- Malaysia

- /

- Infrastructure

- /

- KLSE:WCEHB

WCE Holdings Berhad (KLSE:WCEHB) pulls back 11% this week, but still delivers shareholders solid 25% CAGR over 5 years

It hasn't been the best quarter for WCE Holdings Berhad (KLSE:WCEHB) shareholders, since the share price has fallen 15% in that time. But that doesn't change the fact that the returns over the last five years have been very strong. Indeed, the share price is up an impressive 209% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 32% decline over the last twelve months.

Although WCE Holdings Berhad has shed RM281m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Given that WCE Holdings Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years WCE Holdings Berhad saw its revenue shrink by 2.4% per year. Given that scenario, we wouldn't have expected the share price to rise 25% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

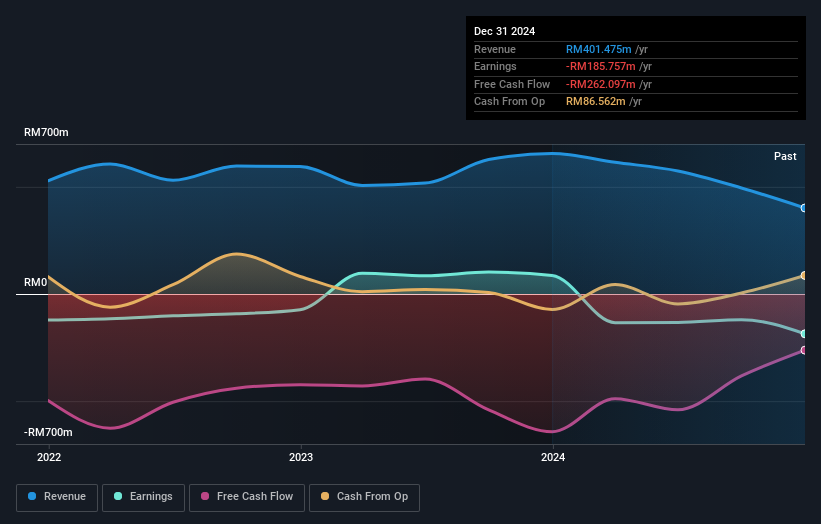

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling WCE Holdings Berhad stock, you should check out this FREE detailed report on its balance sheet .

A Different Perspective

While the broader market lost about 2.8% in the twelve months, WCE Holdings Berhad shareholders did even worse, losing 32%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 25% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - WCE Holdings Berhad has 1 warning sign we think you should be aware of.

We will like WCE Holdings Berhad better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WCE Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WCEHB

WCE Holdings Berhad

An investment holding company, engages in the construction, management, and tolling of highway operation in Malaysia.

Very low with weak fundamentals.

Market Insights

Community Narratives