Shareholders May Be More Conservative With Systech Bhd's (KLSE:SYSTECH) CEO Compensation For Now

Despite positive share price growth of 9.1% for Systech Bhd (KLSE:SYSTECH) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 28 July 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Systech Bhd

Comparing Systech Bhd's CEO Compensation With the industry

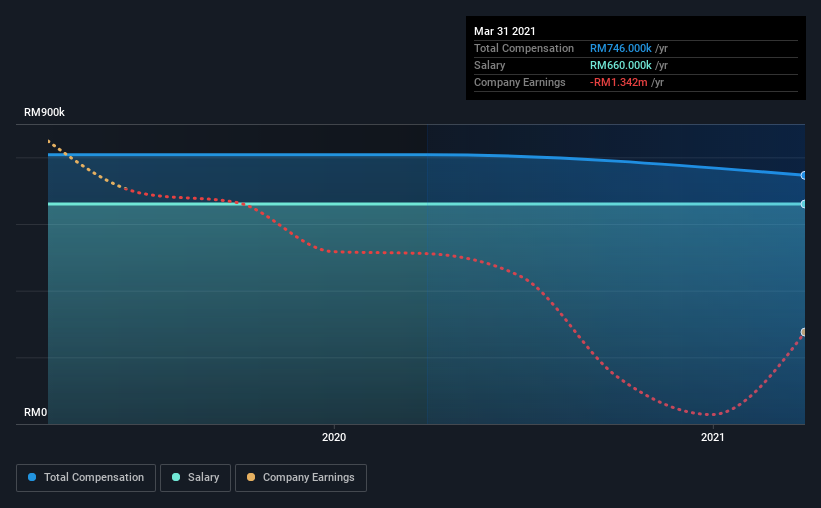

Our data indicates that Systech Bhd has a market capitalization of RM109m, and total annual CEO compensation was reported as RM746k for the year to March 2021. That's a slight decrease of 7.7% on the prior year. Notably, the salary which is RM660.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below RM844m, we found that the median total CEO compensation was RM144k. This suggests that Raymond Tan is paid more than the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM660k | RM660k | 88% |

| Other | RM86k | RM148k | 12% |

| Total Compensation | RM746k | RM808k | 100% |

Speaking on an industry level, nearly 88% of total compensation represents salary, while the remainder of 12% is other remuneration. Systech Bhd is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Systech Bhd's Growth Numbers

Over the last three years, Systech Bhd has shrunk its earnings per share by 119% per year. Its revenue is down 19% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Systech Bhd Been A Good Investment?

With a total shareholder return of 9.1% over three years, Systech Bhd has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for Systech Bhd (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SYSTECH

Systech Bhd

An investment holding company, engages in the e-business solutions, cybersecurity, and e-logistics businesses in Malaysia, Hong Kong, Indonesia, Thailand, Singapore, China, Europe, the United States, and internationally.

Slight with mediocre balance sheet.