- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets face a pullback with the pan-European STOXX Europe 600 Index ending 1.24% lower due to concerns over AI-related stock valuations, investors are increasingly looking for stability amid fluctuating sentiment. In such an environment, dividend stocks can provide consistent income and potential resilience against market volatility, making them attractive options for enhancing portfolio stability.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.25% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.13% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.24% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.08% | ★★★★★★ |

| Evolution (OM:EVO) | 4.77% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.07% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.65% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.21% | ★★★★★☆ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

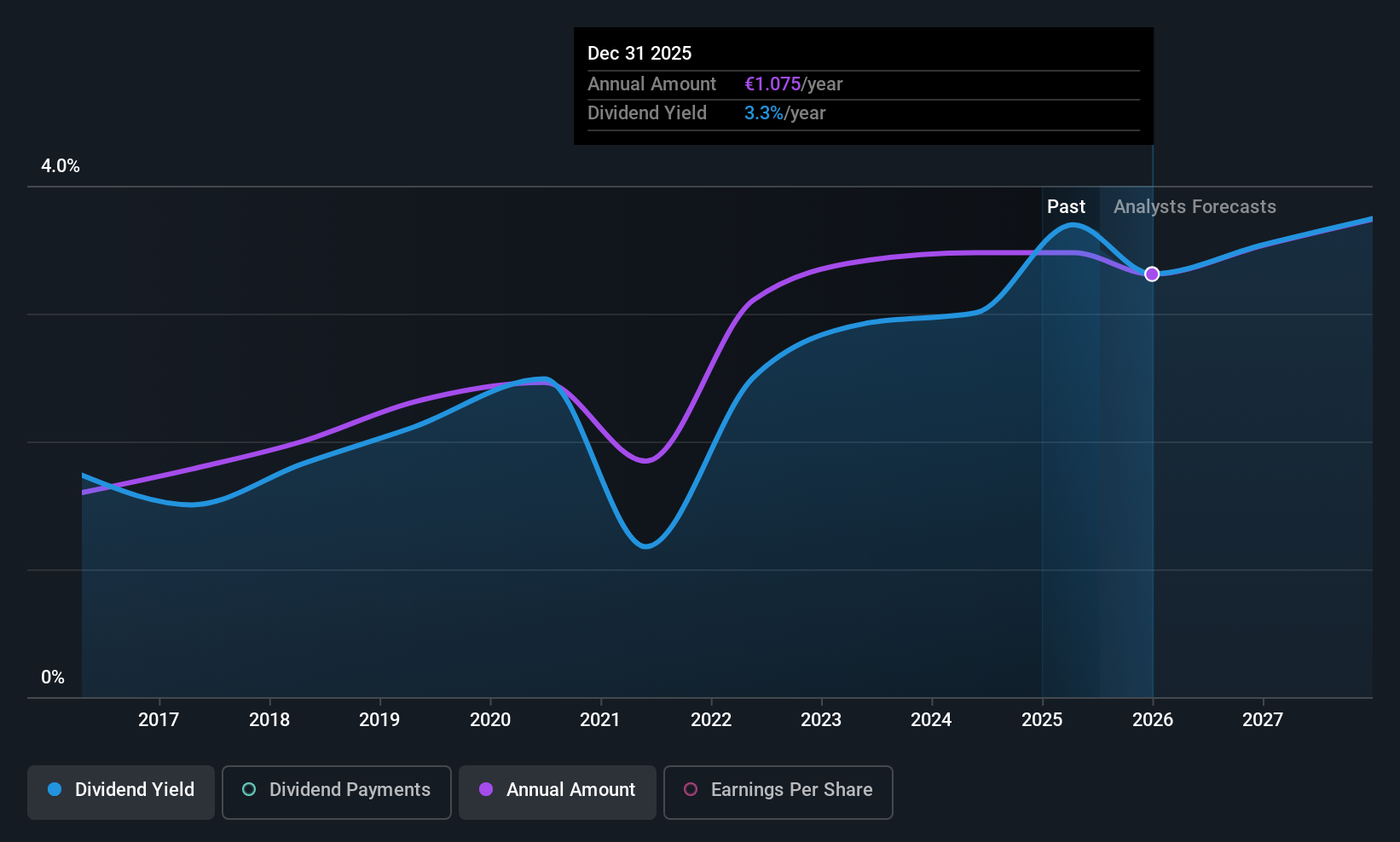

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V., with a market cap of €3.02 billion, provides mission-critical technologies for building, industry, and semiconductor markets across Europe, the United States, the Asia Pacific, the Middle East, and Africa.

Operations: Aalberts N.V.'s revenue is derived from its Semicon segment (€467.10 million), Building Technology segment (€1.58 billion), and Industrial Technology segment (€1.06 billion).

Dividend Yield: 4%

Aalberts' dividend sustainability is supported by a payout ratio of 82.7% and a cash payout ratio of 70.2%, indicating coverage by both earnings and cash flows. However, its dividend yield of 4.04% falls short compared to top-tier Dutch payers, and the track record has been volatile with significant annual drops over the past decade. Recent exclusion from the FTSE All-World Index may impact investor sentiment despite trading below estimated fair value.

