- Malaysia

- /

- Tech Hardware

- /

- KLSE:JCY

The JCY International Berhad (KLSE:JCY) Share Price Has Gained 46% And Shareholders Are Hoping For More

JCY International Berhad (KLSE:JCY) shareholders might understandably be very concerned that the share price has dropped 31% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. In that time we've seen the stock easily surpass the market return, with a gain of 46%.

See our latest analysis for JCY International Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

JCY International Berhad went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 3.8% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

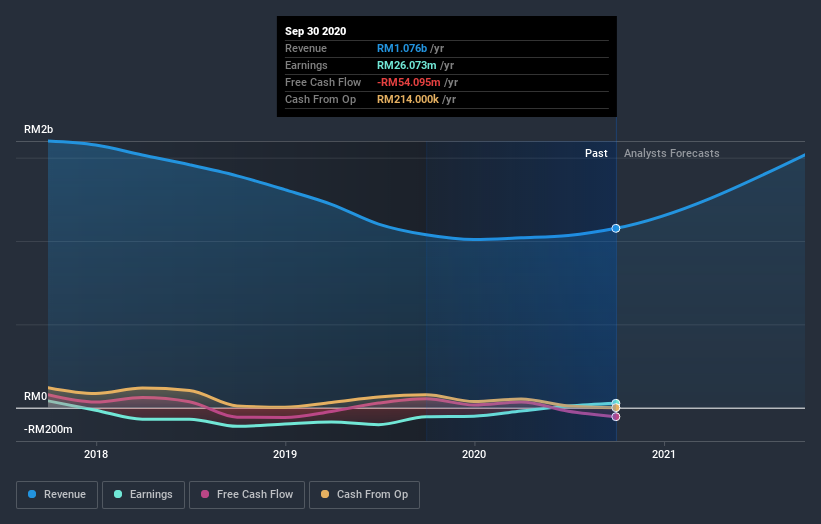

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that JCY International Berhad has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think JCY International Berhad will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that JCY International Berhad shareholders have received a total shareholder return of 46% over the last year. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with JCY International Berhad (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

We will like JCY International Berhad better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade JCY International Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:JCY

JCY International Berhad

An investment holding company, engages in the trading, manufacturing, and assembling of hard disk drive components and other mechanical components in Malaysia, Thailand, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives