- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:MIKROMB

Mikro MSC Berhad (KLSE:MIKROMB) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Mikro MSC Berhad (KLSE:MIKROMB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Mikro MSC Berhad

How Much Debt Does Mikro MSC Berhad Carry?

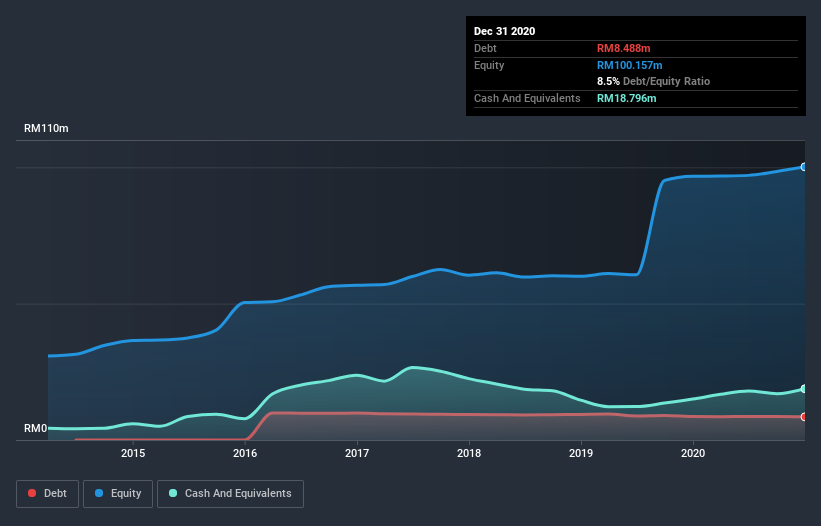

As you can see below, Mikro MSC Berhad had RM8.49m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have RM18.8m in cash offsetting this, leading to net cash of RM10.3m.

How Strong Is Mikro MSC Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Mikro MSC Berhad had liabilities of RM9.84m due within 12 months and liabilities of RM9.47m due beyond that. Offsetting these obligations, it had cash of RM18.8m as well as receivables valued at RM28.5m due within 12 months. So it actually has RM28.0m more liquid assets than total liabilities.

It's good to see that Mikro MSC Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Mikro MSC Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Mikro MSC Berhad has increased its EBIT by 3.3% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is Mikro MSC Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Mikro MSC Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Mikro MSC Berhad's free cash flow amounted to 21% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Mikro MSC Berhad has net cash of RM10.3m, as well as more liquid assets than liabilities. On top of that, it increased its EBIT by 3.3% in the last twelve months. So we don't have any problem with Mikro MSC Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Mikro MSC Berhad is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Mikro MSC Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MIKROMB

Mikro MSC Berhad

Engages in the research, design, development, manufacture, and sale of analogue, digital, and computer controlled electronic systems or devices in Malaysia, Vietnam, Bangladesh, Indonesia, Singapore, India, Thailand, the Philippines, Taiwan, Myanmar, Sri Lanka, Hong Kong, Australia, Cambodia, and internationally.

Flawless balance sheet with solid track record.