AirAsia X Berhad's (KLSE:AAX) Stock Price Has Reduced 80% In The Past Three Years

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of AirAsia X Berhad (KLSE:AAX), who have seen the share price tank a massive 80% over a three year period. That would be a disturbing experience. The good news is that the stock is up 13% in the last week.

See our latest analysis for AirAsia X Berhad

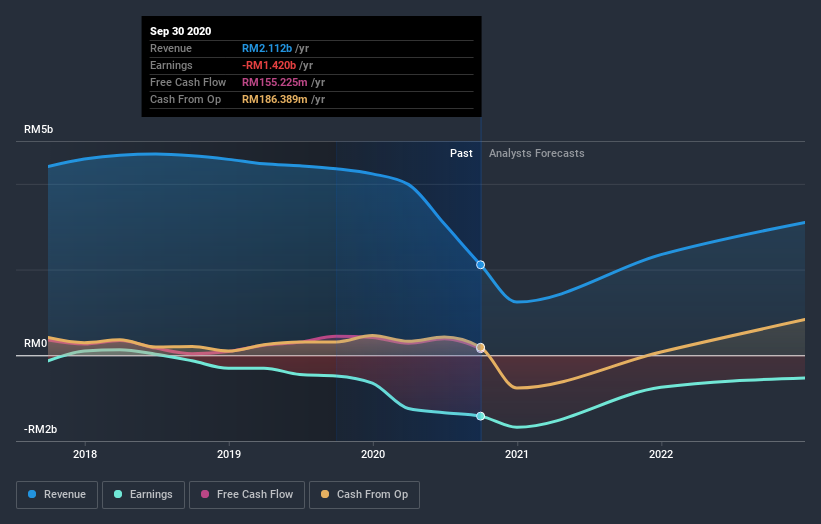

Because AirAsia X Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years AirAsia X Berhad saw its revenue shrink by 14% per year. That is not a good result. Having said that the 22% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on AirAsia X Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 11% in the last year, AirAsia X Berhad shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for AirAsia X Berhad (of which 1 can't be ignored!) you should know about.

But note: AirAsia X Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you’re looking to trade AirAsia X Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:AAX

AirAsia X Berhad

Provides long haul air transportation services under the AirAsia brand in Malaysia and Thailand.

Very undervalued with exceptional growth potential.