- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:UCHITEC

Uchi Technologies Berhad (KLSE:UCHITEC) Stock Goes Ex-Dividend In Just Three Days

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Uchi Technologies Berhad (KLSE:UCHITEC) is about to go ex-dividend in just three days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Uchi Technologies Berhad's shares on or after the 6th of September will not receive the dividend, which will be paid on the 26th of September.

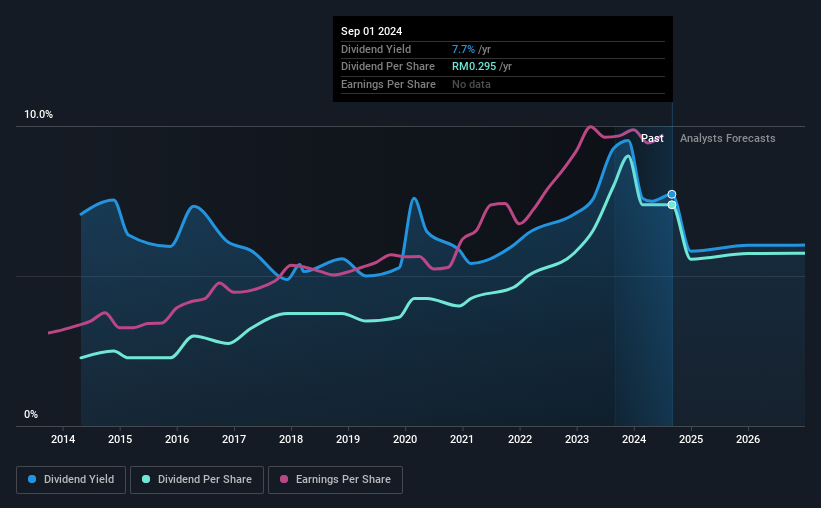

The company's next dividend payment will be RM00.065 per share. Last year, in total, the company distributed RM0.29 to shareholders. Calculating the last year's worth of payments shows that Uchi Technologies Berhad has a trailing yield of 7.7% on the current share price of RM03.82. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Uchi Technologies Berhad

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. It paid out 88% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. A useful secondary check can be to evaluate whether Uchi Technologies Berhad generated enough free cash flow to afford its dividend. It paid out 99% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Uchi Technologies Berhad paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Uchi Technologies Berhad's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see Uchi Technologies Berhad's earnings per share have risen 13% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Uchi Technologies Berhad has increased its dividend at approximately 12% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

To Sum It Up

Should investors buy Uchi Technologies Berhad for the upcoming dividend? It's good to see that earnings per share are growing and that the company's payout ratio is within a normal range for most businesses. However we're somewhat concerned that it paid out 99% of its cashflow, which is uncomfortably high. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

If you're not too concerned about Uchi Technologies Berhad's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. For instance, we've identified 2 warning signs for Uchi Technologies Berhad (1 is a bit unpleasant) you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:UCHITEC

Uchi Technologies Berhad

An investment holding company, engages in the research, design, development, manufacture, and sale of electronic control systems in Switzerland, Portugal, Germany, the United Kingdom, China, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.