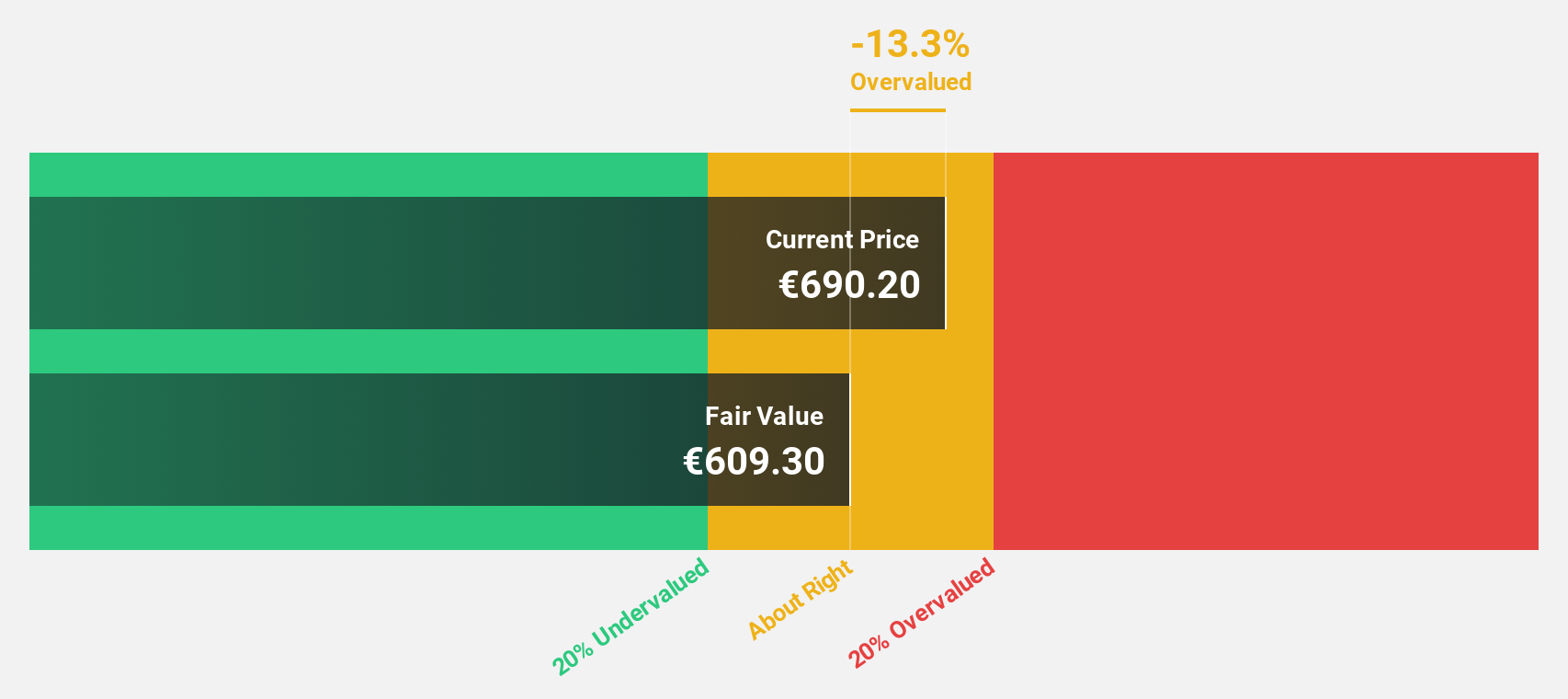

Estimated Discount To Fair Value: 10.7%

ASML Holding, trading at €784, is undervalued based on discounted cash flows with an estimated fair value of €878.31. Despite a volatile share price and recent declines in revenue (€6.24 billion) and net income (€1.58 billion), ASML's earnings are forecast to grow 23.2% annually, outpacing the Dutch market's 19.6%. The company reaffirmed its full-year guidance for 2024 and expects higher performance in the second half of the year.

- Our earnings growth report unveils the potential for significant increases in ASML Holding's future results.

- Take a closer look at ASML Holding's balance sheet health here in our report.

Envipco Holding (ENXTAM:ENVI)

Overview: Envipco Holding N.V. designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines to collect and process used beverage containers primarily in the Netherlands, North America, and Europe with a market cap of €317.30 million.

