- Malaysia

- /

- Electric Utilities

- /

- KLSE:TENAGA

Does Tenaga Nasional Berhad (KLSE:TENAGA) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Tenaga Nasional Berhad (KLSE:TENAGA) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Tenaga Nasional Berhad

What Is Tenaga Nasional Berhad's Debt?

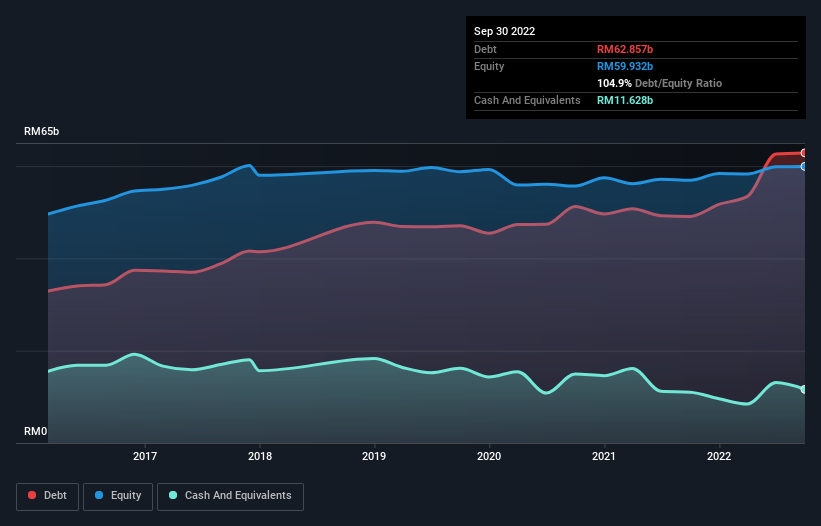

As you can see below, at the end of September 2022, Tenaga Nasional Berhad had RM62.9b of debt, up from RM49.1b a year ago. Click the image for more detail. However, it also had RM11.6b in cash, and so its net debt is RM51.2b.

A Look At Tenaga Nasional Berhad's Liabilities

The latest balance sheet data shows that Tenaga Nasional Berhad had liabilities of RM36.8b due within a year, and liabilities of RM107.3b falling due after that. On the other hand, it had cash of RM11.6b and RM27.7b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM104.7b.

The deficiency here weighs heavily on the RM56.2b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Tenaga Nasional Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Tenaga Nasional Berhad's debt to EBITDA ratio (3.1) suggests that it uses some debt, its interest cover is very weak, at 2.4, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On the other hand, Tenaga Nasional Berhad grew its EBIT by 23% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Tenaga Nasional Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Tenaga Nasional Berhad recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Tenaga Nasional Berhad's struggle to handle its total liabilities had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. In particular, its EBIT growth rate was re-invigorating. It's also worth noting that Tenaga Nasional Berhad is in the Electric Utilities industry, which is often considered to be quite defensive. Taking the abovementioned factors together we do think Tenaga Nasional Berhad's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Tenaga Nasional Berhad (including 1 which is a bit unpleasant) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Tenaga Nasional Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tenaga Nasional Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TENAGA

Tenaga Nasional Berhad

Engages in the generation, transmission, distribution, and sale of electricity in Malaysia and internationally.

Proven track record average dividend payer.