- Dive into the specifics of Aalberts here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aalberts shares in the market.

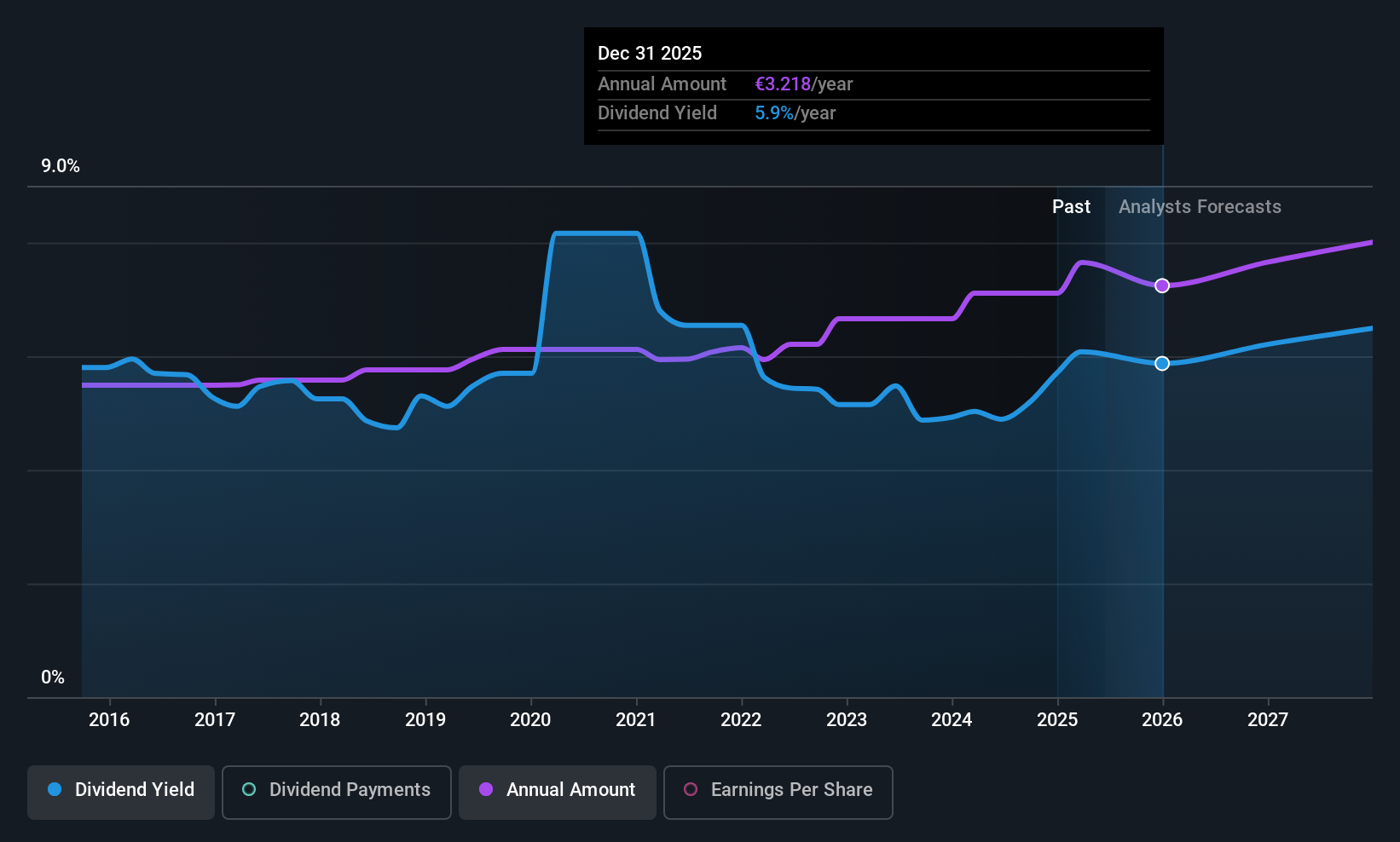

TotalEnergies (ENXTPA:TTE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TotalEnergies SE is a multi-energy company engaged in the production and marketing of oil, biofuels, natural gas, biogas, low-carbon hydrogen, renewables, and electricity across France, Europe, and globally with a market cap of €121.27 billion.

Operations: TotalEnergies SE generates revenue through several key segments, including Integrated LNG ($20.24 billion), Integrated Power ($22.60 billion), Marketing & Services ($61.47 billion), Refining & Chemicals ($114.52 billion), and Exploration & Production ($41.69 billion).

Dividend Yield: 6%

TotalEnergies' dividend is supported by a payout ratio of 57.8% and a cash payout ratio of 65.3%, ensuring coverage by earnings and cash flows, but its history shows volatility. The recent third interim dividend increase to €0.85/share indicates growth, yet past instability may concern investors seeking reliability. Despite trading significantly below estimated fair value, the stock's appeal as a top-tier French dividend payer is tempered by this inconsistency in payouts over the last decade.

- Delve into the full analysis dividend report here for a deeper understanding of TotalEnergies.