Operations: Envipco Holding generates revenue through the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe.

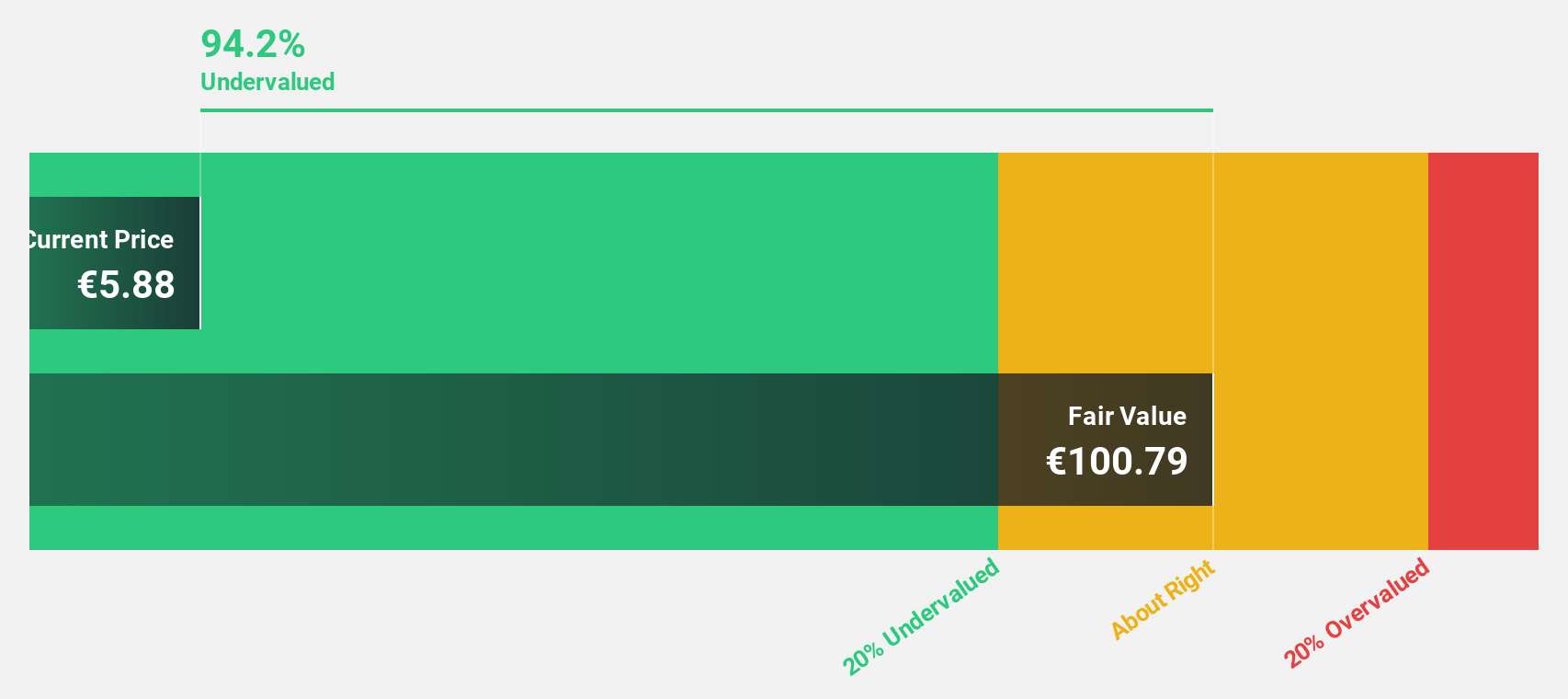

Estimated Discount To Fair Value: 28.2%

Envipco Holding, trading at €5.50, is undervalued based on discounted cash flows with an estimated fair value of €7.66. Despite recent share price volatility and past shareholder dilution, the company has turned profitable this year and reported significant Q1 2024 sales growth to €27.44 million from €10.41 million a year ago. Envipco's earnings are forecast to grow 68.9% annually over the next three years, significantly outpacing the Dutch market's average growth rate of 19.6%.

- Insights from our recent growth report point to a promising forecast for Envipco Holding's business outlook.

- Click here to discover the nuances of Envipco Holding with our detailed financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 6 Undervalued Euronext Amsterdam Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives