- Malaysia

- /

- Wireless Telecom

- /

- KLSE:CDB

Digi.Com Berhad's (KLSE:DIGI) Dividend Is Being Reduced To RM0.036

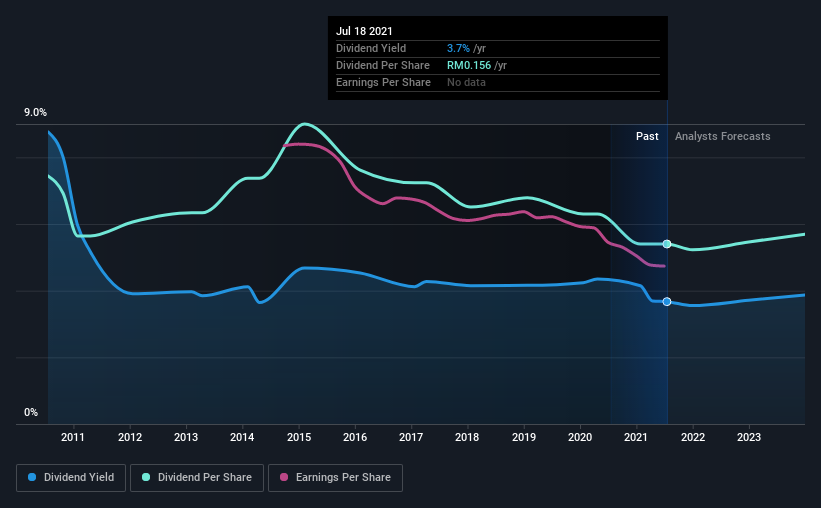

Digi.Com Berhad (KLSE:DIGI) has announced it will be reducing its dividend payable on the 24th of September to RM0.036. However, the dividend yield of 3.5% still remains in a typical range for the industry.

View our latest analysis for Digi.Com Berhad

Digi.Com Berhad's Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, the dividend made up 76% of cash flows, but a higher proportion of net income. This indicates that the company could be more focused on returning cash to shareholders than reinvesting to grow the business.

EPS is set to grow by 4.8% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 88%. This is definitely on the higher side, but we wouldn't necessarily say this is unsustainable.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from RM0.21 in 2011 to the most recent annual payment of RM0.16. This works out to be a decline of approximately 3.2% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Over the past five years, it looks as though Digi.Com Berhad's EPS has declined at around 6.4% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

Digi.Com Berhad's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Digi.Com Berhad has 2 warning signs (and 1 which is a bit concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CDB

Celcomdigi Berhad

An investment holding company, provides mobile communication services and related products in Malaysia.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives