Cautious Investors Not Rewarding Capital A Berhad's (KLSE:CAPITALA) Performance Completely

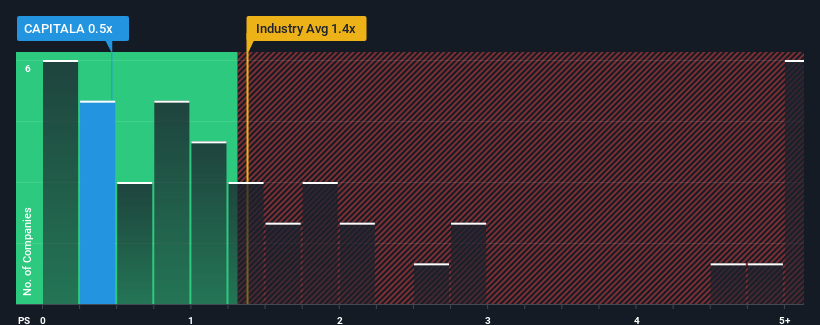

When close to half the companies operating in the Airlines industry in Malaysia have price-to-sales ratios (or "P/S") above 1.4x, you may consider Capital A Berhad (KLSE:CAPITALA) as an attractive investment with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Capital A Berhad

What Does Capital A Berhad's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Capital A Berhad has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Capital A Berhad will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Capital A Berhad?

In order to justify its P/S ratio, Capital A Berhad would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 245% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 46% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 33% per year during the coming three years according to the ten analysts following the company. With the industry only predicted to deliver 28% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Capital A Berhad's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Capital A Berhad currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Capital A Berhad you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CAPITALA

Capital A Berhad

An investment holding company, provides air transportation services in Malaysia, Indonesia, the Philippines, Thailand, and internationally under the AirAsia brand.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives