- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:UCHITEC

Uchi Technologies Berhad (KLSE:UCHITEC) Is Paying Out Less In Dividends Than Last Year

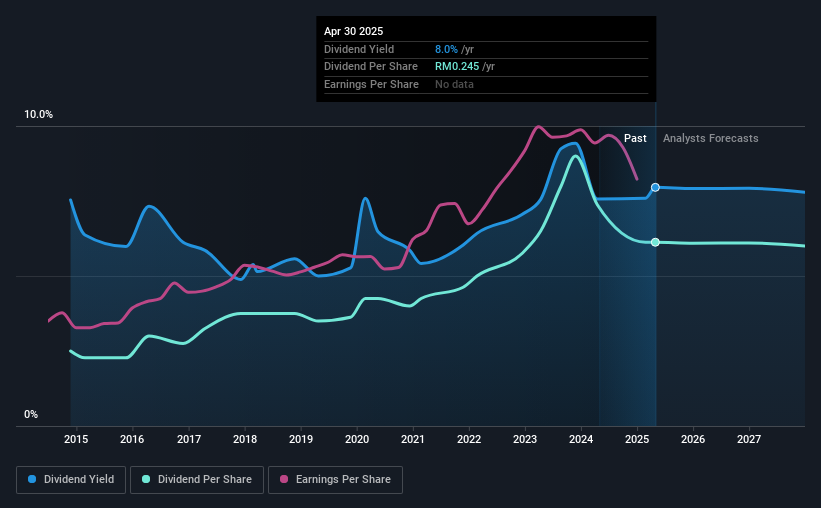

Uchi Technologies Berhad's (KLSE:UCHITEC) dividend is being reduced from last year's payment covering the same period to MYR0.06 on the 26th of June. However, the dividend yield of 8.0% is still a decent boost to shareholder returns.

Estimates Indicate Uchi Technologies Berhad's Could Struggle to Maintain Dividend Payments In The Future

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, the company's dividend was much higher than its earnings. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Earnings per share is forecast to rise by 9.8% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 121% over the next year.

View our latest analysis for Uchi Technologies Berhad

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the annual payment back then was MYR0.10, compared to the most recent full-year payment of MYR0.245. This means that it has been growing its distributions at 9.4% per annum over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Uchi Technologies Berhad May Have Challenges Growing The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Uchi Technologies Berhad has impressed us by growing EPS at 7.8% per year over the past five years. Although per-share earnings are growing at a credible rate, the massive payout ratio may limit growth in the company's future dividend payments.

Uchi Technologies Berhad's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Uchi Technologies Berhad that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:UCHITEC

Uchi Technologies Berhad

An investment holding company, engages in the research, design, development, manufacture, and sale of electronic control systems in Switzerland, Portugal, Germany, the United Kingdom, China, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026