- Malaysia

- /

- Water Utilities

- /

- KLSE:PBA

We Think PBA Holdings Bhd (KLSE:PBA) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that PBA Holdings Bhd (KLSE:PBA) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for PBA Holdings Bhd

What Is PBA Holdings Bhd's Debt?

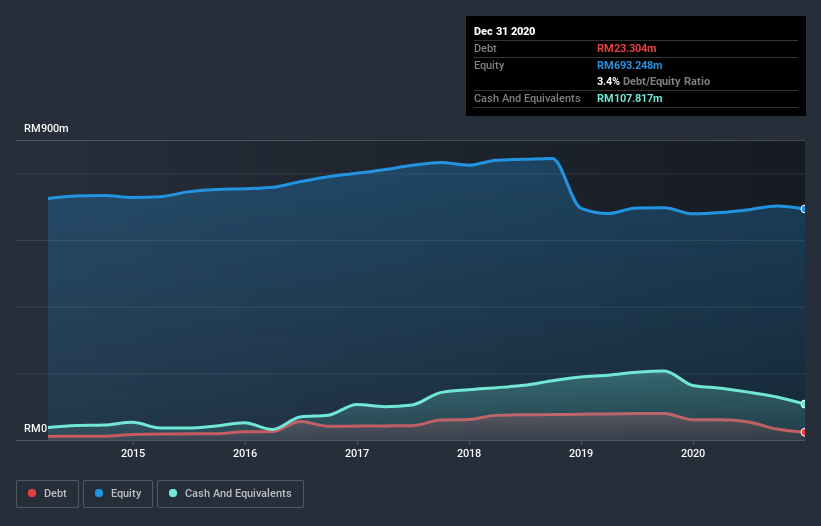

The image below, which you can click on for greater detail, shows that PBA Holdings Bhd had debt of RM23.3m at the end of December 2020, a reduction from RM61.0m over a year. But it also has RM107.8m in cash to offset that, meaning it has RM84.5m net cash.

A Look At PBA Holdings Bhd's Liabilities

Zooming in on the latest balance sheet data, we can see that PBA Holdings Bhd had liabilities of RM215.8m due within 12 months and liabilities of RM556.5m due beyond that. Offsetting this, it had RM107.8m in cash and RM35.6m in receivables that were due within 12 months. So it has liabilities totalling RM628.8m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM281.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, PBA Holdings Bhd would probably need a major re-capitalization if its creditors were to demand repayment. Given that PBA Holdings Bhd has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

It is just as well that PBA Holdings Bhd's load is not too heavy, because its EBIT was down 28% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since PBA Holdings Bhd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While PBA Holdings Bhd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, PBA Holdings Bhd produced sturdy free cash flow equating to 79% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While PBA Holdings Bhd does have more liabilities than liquid assets, it also has net cash of RM84.5m. And it impressed us with free cash flow of RM17m, being 79% of its EBIT. So while PBA Holdings Bhd does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for PBA Holdings Bhd (of which 1 is a bit concerning!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading PBA Holdings Bhd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PBA

PBA Holdings Bhd

An investment holding company, operates as a water supplier in the state of Penang, Malaysia.

Solid track record with excellent balance sheet.