- Malaysia

- /

- Wireless Telecom

- /

- KLSE:XOX

Announcing: XOX Berhad (KLSE:XOX) Stock Soared An Exciting 367% In The Last Year

XOX Berhad (KLSE:XOX) shareholders might understandably be very concerned that the share price has dropped 33% in the last quarter. But over the last year the share price has taken off like one of Elon Musk's rockets. In fact, it is up 367% in that time. So the recent fall isn't enough to negate the good performance. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

View our latest analysis for XOX Berhad

Because XOX Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

XOX Berhad actually shrunk its revenue over the last year, with a reduction of 0.5%. This is in stark contrast to the splendorous stock price, which has rocketed 367% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

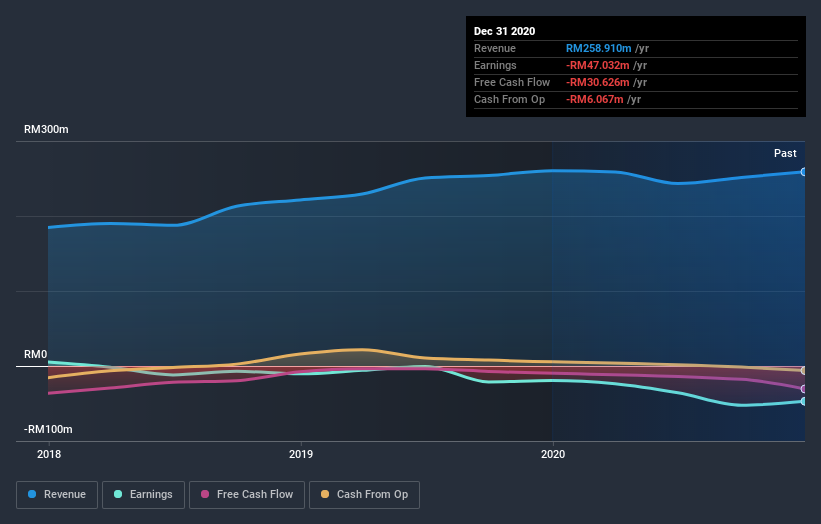

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that XOX Berhad shareholders have received a total shareholder return of 367% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand XOX Berhad better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for XOX Berhad (of which 2 don't sit too well with us!) you should know about.

But note: XOX Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade XOX Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:XOX

XOX Berhad

An investment holding company, provides mobile telecommunication products and services primarily in Malaysia.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives