- Malaysia

- /

- Specialty Stores

- /

- KLSE:MRDIY

Top Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs, growth stocks have shown significant strength, particularly in the technology sector. In this favorable environment, companies with high insider ownership can offer unique investment opportunities due to the confidence and commitment demonstrated by those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Here we highlight a subset of our preferred stocks from the screener.

Cosan (BOVESPA:CSAN3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cosan S.A. operates in the fuel distribution sector and has a market cap of R$24.83 billion.

Operations: Cosan's revenue segments include Rumo (R$12.51 billion), Moove (R$9.99 billion), Radar (R$732.84 million), Compass (R$17.16 billion), and Raízen (R$229.35 billion).

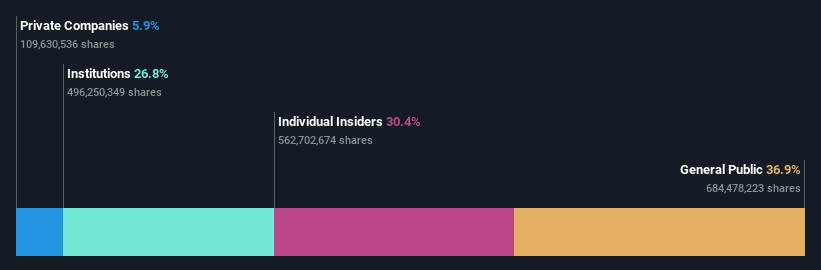

Insider Ownership: 30.4%

Revenue Growth Forecast: 27.1% p.a.

Cosan's earnings are forecast to grow at 16.4% annually, outpacing the Brazilian market's 14%. Revenue is expected to increase by 27.1% per year, significantly above the market average of 7.8%. Despite becoming profitable this year, Cosan reported a net loss of BRL 227.11 million for Q2 2024, an improvement from BRL 1.04 billion a year ago. The stock trades at an estimated fair value discount of 18.5%, but its debt coverage by operating cash flow remains weak.

- Click here and access our complete growth analysis report to understand the dynamics of Cosan.

- Our valuation report here indicates Cosan may be undervalued.

Mr D.I.Y. Group (M) Berhad (KLSE:MRDIY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mr D.I.Y. Group (M) Berhad, with a market cap of MYR19.00 billion, is an investment holding company that operates in the retail sector, offering home improvement products and mass merchandise in Malaysia and Brunei.

Operations: The company generates MYR4.55 billion in revenue from its retail - home improvement segment.

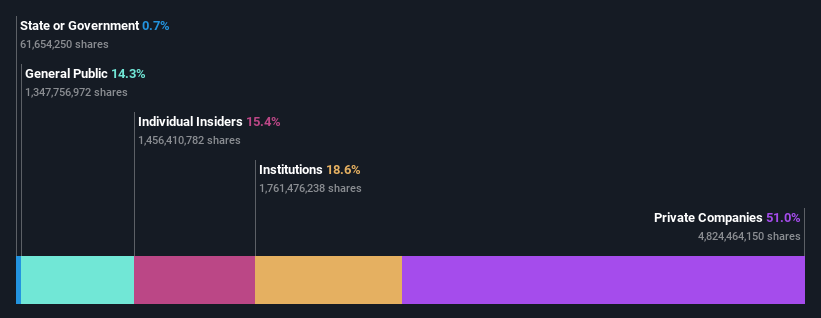

Insider Ownership: 15.3%

Revenue Growth Forecast: 12.1% p.a.

Mr D.I.Y. Group (M) Berhad's earnings are forecast to grow at 14.8% annually, outpacing the Malaysian market's 10.6%. Revenue is expected to increase by 12.1% per year, faster than the market average of 6.2%. Recent earnings reported MYR 1.20 billion in sales for Q2 2024, with net income of MYR 155.21 million, reflecting steady growth from last year’s figures and a high return on equity forecast of 33.7%.

- Take a closer look at Mr D.I.Y. Group (M) Berhad's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Mr D.I.Y. Group (M) Berhad is trading beyond its estimated value.

V.S. Industry Berhad (KLSE:VS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: V.S. Industry Berhad, with a market cap of MYR4.30 billion, is an investment holding company involved in manufacturing, assembling, and selling electronic and electrical products as well as plastic molded components and parts.

Operations: The company's revenue segments are comprised of MYR3.83 billion from Malaysia, MYR900.14 million from Singapore, MYR322.48 million from Indonesia, and MYR41.35 million from China.

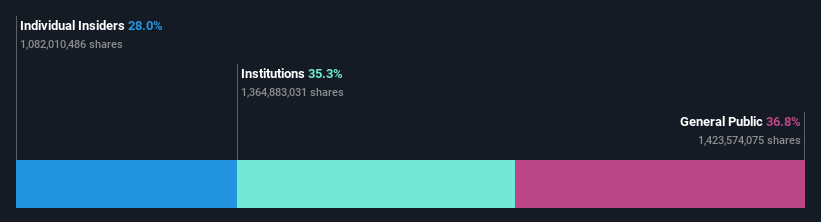

Insider Ownership: 28.0%

Revenue Growth Forecast: 15.8% p.a.

V.S. Industry Berhad's earnings are forecast to grow 27.7% annually, significantly outpacing the Malaysian market's 10.6%. The company recently reported Q3 sales of MYR 1.01 billion and net income of MYR 54.42 million, reflecting strong year-over-year growth in earnings per share from continuing operations. A recent lease agreement with ALogis Artico Inc., alongside a proposed bonus issue and planned capital expenditure of MYR 100 million, underscores its commitment to expansion and operational efficiency improvements.

- Get an in-depth perspective on V.S. Industry Berhad's performance by reading our analyst estimates report here.

- The analysis detailed in our V.S. Industry Berhad valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1523 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:MRDIY

Mr D.I.Y. Group (M) Berhad

An investment holding company, engages in the retail of home improvement products and mass merchandise in Malaysia and Brunei.

Flawless balance sheet with reasonable growth potential.