Further weakness as Harvest Miracle Capital Berhad (KLSE:HM) drops 14% this week, taking five-year losses to 65%

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. To wit, the Harvest Miracle Capital Berhad (KLSE:HM) share price managed to fall 82% over five long years. That is extremely sub-optimal, to say the least. And we doubt long term believers are the only worried holders, since the stock price has declined 59% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 33% in the last 90 days. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Harvest Miracle Capital Berhad has shed RM41m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Harvest Miracle Capital Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Harvest Miracle Capital Berhad became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

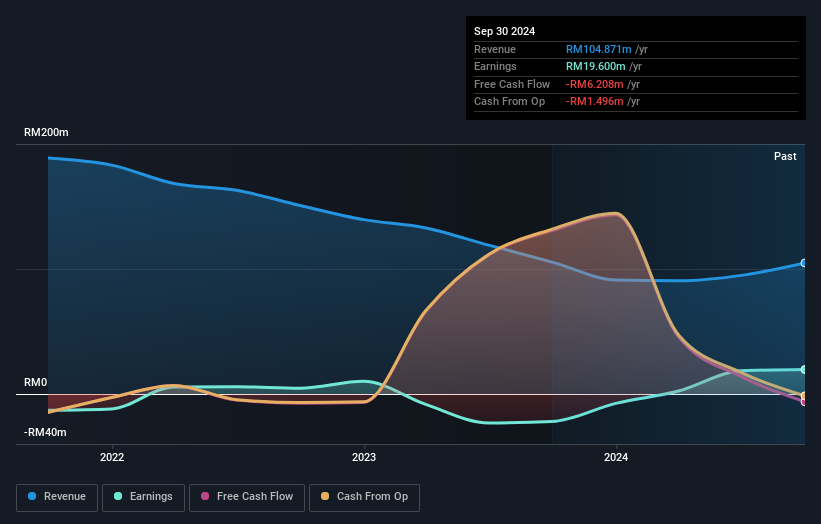

Arguably, the revenue drop of 9.5% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Harvest Miracle Capital Berhad's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Harvest Miracle Capital Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Harvest Miracle Capital Berhad hasn't been paying dividends, but its TSR of -65% exceeds its share price return of -82%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Harvest Miracle Capital Berhad had a tough year, with a total loss of 21%, against a market gain of about 9.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Harvest Miracle Capital Berhad (2 are a bit concerning) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Harvest Miracle Capital Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HM

Harvest Miracle Capital Berhad

An investment holding company, engages in the trading of information technology (IT) and information communication technology (ICT) related products and services in Malaysia, Japan, the United Kingdom, Australia, and Taiwan.

Flawless balance sheet very low.

Market Insights

Community Narratives