- According our valuation report, there's an indication that TotalEnergies' share price might be on the cheaper side.

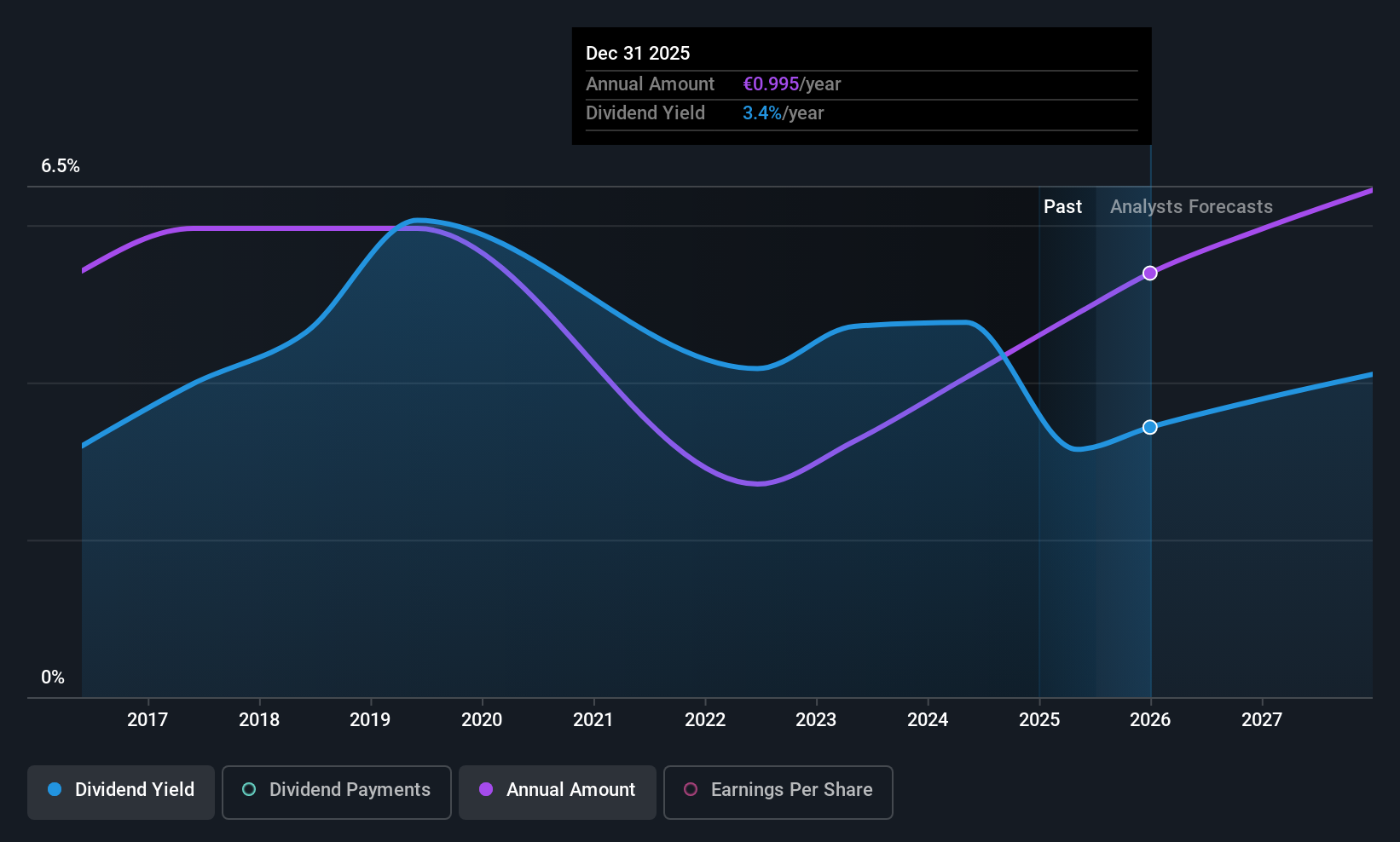

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company operating in Austria, Germany, Poland, the Czech Republic, Italy, Romania, Switzerland, Serbia, Great Britain, Slovakia, Norway and Belgium with a market cap of €1.05 billion.

Operations: PORR AG generates revenue from various segments, including €1.34 billion from Germany, €877.88 million from Poland, €719.73 million from Central and Eastern Europe (CEE), €2.88 billion from Austria and Switzerland (AT/CH), and €478.20 million from Infrastructure International.

Dividend Yield: 3.4%

PORR's dividend payments are well covered by earnings, with a payout ratio of 37.3% and cash flows at 21.6%, suggesting sustainability despite a history of volatility over the past decade. The stock trades significantly below its estimated fair value, offering potential value compared to peers. Recent inclusion in the Austria ATX Index and improved earnings results highlight positive momentum, though its dividend yield remains lower than top Austrian payers, which may affect attractiveness for yield-focused investors.

- Take a closer look at PORR's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that PORR is priced lower than what may be justified by its financials.

Make It Happen

- Gain an insight into the universe of 226 Top European Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives