- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:NOTION

Notion VTec Berhad's (KLSE:NOTION) one-year total shareholder returns outpace the underlying earnings growth

Some Notion VTec Berhad (KLSE:NOTION) shareholders are probably rather concerned to see the share price fall 50% over the last three months. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 219% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Notion VTec Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Notion VTec Berhad grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We doubt the modest 2.0% dividend yield is doing much to support the share price. However the year on year revenue growth of 30% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

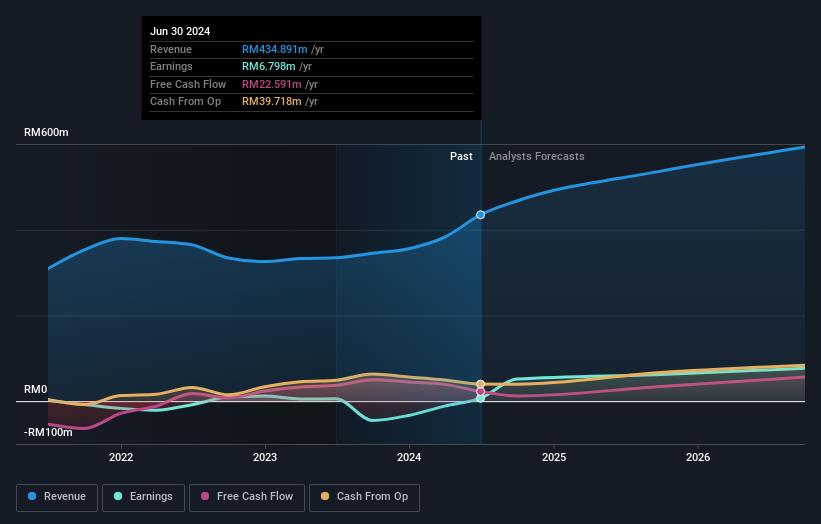

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Notion VTec Berhad has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Notion VTec Berhad has rewarded shareholders with a total shareholder return of 220% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 25% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Notion VTec Berhad better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Notion VTec Berhad (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Notion VTec Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NOTION

Notion VTec Berhad

An investment holding company, engages in design, manufacture, and sale of precision components and tools.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026