- Malaysia

- /

- Wireless Telecom

- /

- KLSE:MTOUCHE

Is mTouche Technology Berhad (KLSE:MTOUCHE) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that mTouche Technology Berhad (KLSE:MTOUCHE) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is mTouche Technology Berhad's Net Debt?

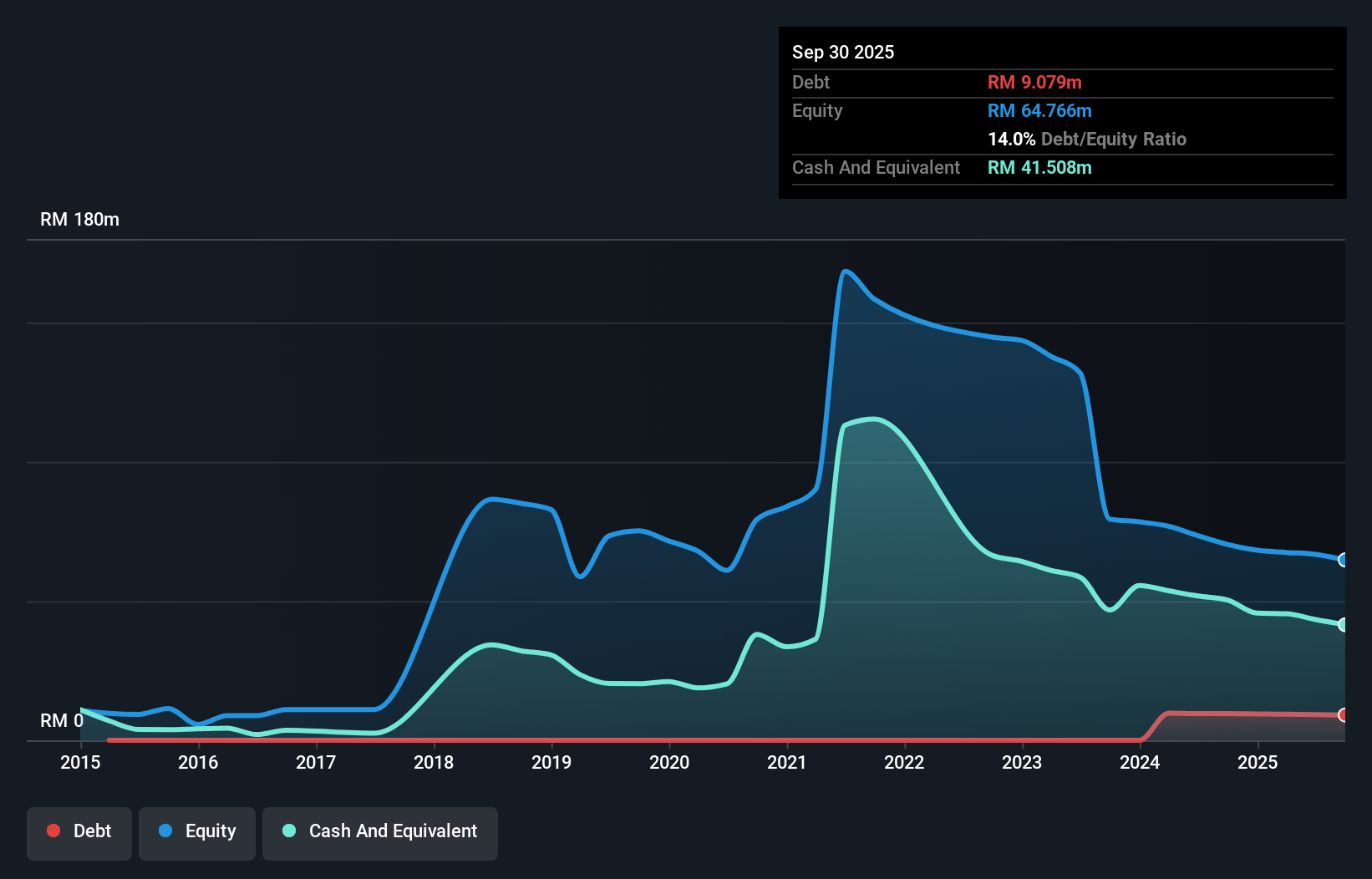

The image below, which you can click on for greater detail, shows that mTouche Technology Berhad had debt of RM9.08m at the end of September 2025, a reduction from RM9.61m over a year. But on the other hand it also has RM41.5m in cash, leading to a RM32.4m net cash position.

How Strong Is mTouche Technology Berhad's Balance Sheet?

The latest balance sheet data shows that mTouche Technology Berhad had liabilities of RM8.43m due within a year, and liabilities of RM10.3m falling due after that. Offsetting this, it had RM41.5m in cash and RM8.40m in receivables that were due within 12 months. So it actually has RM31.2m more liquid assets than total liabilities.

This excess liquidity is a great indication that mTouche Technology Berhad's balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, mTouche Technology Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since mTouche Technology Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Check out our latest analysis for mTouche Technology Berhad

In the last year mTouche Technology Berhad had a loss before interest and tax, and actually shrunk its revenue by 49%, to RM7.8m. To be frank that doesn't bode well.

So How Risky Is mTouche Technology Berhad?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months mTouche Technology Berhad lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of RM8.7m and booked a RM10m accounting loss. But the saving grace is the RM32.4m on the balance sheet. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with mTouche Technology Berhad (at least 3 which don't sit too well with us) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MTOUCHE

mTouche Technology Berhad

An investment holding company, engages in the research and development of technologies in the field of information technology, telecommunications, and related activities in Malaysia, Indonesia, Thailand, Hong Kong, Vietnam, Cambodia, and the Philippines.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)