Strong week for Harvest Miracle Capital Berhad (KLSE:HM) shareholders doesn't alleviate pain of five-year loss

Over the last month the Harvest Miracle Capital Berhad (KLSE:HM) has been much stronger than before, rebounding by 35%. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 81% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 21% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

We've discovered 2 warning signs about Harvest Miracle Capital Berhad. View them for free.Given that Harvest Miracle Capital Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Harvest Miracle Capital Berhad reduced its trailing twelve month revenue by 11% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 13% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

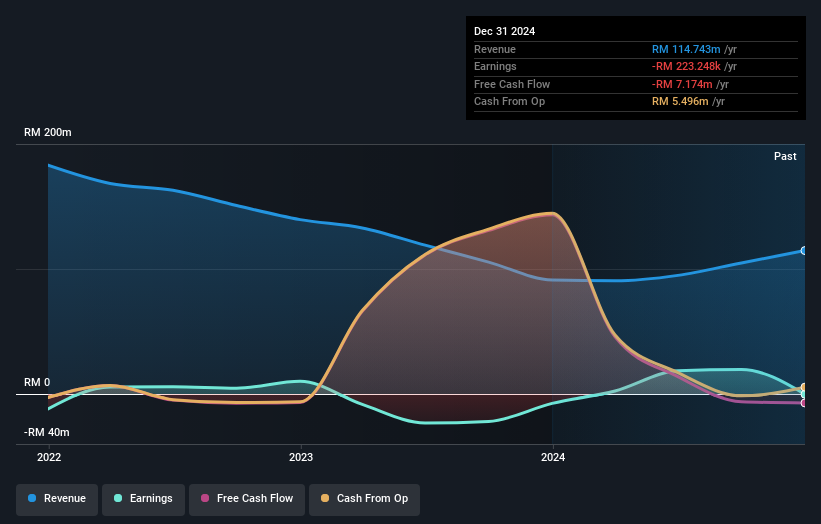

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Harvest Miracle Capital Berhad's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Harvest Miracle Capital Berhad's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Harvest Miracle Capital Berhad hasn't been paying dividends, but its TSR of -61% exceeds its share price return of -81%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Harvest Miracle Capital Berhad has rewarded shareholders with a total shareholder return of 13% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Harvest Miracle Capital Berhad you should be aware of, and 1 of them is a bit unpleasant.

But note: Harvest Miracle Capital Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

If you're looking to trade Harvest Miracle Capital Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harvest Miracle Capital Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HM

Harvest Miracle Capital Berhad

An investment holding company, engages in the trading of information technology (IT) and information communication technology (ICT) related products and services in Malaysia, Japan, the United Kingdom, Australia, and Taiwan.

Flawless balance sheet very low.

Market Insights

Community Narratives