- Malaysia

- /

- Marine and Shipping

- /

- KLSE:FM

FM Global Logistics Holdings Berhad (KLSE:FM) Is Paying Out A Larger Dividend Than Last Year

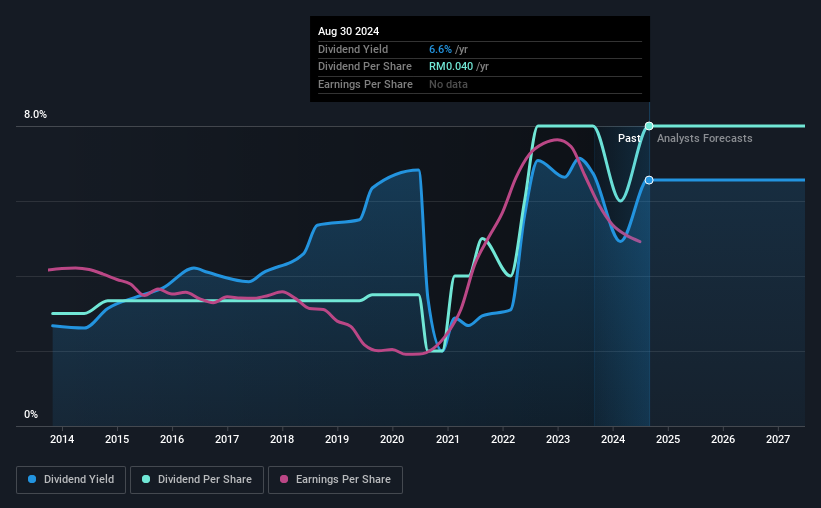

FM Global Logistics Holdings Berhad (KLSE:FM) has announced that it will be increasing its dividend from last year's comparable payment on the 18th of October to MYR0.03. This takes the dividend yield to 6.6%, which shareholders will be pleased with.

View our latest analysis for FM Global Logistics Holdings Berhad

FM Global Logistics Holdings Berhad's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. At the time of the last dividend payment, FM Global Logistics Holdings Berhad was paying out a very large proportion of what it was earning and 202% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, earnings per share is forecast to rise by 44.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 55%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was MYR0.015 in 2014, and the most recent fiscal year payment was MYR0.04. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. FM Global Logistics Holdings Berhad has seen EPS rising for the last five years, at 18% per annum. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Our Thoughts On FM Global Logistics Holdings Berhad's Dividend

In summary, while it's always good to see the dividend being raised, we don't think FM Global Logistics Holdings Berhad's payments are rock solid. While FM Global Logistics Holdings Berhad is earning enough to cover the payments, the cash flows are lacking. We don't think FM Global Logistics Holdings Berhad is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for FM Global Logistics Holdings Berhad that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FM

FM Global Logistics Holdings Berhad

Provides international multi-modal freight services in Malaysia, Thailand, Indonesia, Vietnam, India, Australia, the Philippines, Singapore, and the United States.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives