- Malaysia

- /

- Other Utilities

- /

- KLSE:YTL

Here's Why We Think YTL Corporation Berhad (KLSE:YTL) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like YTL Corporation Berhad (KLSE:YTL), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for YTL Corporation Berhad

YTL Corporation Berhad's Improving Profits

Over the last three years, YTL Corporation Berhad has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, YTL Corporation Berhad's EPS grew from RM0.05 to RM0.094, over the previous 12 months. It's not often a company can achieve year-on-year growth of 89%.

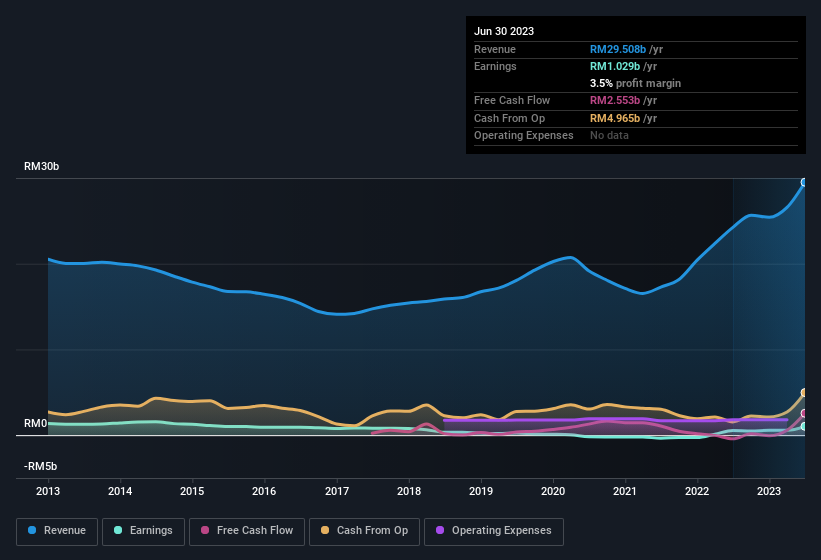

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. YTL Corporation Berhad shareholders can take confidence from the fact that EBIT margins are up from 11% to 15%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for YTL Corporation Berhad's future EPS 100% free.

Are YTL Corporation Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that YTL Corporation Berhad insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth RM1.0b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is YTL Corporation Berhad Worth Keeping An Eye On?

YTL Corporation Berhad's earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching YTL Corporation Berhad very closely. Even so, be aware that YTL Corporation Berhad is showing 2 warning signs in our investment analysis , and 1 of those is significant...

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YTL

YTL Corporation Berhad

Operates as an integrated infrastructure developer.

Undervalued with moderate growth potential.

Market Insights

Community Narratives