- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:UCHITEC

Read This Before Considering Uchi Technologies Berhad (KLSE:UCHITEC) For Its Upcoming RM0.075 Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Uchi Technologies Berhad (KLSE:UCHITEC) is about to trade ex-dividend in the next three days. Investors can purchase shares before the 30th of December in order to be eligible for this dividend, which will be paid on the 26th of January.

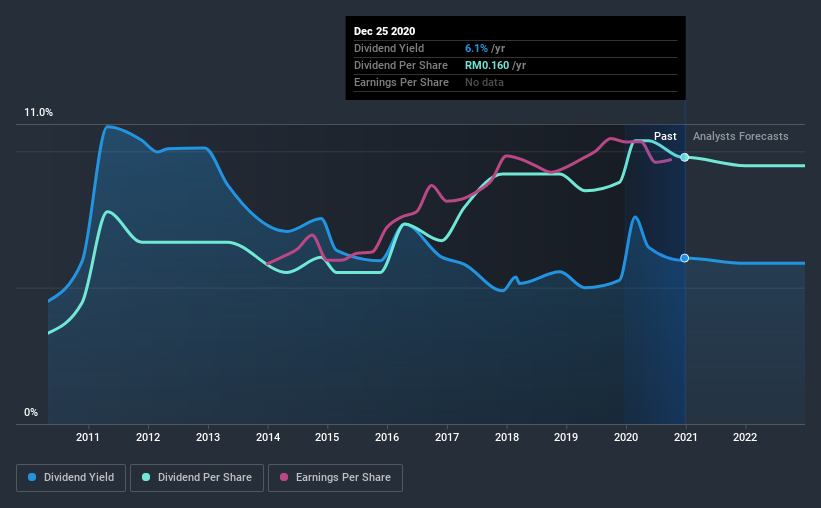

Uchi Technologies Berhad's next dividend payment will be RM0.075 per share, and in the last 12 months, the company paid a total of RM0.16 per share. Looking at the last 12 months of distributions, Uchi Technologies Berhad has a trailing yield of approximately 6.1% on its current stock price of MYR2.63. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Uchi Technologies Berhad

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Last year, Uchi Technologies Berhad paid out 101% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 96% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want look more closely here.

Cash is slightly more important than profit from a dividend perspective, but given Uchi Technologies Berhad's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Fortunately for readers, Uchi Technologies Berhad's earnings per share have been growing at 10% a year for the past five years. We're a bit put out by the fact that Uchi Technologies Berhad paid out virtually all of its earnings and cashflow as dividends over the last year. Earnings are growing at a decent clip, so this payout ratio may prove sustainable, but it's not great to see.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Uchi Technologies Berhad has lifted its dividend by approximately 11% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Is Uchi Technologies Berhad an attractive dividend stock, or better left on the shelf? While it's nice to see earnings per share growing, we're curious about how Uchi Technologies Berhad intends to continue growing, or maintain the dividend in a downturn given that it's paying out such a high percentage of its earnings and cashflow. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Uchi Technologies Berhad. For example - Uchi Technologies Berhad has 1 warning sign we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Uchi Technologies Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:UCHITEC

Uchi Technologies Berhad

An investment holding company, engages in the research, design, development, manufacture, and sale of electronic control systems in Switzerland, Portugal, Germany, the United Kingdom, China, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)