Is CJ Century Logistics Holdings Berhad (KLSE:CJCEN) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies CJ Century Logistics Holdings Berhad (KLSE:CJCEN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for CJ Century Logistics Holdings Berhad

How Much Debt Does CJ Century Logistics Holdings Berhad Carry?

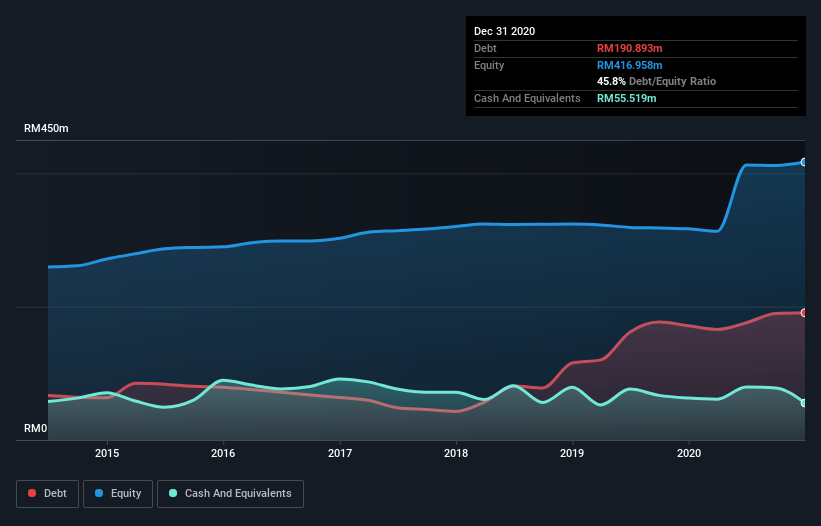

You can click the graphic below for the historical numbers, but it shows that as of December 2020 CJ Century Logistics Holdings Berhad had RM190.9m of debt, an increase on RM171.3m, over one year. However, it does have RM55.5m in cash offsetting this, leading to net debt of about RM135.4m.

How Healthy Is CJ Century Logistics Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that CJ Century Logistics Holdings Berhad had liabilities of RM242.2m falling due within a year, and liabilities of RM164.9m due beyond that. Offsetting these obligations, it had cash of RM55.5m as well as receivables valued at RM199.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM151.8m.

This deficit isn't so bad because CJ Century Logistics Holdings Berhad is worth RM261.2m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CJ Century Logistics Holdings Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (7.0), and fairly weak interest coverage, since EBIT is just 0.049 times the interest expense. This means we'd consider it to have a heavy debt load. One redeeming factor for CJ Century Logistics Holdings Berhad is that it turned last year's EBIT loss into a gain of RM417k, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine CJ Century Logistics Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, CJ Century Logistics Holdings Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both CJ Century Logistics Holdings Berhad's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. We're quite clear that we consider CJ Century Logistics Holdings Berhad to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 6 warning signs we've spotted with CJ Century Logistics Holdings Berhad (including 3 which are a bit concerning) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CJCEN

CJ Century Logistics Holdings Berhad

An investment holding company, provides logistics solutions in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives