- Malaysia

- /

- Water Utilities

- /

- KLSE:RANHILL

Should You Be Adding Ranhill Utilities Berhad (KLSE:RANHILL) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Ranhill Utilities Berhad (KLSE:RANHILL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Ranhill Utilities Berhad

How Fast Is Ranhill Utilities Berhad Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Ranhill Utilities Berhad's EPS has grown 21% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Ranhill Utilities Berhad's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

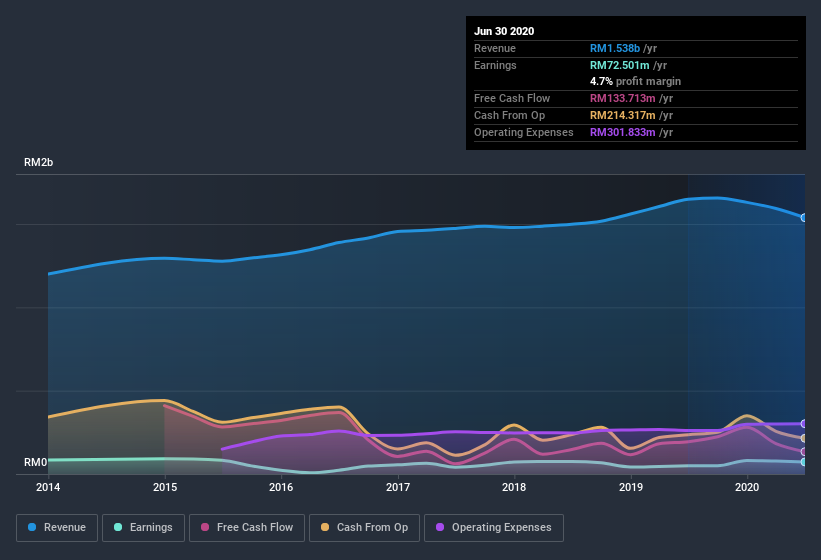

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Ranhill Utilities Berhad's forecast profits?

Are Ranhill Utilities Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Ranhill Utilities Berhad shares worth a considerable sum. Indeed, they hold RM141m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 15% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Ranhill Utilities Berhad To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Ranhill Utilities Berhad's strong EPS growth. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. What about risks? Every company has them, and we've spotted 3 warning signs for Ranhill Utilities Berhad (of which 1 can't be ignored!) you should know about.

Although Ranhill Utilities Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Ranhill Utilities Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:RANHILL

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion